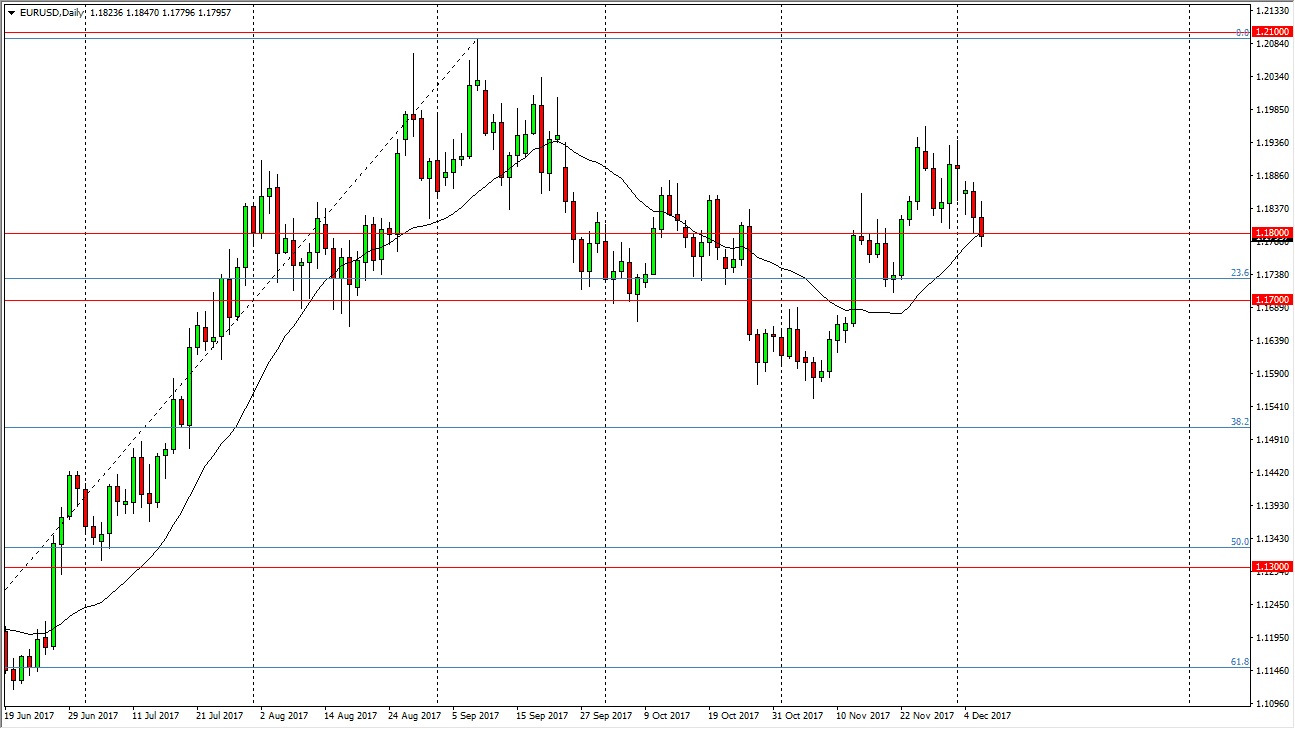

EUR/USD

The EUR/USD pair initially tried to rally during the trading session on Thursday, but then rolled over to break slightly below the 1.18 level. That is a massive supportive area, so I think it’s only a matter of time before the buyers get involved. Longer-term, I think that the market will try to go to the 1.21 handle above, and once we break above there becomes more of a buy-and-hold situation. There is also a gap above that still hasn’t been filled, so I felt only a matter of time before we do that. The 1.17 level underneath is the “floor” in the uptrend, and essentially, it’s likely that we will buyers eventually returned to the market. If we were to break down below the 1.17 handle, then I think the market finds itself in a significant amount of trouble.

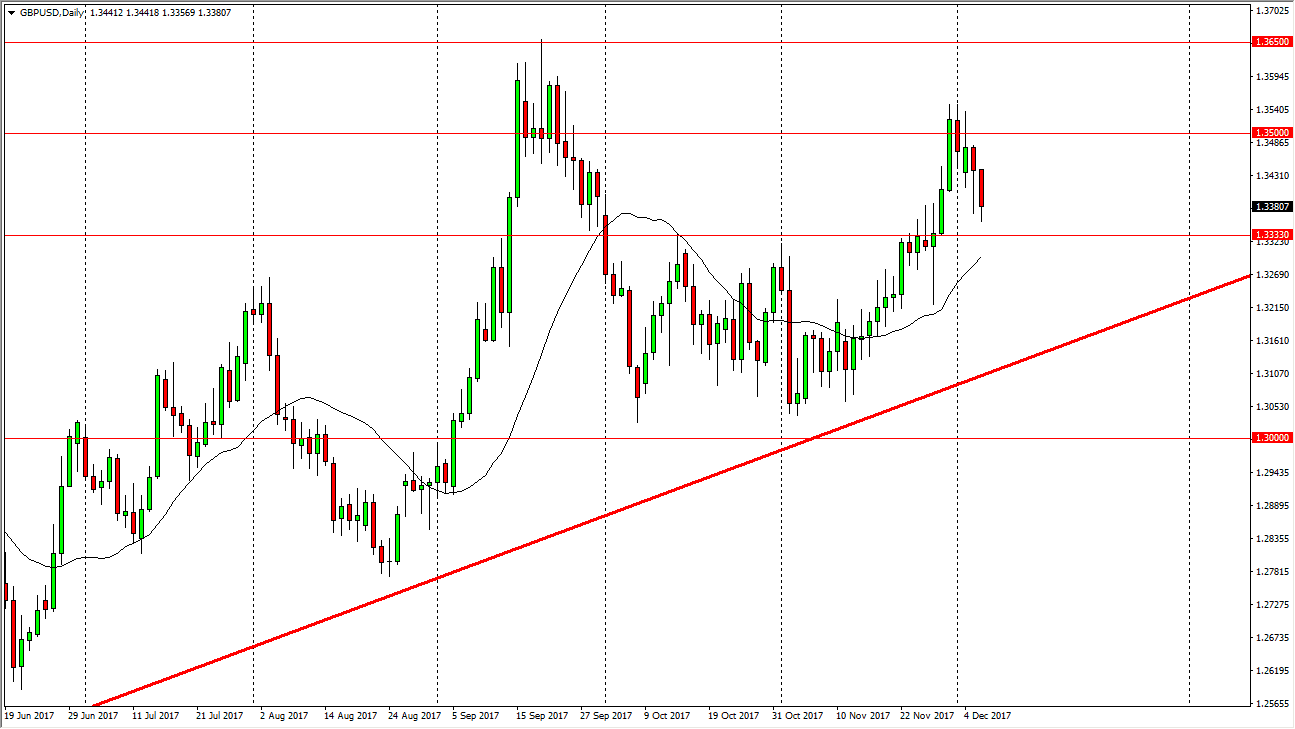

GBP/USD

The British pound initially fell during the trading session, but found enough support just above the 1.3350 level to turn around and show signs of life. I think that the 1.3333 handle underneath is massive support, and I think that buying in that general vicinity continues to be a nice way to play this market as it is in a strong uptrend. The uptrend line below is also essentially the “floor” in the market, so I’m a buyer of dips and I think we will eventually go to the 1.35 level, which has offered resistance. After that, we should then go to the 1.3650 level, which is the gap lower from many months ago that continues to be a bit of a ceiling in the market. Once we break above there, then it becomes a buy-and-hold scenario that should go to at least the 1.40 level, if not the 1.45 level. I am bullish of the British pound and think it is oversold.