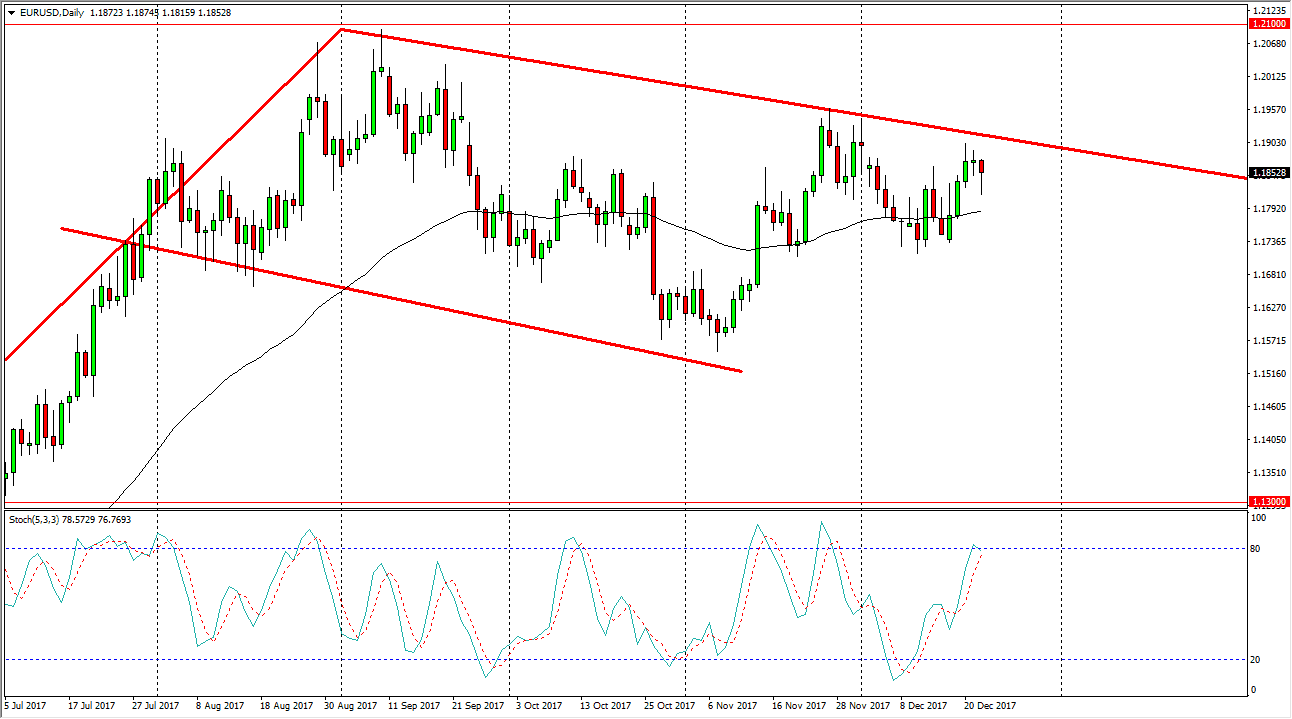

EUR/USD

The EUR/USD pair initially fell during the trading session on Friday, but turned around to form a hammer. This suggests to me that we are going to continue to see buyers jump into this market, and with this being the case it’s likely that the buyers will return once liquidity comes back. If we can break above the downtrend line at the top of the bullish flag, I feel that the market continues to reach towards the 1.21 handle next, and then eventually the 1.32 level. I think that short-term pullbacks continue to offer buying opportunities, and I am not interested in selling this market until we break down below the 1.15 handle, which should send the market down to the 1.13 level underneath. In general, the market should continue to be very volatile, but eventually we should see the buyers come back into the marketplace.

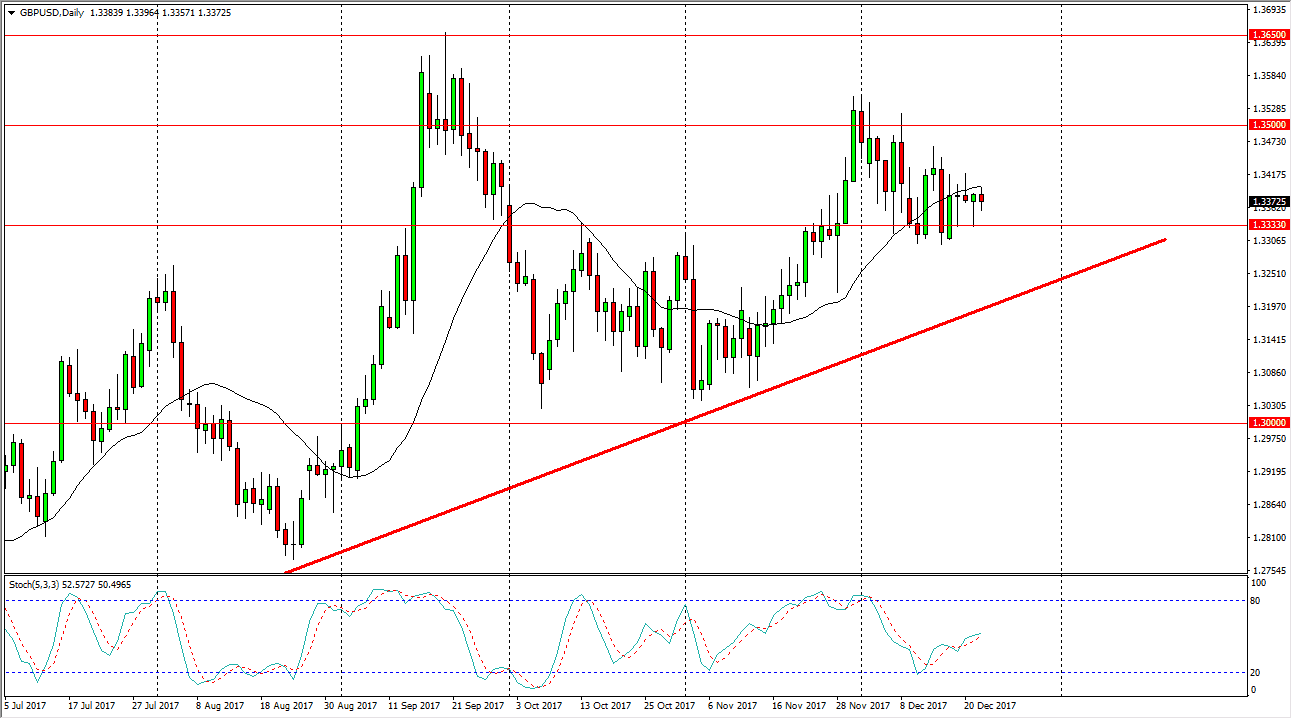

GBP/USD

The British pound did very little during the day on Friday, as we have seen a lot of choppiness in a low-volume day. Longer-term, the market should continue to go much higher, as the 1.33 handle underneath has offered significant support. If we can reach towards the upside, I think we will go to the 1.35 handle after that, and perhaps even the 1.3650 level above. The uptrend line underneath should continue to be massively supportive as well, so even if we do break down a little bit, I think that the market will more than likely be bullish longer-term, as I think that there is plenty of support underneath. The 1.30 level below is the “floor” in the market, and if we break down below there, it could get ugly rather quick. However, I am bullish of the British pound in general.