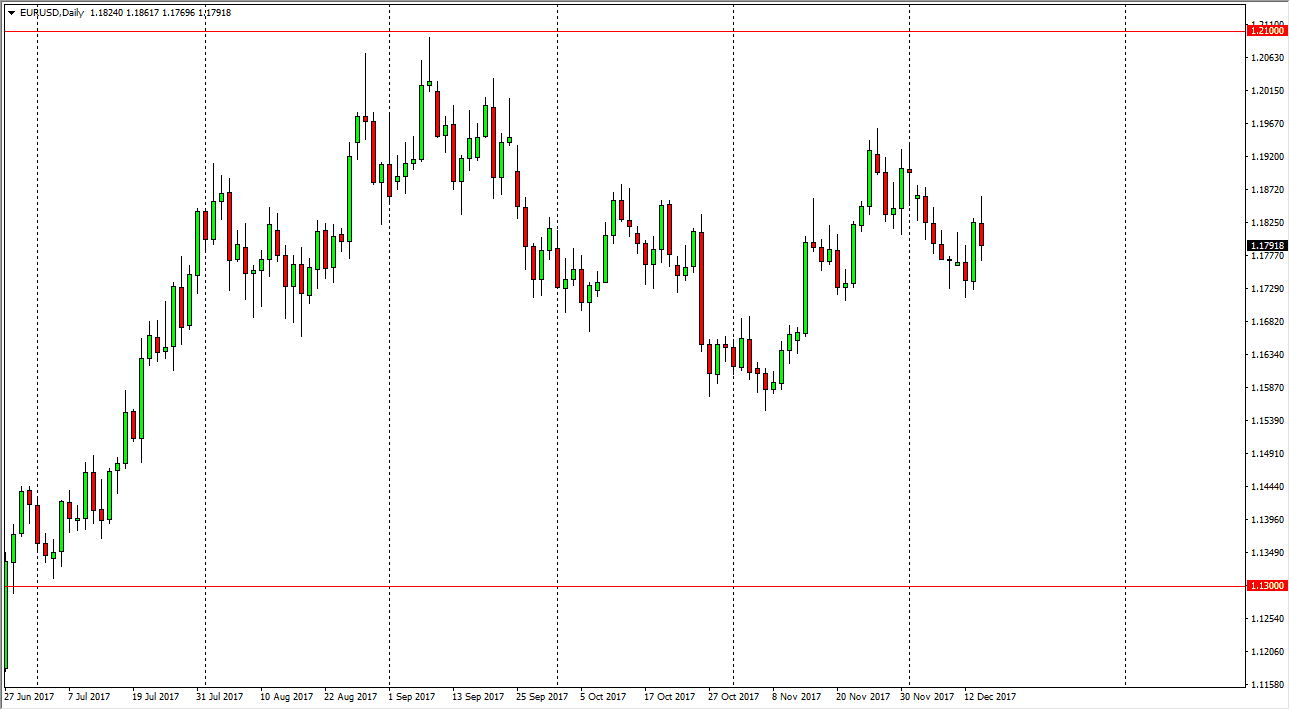

EUR/USD

The EUR started of the day rather positively, but turned around as Mario Draghi started speaking, effectively doing what most central bankers do these days: try to kill their own currency. This being the case, it looks as if we are going to give back some of the gains, and I think at this point we are looking at a market that is probably ready to chop around between now and the end of the year. Longer-term, we have formed a nice-looking bullish flag, and a break above the recent highs could send this market as high as 1.32 over the longer term. I have no interest in shorting this market, as I believe that the 1.17 level will offer support, and most certainly the 1.15 level will after that. Overall, expect a lot of noise, but that’s nothing new as high-frequency traders have taken over this pair.

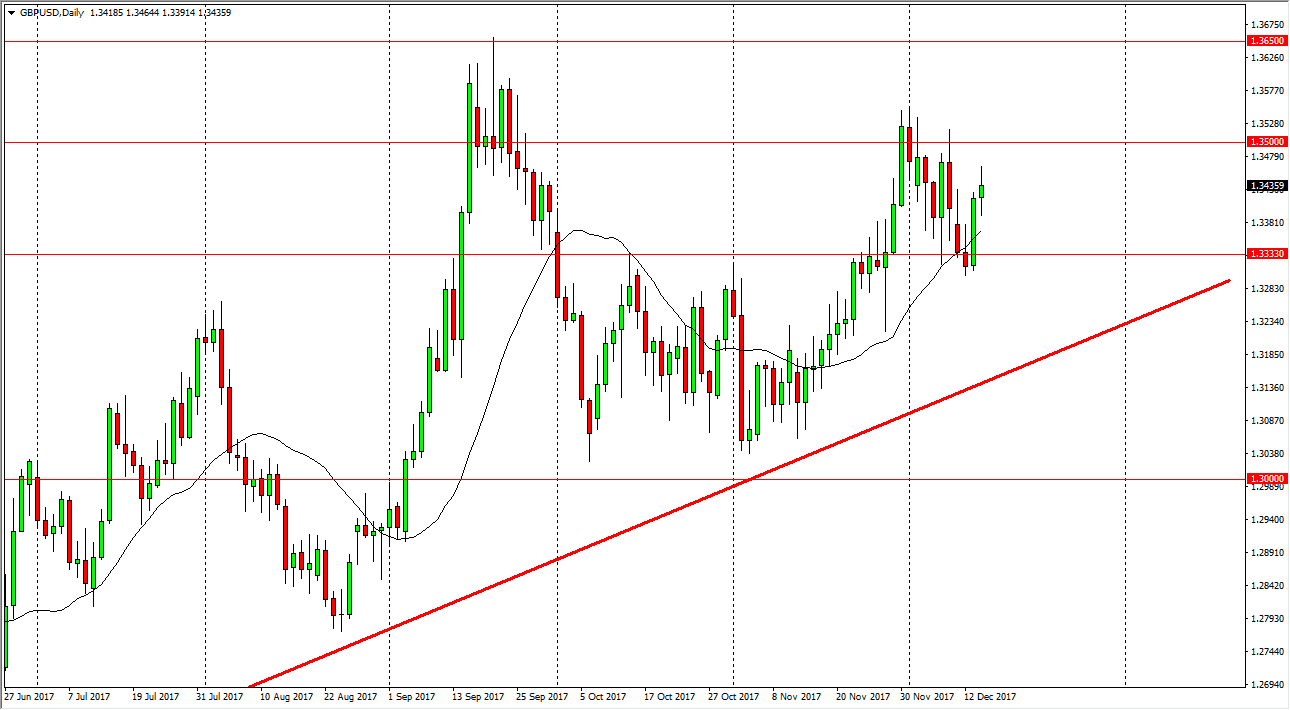

GBP/USD

The British pound also was relatively volatile during the session, forming a slightly positive candle that looks a bit exhausted. In general, I think that pullbacks offer buying opportunities, and that the 1.3333 handle should offer a bit of a floor. If we can bounce from there, that would be an excellent buying opportunity. If we break down through there, the uptrend line should keep this market higher. Otherwise, I think a break above the 1.35 handle should send this market to the 1.3650 level above, which is a massive resistance barrier, and if we can get above there, I think it becomes a longer-term “buy-and-hold” market. At this point, I believe that eventually the British pound will take off to the upside, as inflation is starting to pick up in the United Kingdom. However, expect a lot of noise between now and the end of the year.