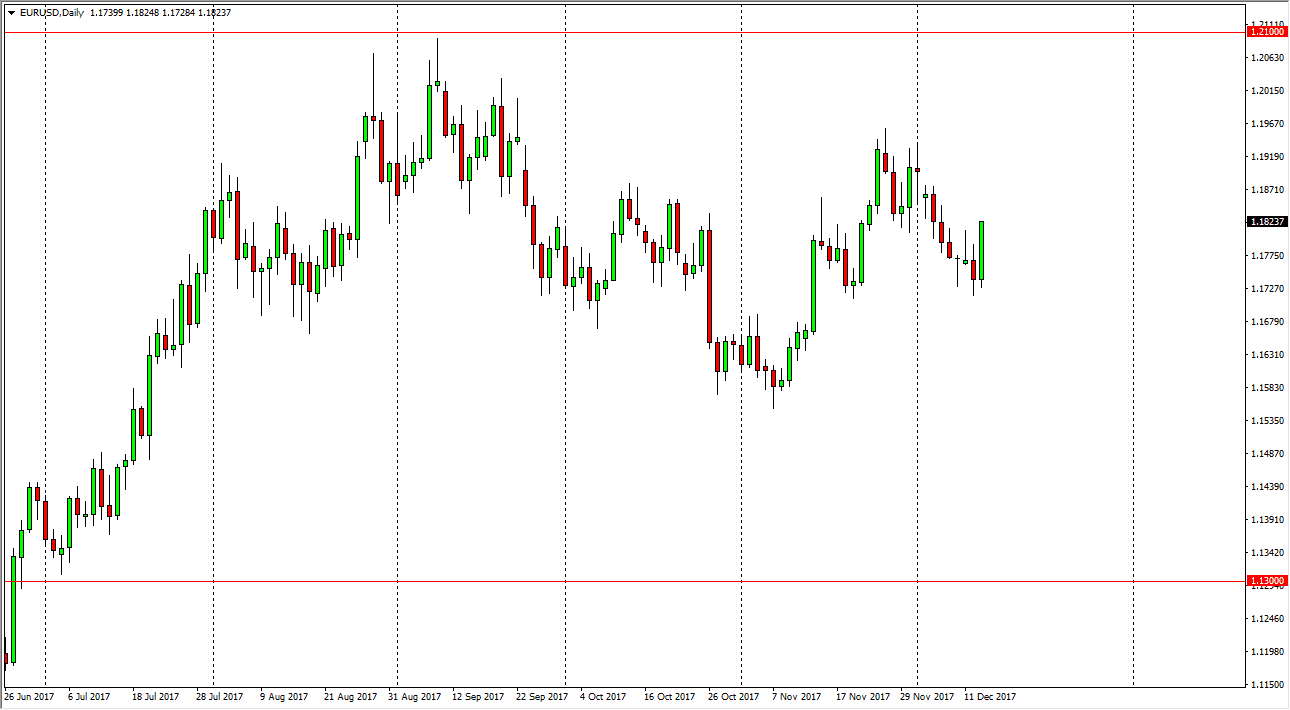

EUR/USD

The EUR/USD pair initially pulled back during the trading session on Wednesday, but after the FOMC Interest Rate Statement, the market should continue to go higher as we have seen such an explosive move above the last couple of sessions. The longer-term chart is very bullish, and it looks as if we’re going to go looking towards the 1.1950 level above, which was the most recent high. Overall, I believe that this pair is bullish, so short-term pullback should be buying opportunities that we can take advantage of. Eventually, this market should go to the 1.20 level, and then eventually the 1.21 level after that. Selling is all but a distant thought at this point, as the US dollar is getting pummeled against most currencies around the world.

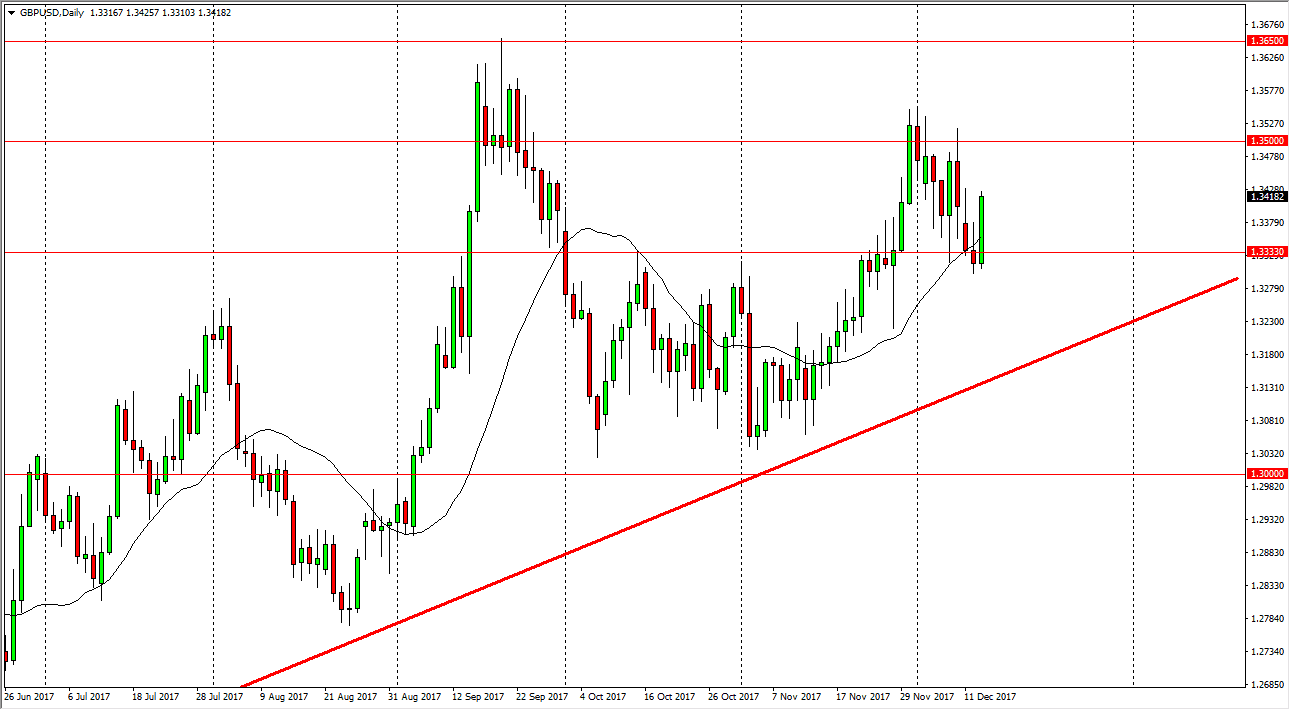

GBP/USD

The British pound skyrocketed during the day, breaking above the top of the shooting star for the previous session, which of course is a very bullish sign. Ultimately, I think that this market will break above the 1.35 handle above, and then reach towards the 1.3650 level which was the scene of a massive gap. It’s going to take a lot of momentum to finally break out to the upside, but once we do this is a market that could go much higher. I think pullbacks at this point are buying opportunity still, and the 1.31 level below coincides with a nice-looking uptrend line that should continue to be the “bottom” of the market. If we were to break down below there, then I think the market breaks down, but I don’t think that happens anytime soon, considering how bullish this move has been. Overall, this is a market that continues to be volatile, but I think is starting to come around to the idea of a higher-priced British pound.