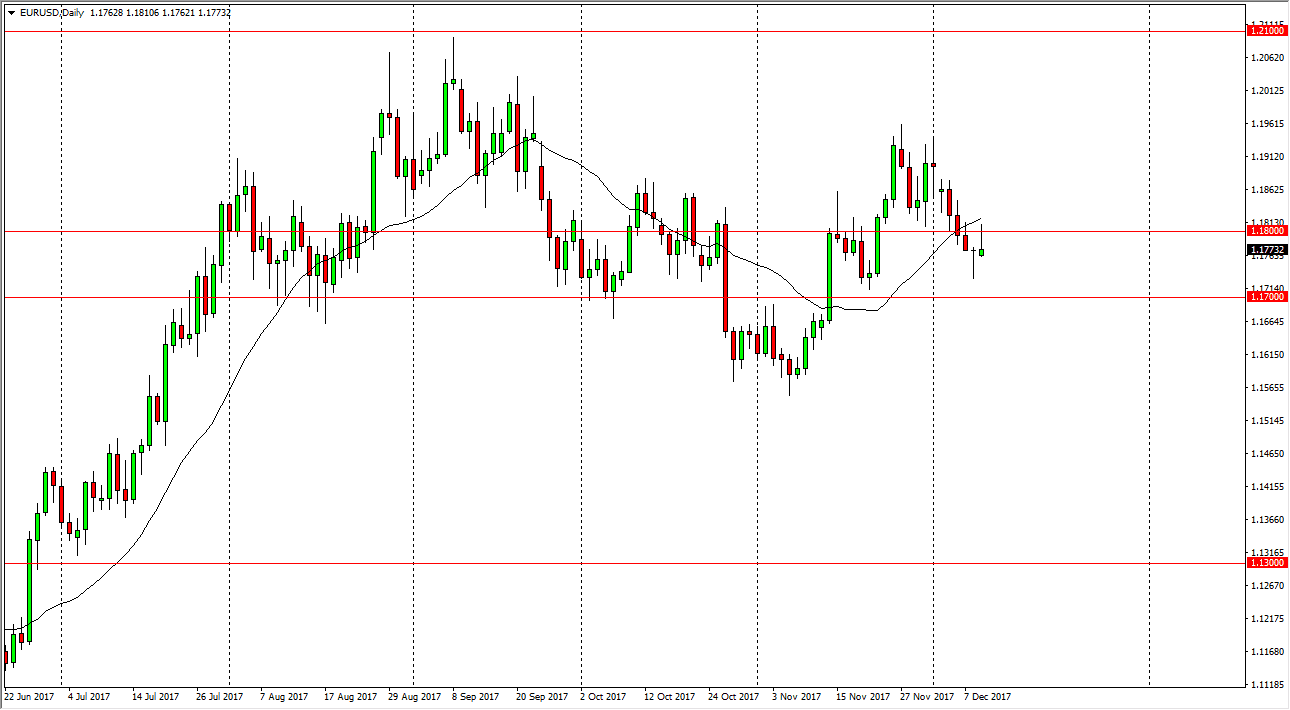

EUR/USD

The EUR/USD pair broke out to the upside during the trading session on Monday, but ran into a buzz saw of problems at the 1.18 handle. At this point, we ended up forming a bit of a shooting star, which is counter to the hammer from the previous session. I think that given enough time, we should continue to see this market go higher, as this area has been important. However, we may be waiting for some type of attitude coming out of the Federal Reserve for the Wednesday statement. A break above the top of the shooting star should send this market towards the 1.1950 level next. If we were to break down below the 1.17 level, that would be very negative and could change things. However, at this point I think eventually we will find a reason to go higher.

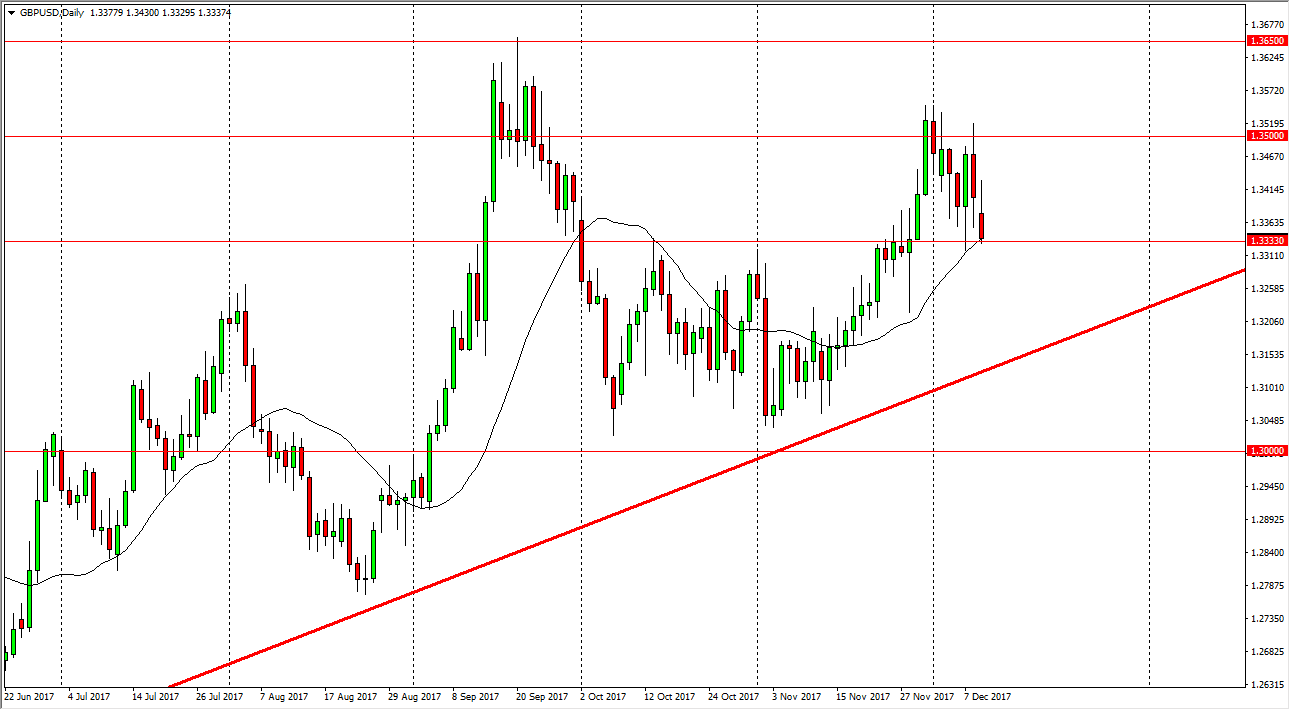

GBP/USD

The British pound gapped lower at the open on Monday, turned around to show signs of strength, and then broke down to the 1.3333 handle. That’s an area that was previous resistance, and I think at this point should show a bit of support. If we bounce towards the 1.3350 level, at that point I think that we will go higher, perhaps reaching towards the 1.35 handle. If we were to break down significantly from here, then we will more than likely test the uptrend line underneath, meaning that we could go as low as 1.3150 underneath. Overall, I think a lot of this is going to come down to how the Federal Reserve speaks about the outlook for interest rate hikes, and therefore I think we may be quiet until Wednesday afternoon. If we were to break above the 1.35 handle, then we should go to the 1.3650 level.