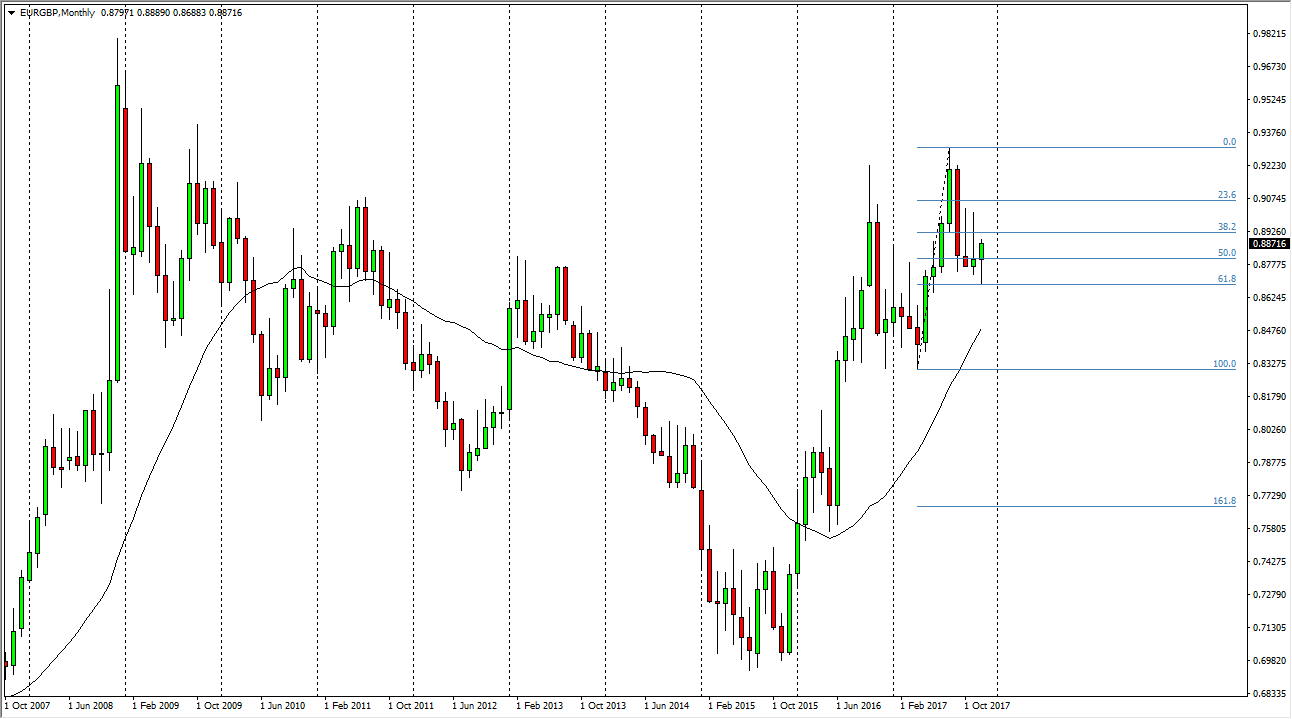

The EUR/GBP pair has been very volatile over the last several months, but one would expect that considering that we have had so much in the way of headline noise coming out of the negotiations between London and Brussels. The December candle is forming a hammer, but that is preceded by a couple of shooting stars. With this in mind, I believe that the market will have a hard fight above, but I think that the European Union in its stability is probably going to attract more in the way of currency trading than the United Kingdom with the unknowns. That doesn’t mean that is can be easy for this market to grind higher, and I think for a significant portion of the beginning of the year will be trading between the 0.88 level on the bottom, and the 0.90 level on the top.

If we do break above the 0.90 level, and I think we will eventually, the market should be free to go to the 0.93 level after that, which was the high from this past year. I think that longer-term traders will continue to push higher, perhaps trying to make a move towards parity. The alternate scenario is that we would break down below the bottom of the December candle, and that would send the market looking for a full retrace back to the 0.8325 handle. I believe this market is going to be very choppy and difficult, but if you can keep your trading position reasonable, you should be able to take advantage of the overall bullish attitude, and of course the negotiations. Longer-term, most pundits I know are calling for parity. I don’t know if we see that in 2018, but I think we have a decent chance of doing so.