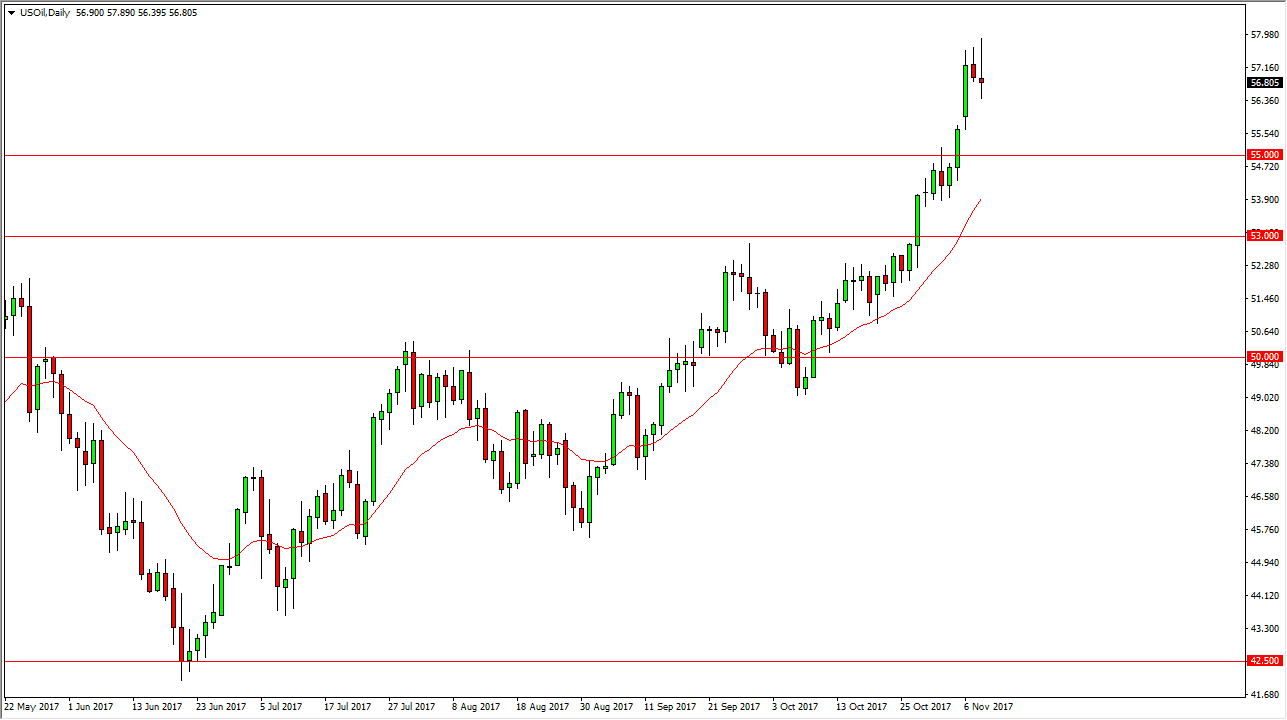

WTI Crude Oil

The WTI Crude Oil market initially rally during the trading session on Wednesday, breaking towards the $58 level. We turned around to form a shooting star though, so I think that perhaps the overextended WTI market will start to roll over, perhaps reaching towards the $55 level underneath. There is a significant amount of support just underneath the $55 level, so I think that this is more or less a buying opportunity just waiting to happen. Some type of support near the $55 level should be thought of as value, as the market should continue to go to the $60 level. However, if we were to break down below the $53 level, the market could breakdown to the $50 handle. We are overbought, so this pullback is welcomed by both the bearish and bullish alike.

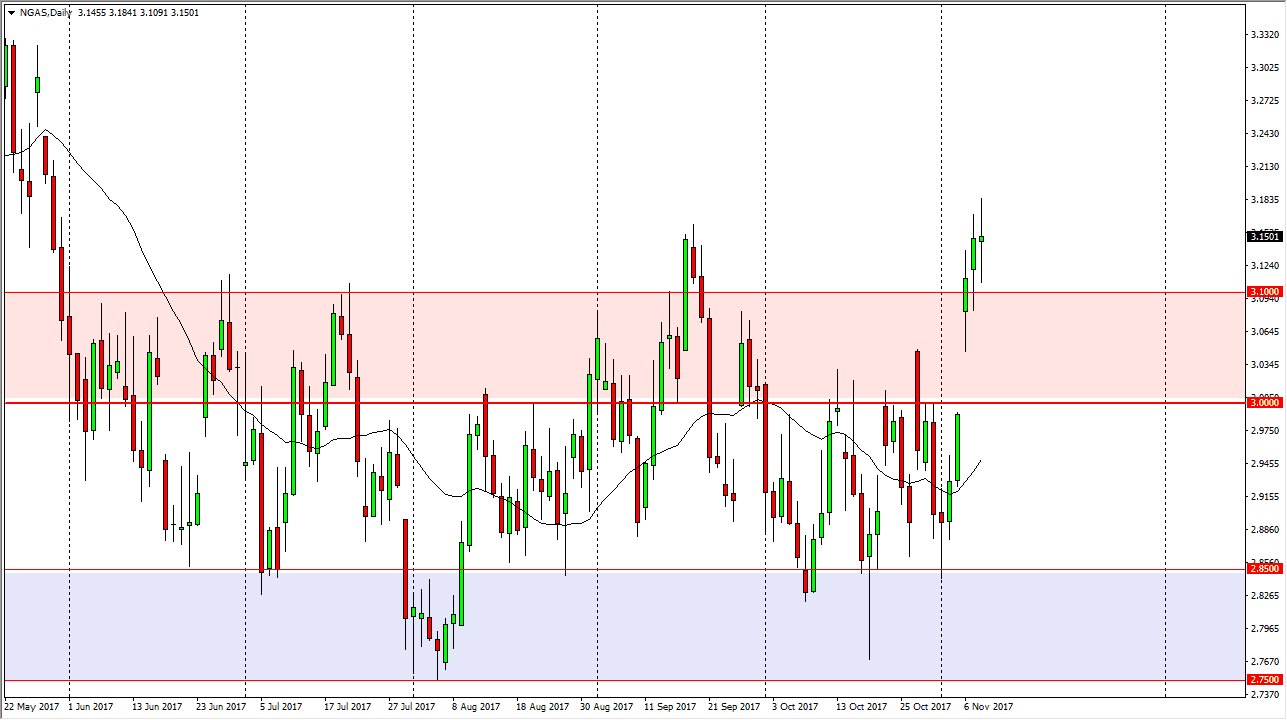

Natural Gas

Natural gas markets continue to be very volatile, as we seem to be hanging about the $3.15 handle. A break above the top of the candle for the session is a very explosive moved to the upside just waiting to happen, but I think we are more likely to pull back towards the $3.10 level, looking for support. If we break down below there, we could go as low as the $3.00 level, which should be supportive due to the gap that appears there. It’s not until we break down below there that I am willing to start selling. The fact that we have made a “higher high”, I suspect that there are plenty of traders out there are willing to pick up dips, and perhaps try to drive this market towards the $3.30 level above. We are heading to the colder months in the United States, so it makes sense that we should continue to rally in the short term.