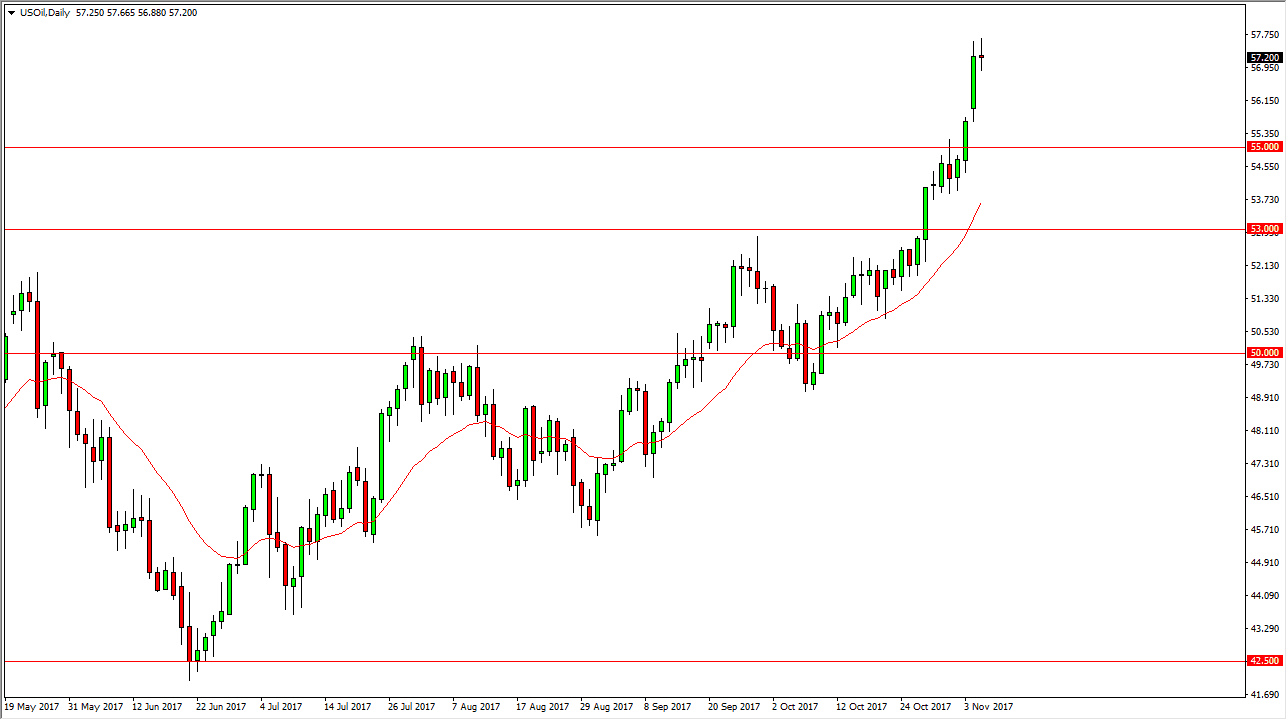

WTI Crude Oil

The WTI Crude Oil market went back and forth during the day on Tuesday, ultimately settling on a very neutral candle. I believe that this suggests that the market is ready for a pullback, and quite frankly I think that’s healthy. The $55 level underneath should be support, as it was previous resistance, and I think a pullback is probably necessary to continue to the upside. The $60 level above is going to be very resistive, and of course will attract a lot of attention. I think the market has gotten ahead of itself, as traders were concerned about Saudi Arabia. If we were to break down below the $55 level, I suspect that the next area of interest will be the $53 level. Longer-term, I believe we roll over, but right now we are obviously very bullish in this market.

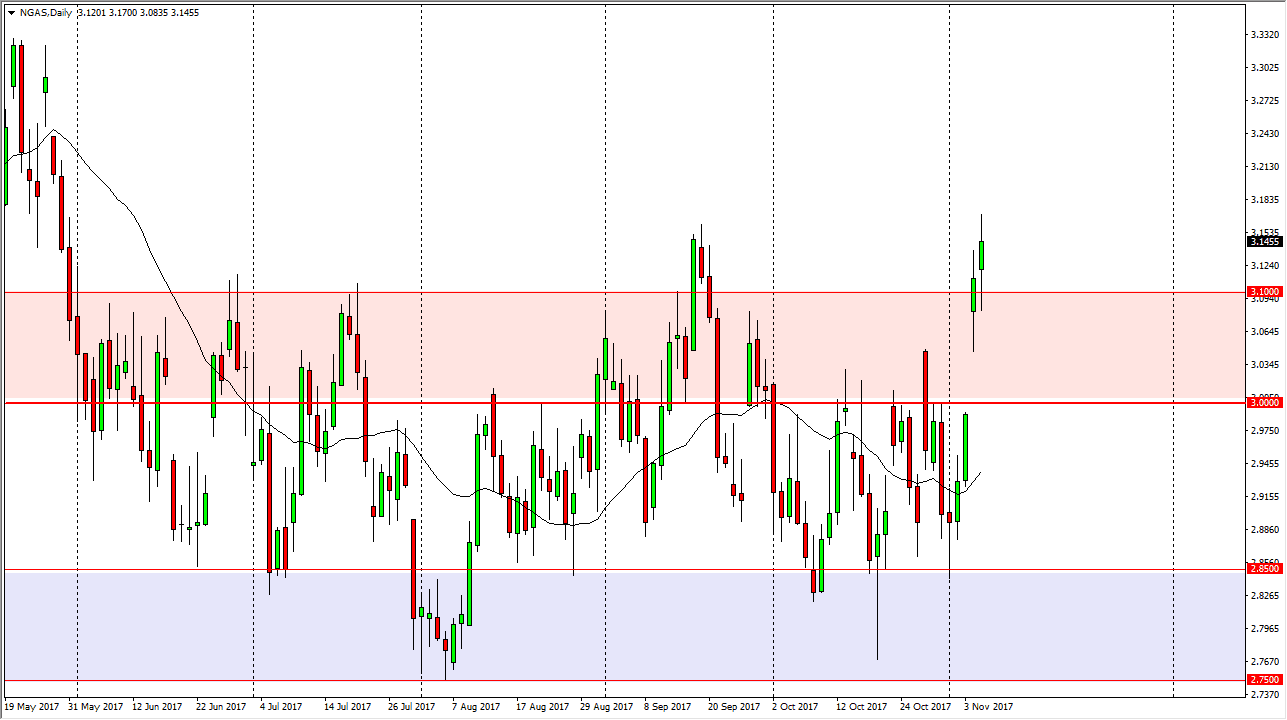

Natural Gas

Natural gas markets fell a bit during the day on Tuesday, but then found enough support underneath the $3.10 level to turn around and form a bullish looking candle. It now looks as if we are starting to follow the seasonal pattern of stronger natural gas during winter in the United States, as demand increases. Because of this, I would not be surprised at all to see this market go looking for the $3.30 level above. However, I don’t know that we will get above there. We also have a gap below that extends down to the $3 level that will more than likely look to be filled. If we break down below the bottom of the candle for the session on Tuesday, I think we do pull back to the $3.00 level. Alternately, on a break above the top of the candle for the day on Tuesday, I’m a buyer, but only short term.