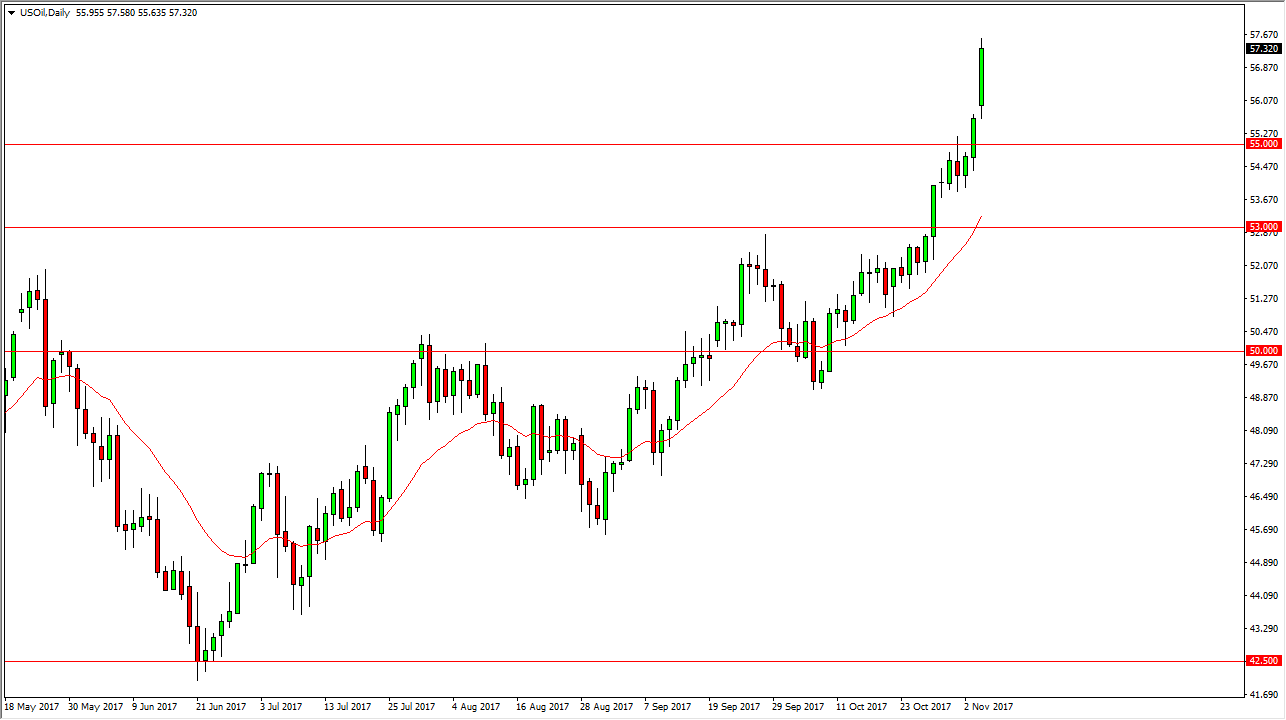

WTI Crude Oil

The WTI Crude Oil market gapped higher at the open on Monday, and then broke above the $57 level. Part of this was due to the purge that we have seen in Saudi Arabia over the weekend, bringing quite a bit of uncertainty when it comes to the petroleum markets. I believe that the $55 level now should offer significant support, and the pullbacks should continue to be buying opportunities. The $60 level above is the target from what I can see, as it is the large, round, psychologically significant number. We are bit overextended, but I think at this point we should continue to see a lot of buying opportunities, based upon value on dips. I think that the market should eventually calm down, and most certainly pull back as it has gotten overextended, but I think in the short term it’s likely that we will see more buying.

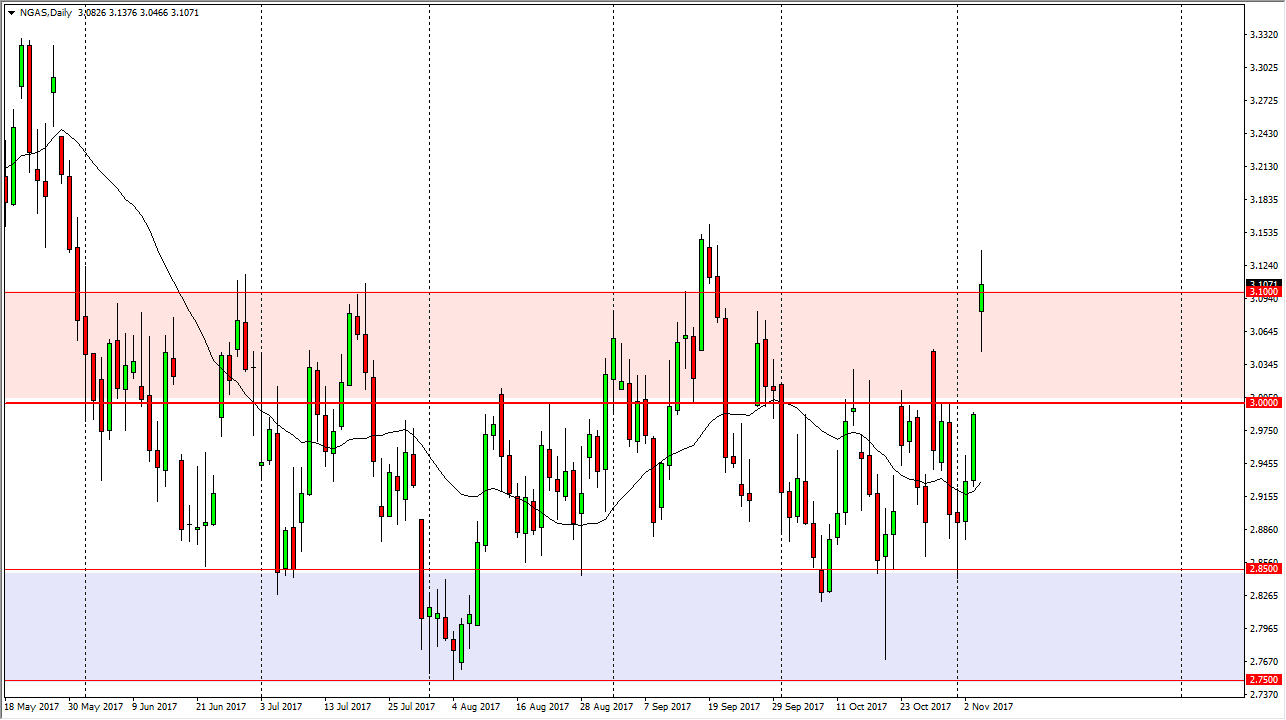

Natural Gas

Natural gas markets have yet again had a very volatile session, gapping drastically higher at the open on Monday. We even reached as high as $3.14, but then pulled back to close just above the $3.10 level. This market as a quite a bit of space underneath to fill the gap, so we could see selling come back in as we are at the extreme of the overall consolidation that we have seen. However, the weekly chart has formed 3 hammers in a row, so I suspect we may be getting ready to see the seasonal break out to the upside that we get due to more demand coming out of the United States. However, this is a short-term opportunity at best, and I think that the $3.30 level will be as far as this market can go. Frankly, the market should continue to be one that remains volatile, because supply will almost certainly come flooding into the market at these elevated levels.