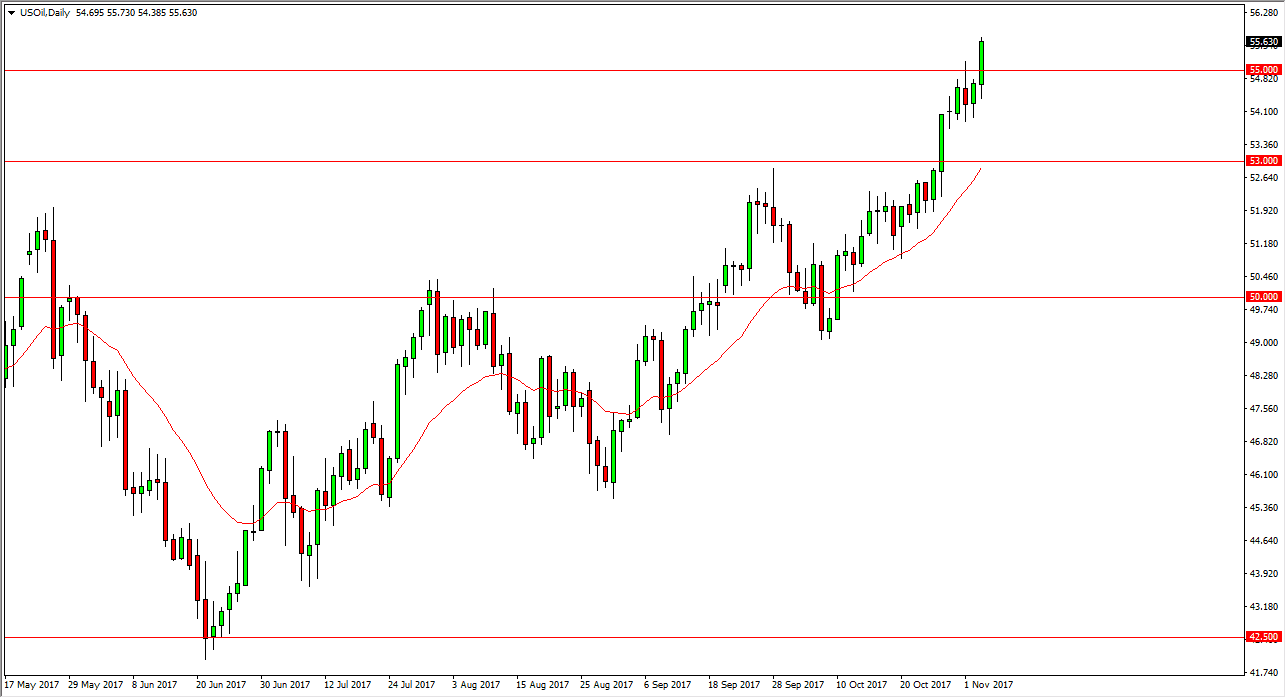

WTI Crude Oil

The WTI Crude Oil market initially fell during the trading session on Friday, but then shot through the $55 handle, an area that I thought would be significantly resistive. We broke above the top of the shooting star from the Wednesday session, and this shows that we have a fresh, new, resiliency about the uptrend. I think that pullbacks will offer buying opportunities, as the breaking of $55 is a significant event. I think that we will then go look towards the $60 handle above, where we should see more resistance. However, I currently have been speaking to several hedge funds about bias, and they all seem to think that for the short term, oil continues to rally. I look at pullbacks as value until we break down below the $50 handle, something that looks less likely now.

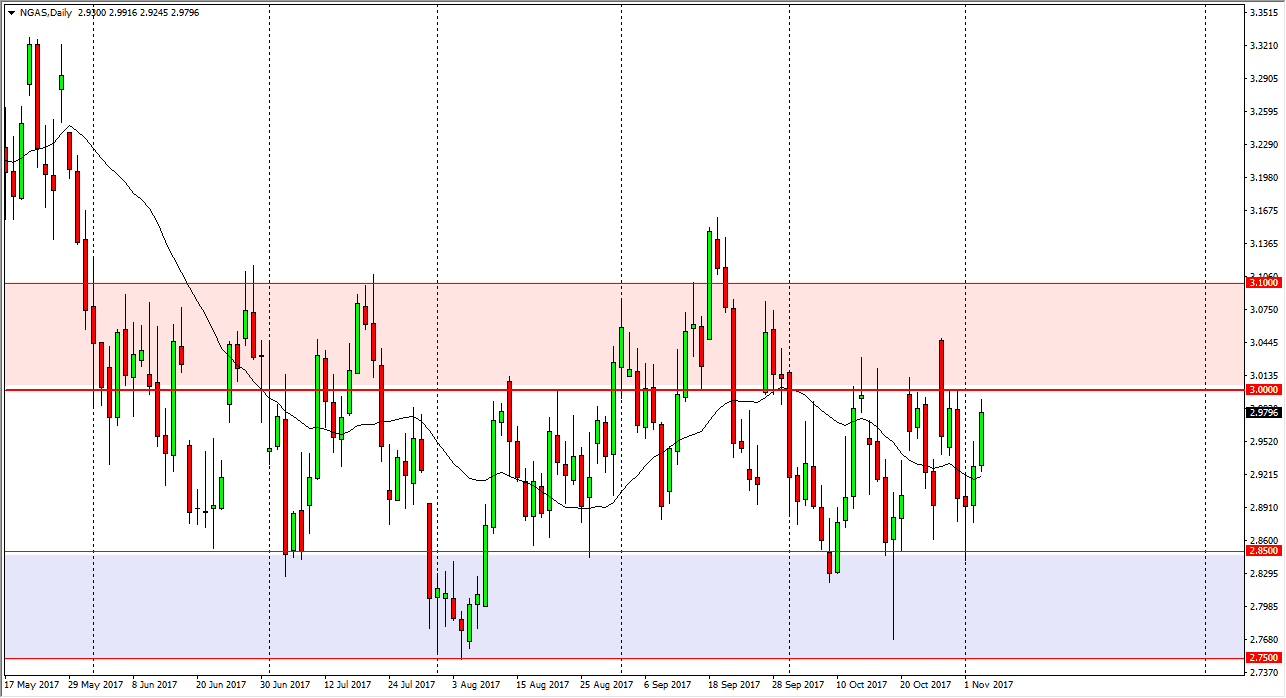

Natural Gas

Natural gas markets continue to bang around in the consolidation area that I have on the chart. I think that once we get into the red zone above the $3.00 level, any signs of exhaustion should invite more selling as we have more than enough supply above there to keep the market down. Ultimately, if we break above the $3.10 level, that would be a very bullish sign, but I don’t think that’s going to happen. Having said that, the weekly chart is starting to show signs of trying to form a base, and that should continue to put the market under a lot of pressure to the upside. On the other hand, we also see a massive amount of oversupply above the $3.00 level, so it’s likely that this will be an epic fight. This explains the overall sideways choppiness, and the fact that the market cannot breakout of this range. Currently, I don’t think anything has changed.