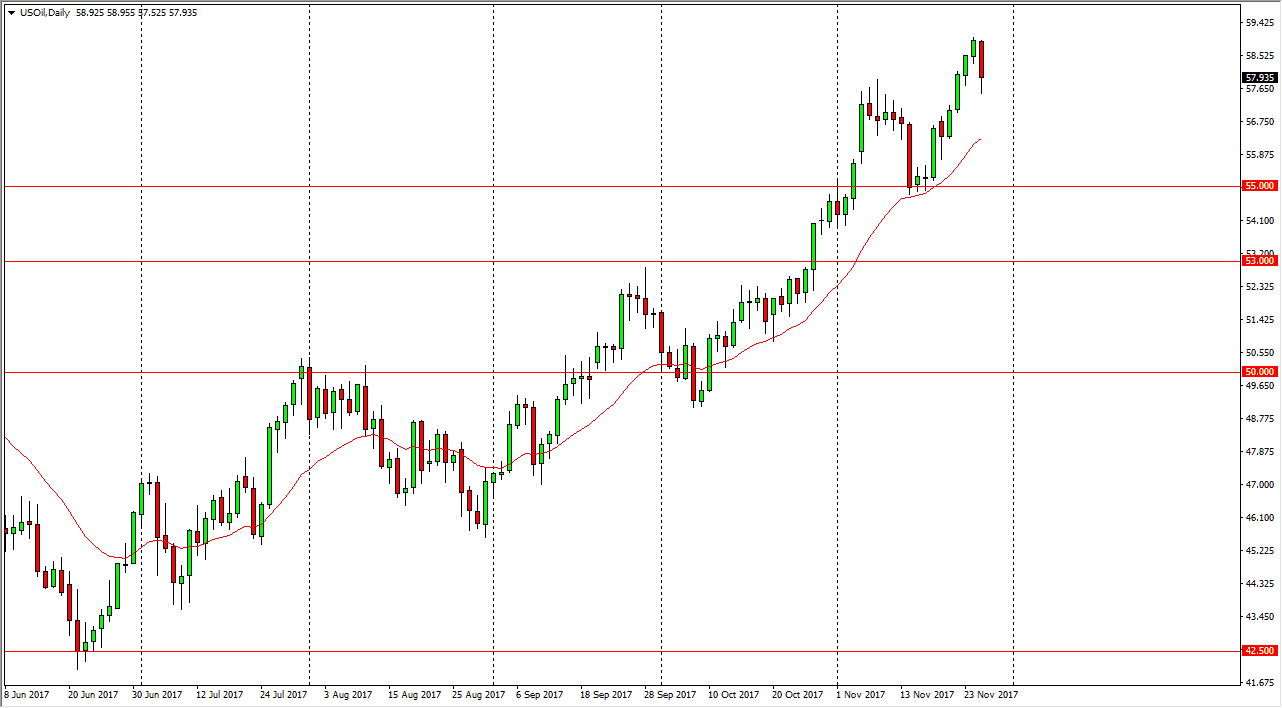

WTI Crude Oil

The WTI Crude Oil market fell significantly during the trading session on Monday, slicing through the $58 level. This is a rather negative candle, but we did find support at the very first place where you would expect to see it. Because of this, it’s likely that the bullish run will continue, as crude oil traders have been aiming for $60 lately. I think that this remains a “buy on the dips” market, and that the $60 level is far too psychologically attractive for traders to ignore. I believe that the “floor” is probably close to the $55 level. If we were to break down below there, the $53 level would be the next target, as it looks to be rather supportive as well. As a side note, the 20-day SMA has been rather reliable as support.

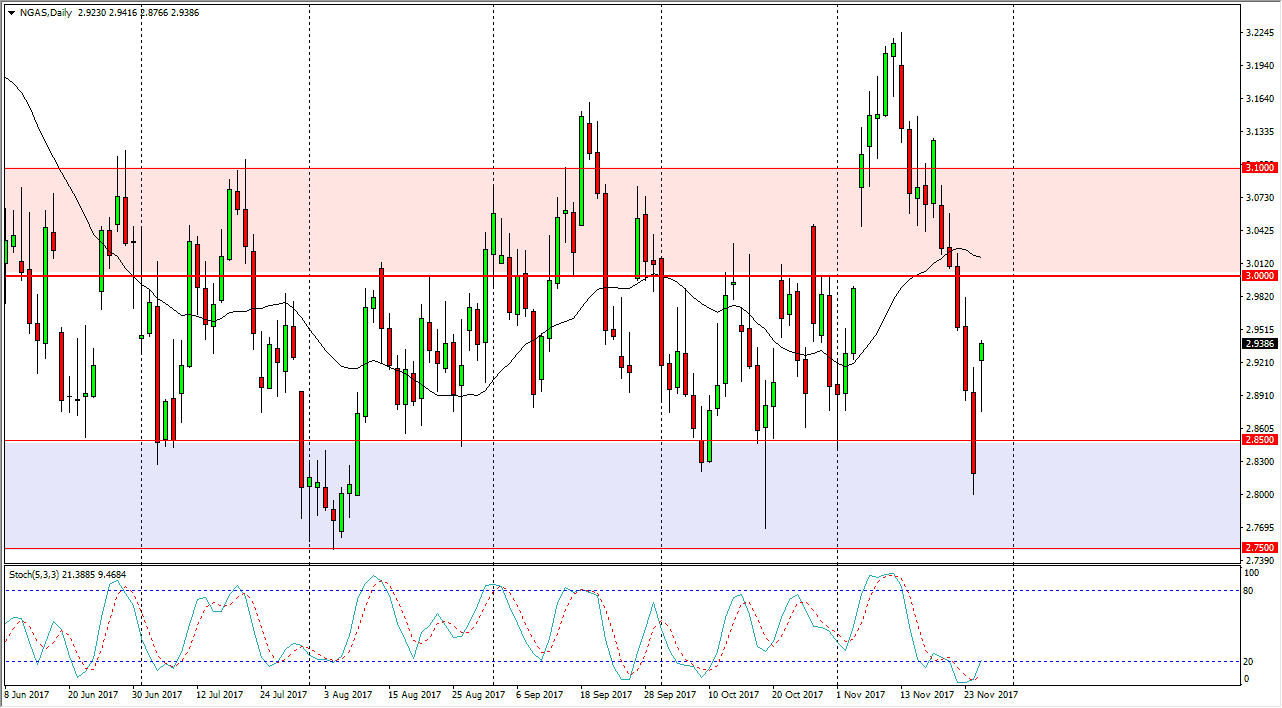

Natural Gas

The natural gas markets gapped higher at the open on Monday, pulled back to test that gap for support, founded, and then turned around to close for a hammer. This is a very bullish sign, but a break above the top of the hammer does not have me buying, rather it has me looking for exhaustion above the start selling again. The fact that we turned around the way we did and started falling tells me just how soft this market probably is underneath. Because of that, I’m waiting for signs of exhaustion above, especially near the $3.00 level, to start selling as seasonality doesn’t seem to apply this year. Quite frankly, natural gas markets are flooded with supply, and even though it starting to become colder in the northeastern part of the United States, it doesn’t seem like we can hold strong pricing in the natural gas markets.