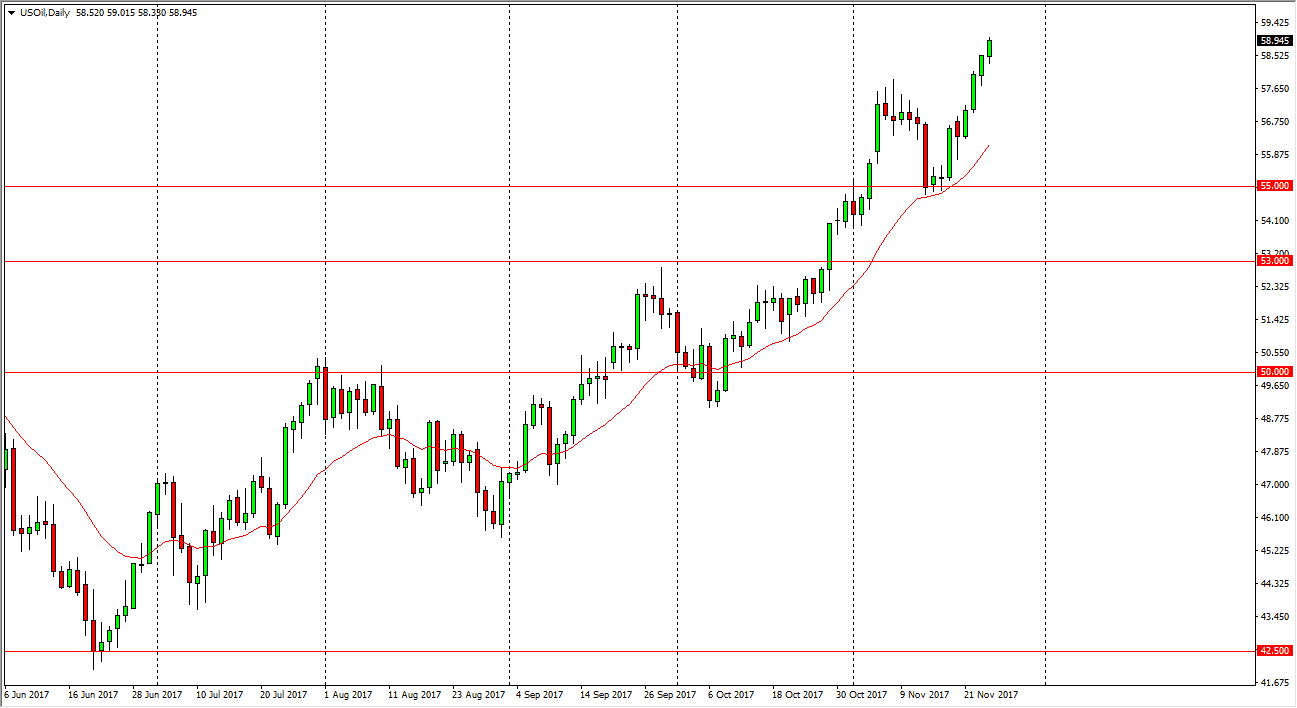

WTI Crude Oil

The WTI Crude Oil market initially fell on Friday, but turned around to rally yet again as we approach the $59 level. Ultimately, I believe the pullbacks offer opportunities to go long, as it should represent value. The $60 level above is the next target, as it is a large, round, psychologically significant number. I think that we will see a significant amount of resistance in that area though, so this is a short-term opportunity only. I have no interest in shorting, least not in the near-term, as I think there is more than enough fear of the tension in the Middle East to continue to push the value of crude higher. If we break above the $60 level, the market should go much higher. On the other, if we break down below the $55 level, that would be an extraordinarily negative sign.

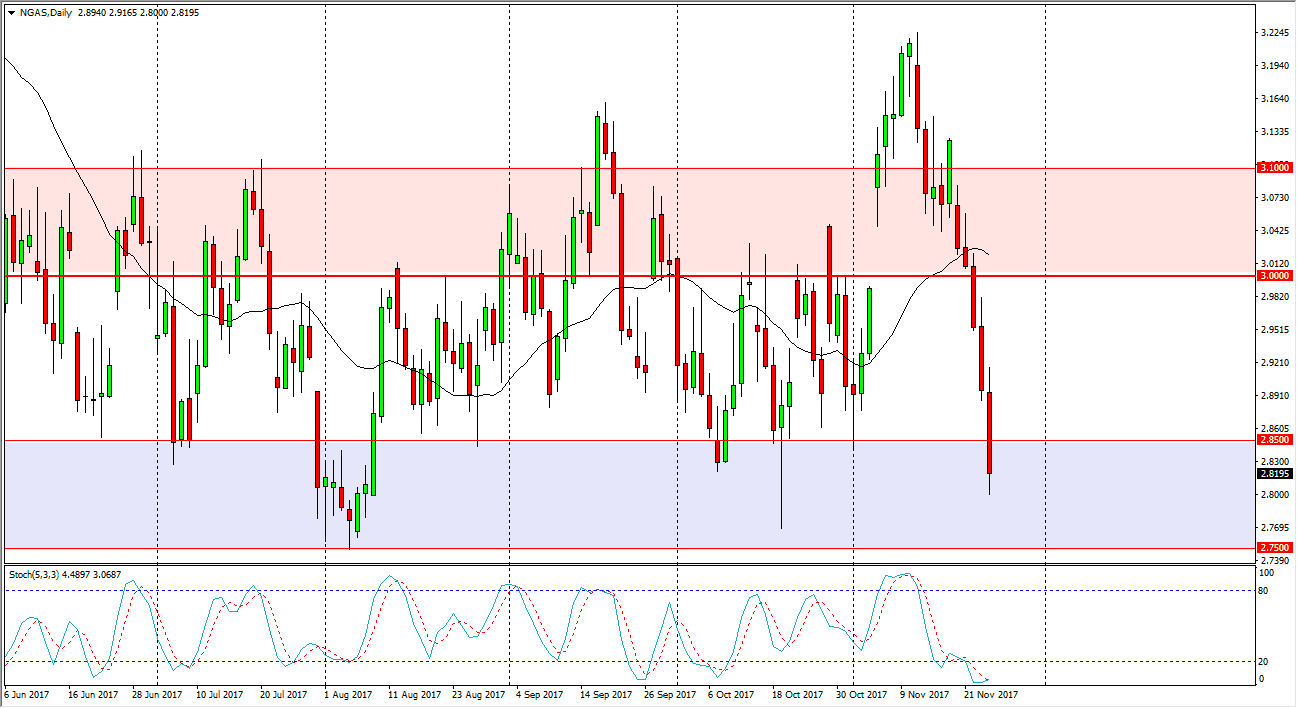

Natural Gas

Natural gas markets broke down significantly again on Friday, slicing through the $2.85 level. By doing so, it shows just how negative this market is, but I think we are bit overdone at this point as we are starting to crossover in the oversold region of the stochastic oscillator. I expect a vicious snapback rally, but if we can stay below the $3.00 level, I think that it’s only a matter of time for the sellers return. After all, we have seen a massive selloff in what should be the height of demand season and bullish pressure in this market. If we cannot keep up the bullish pressure and the natural gas markets during the month of November and possibly December, when will we be able to?