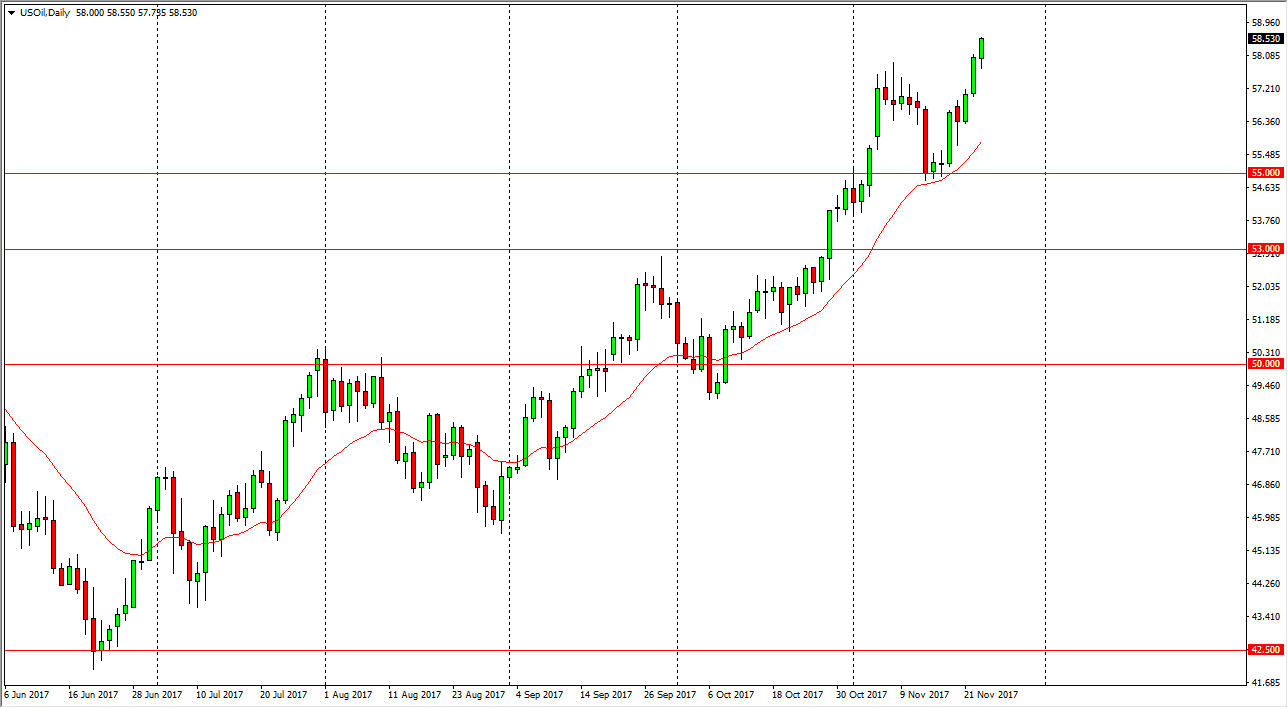

WTI Crude Oil

The WTI Crude Oil market rallied again during the day on Thursday, and what would have been slightly then markets, as Americans were a way for Thanksgiving. However, the electronic session offered trading opportunities for people around the world, and we continue to see buying pressure. I think that the recent spill at the Keystone pipeline has some of the traders thinking bullish, but I also believe that it’s a technical move towards the $60 handle just waiting to happen. I think short-term pullbacks are buying opportunities, and given enough time we will reach that level. I believe that the $55 level is currently the floor in the market, and it’s not until we break down below there that I’m willing to sell, or if we get some type of horrifically negative move towards the $60 handle.

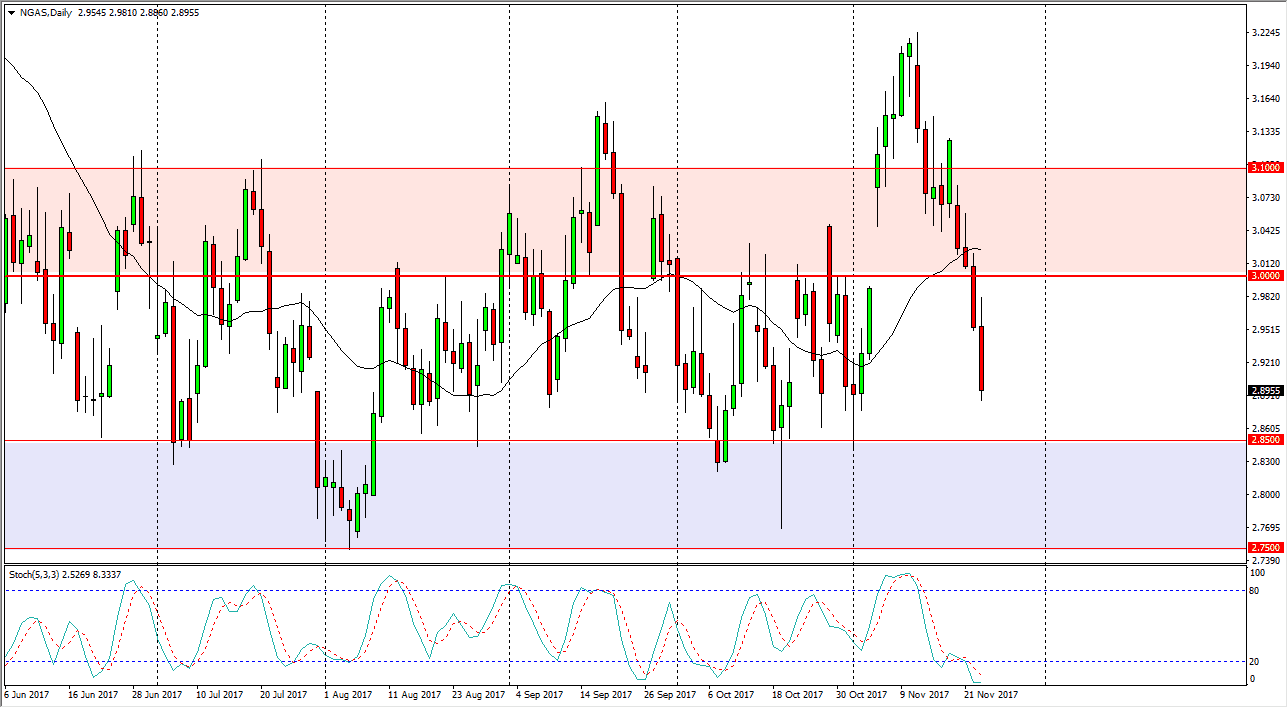

Natural Gas

Natural gas markets have been a mess for some time, and after gapping well above the $3.00 level, we turned around and not only filled the gap, but we are now well below it. Because of this, and the fact that it is the most bullish time year for this market, I think that the natural gas markets are going to continue to struggle, and quite frankly I am a bit surprised. Going forward, I suspect that the $3 level will offer resistance, is as the $2.85 level should offer support. So, with this in mind, I am a seller of short-term rallies that show signs of exhaustion, but I would do so in very small positions. The market is going against its typical seasonality, so that of course is very bearish, but then again, we have a massive amount of support just below. Above all else, be careful.