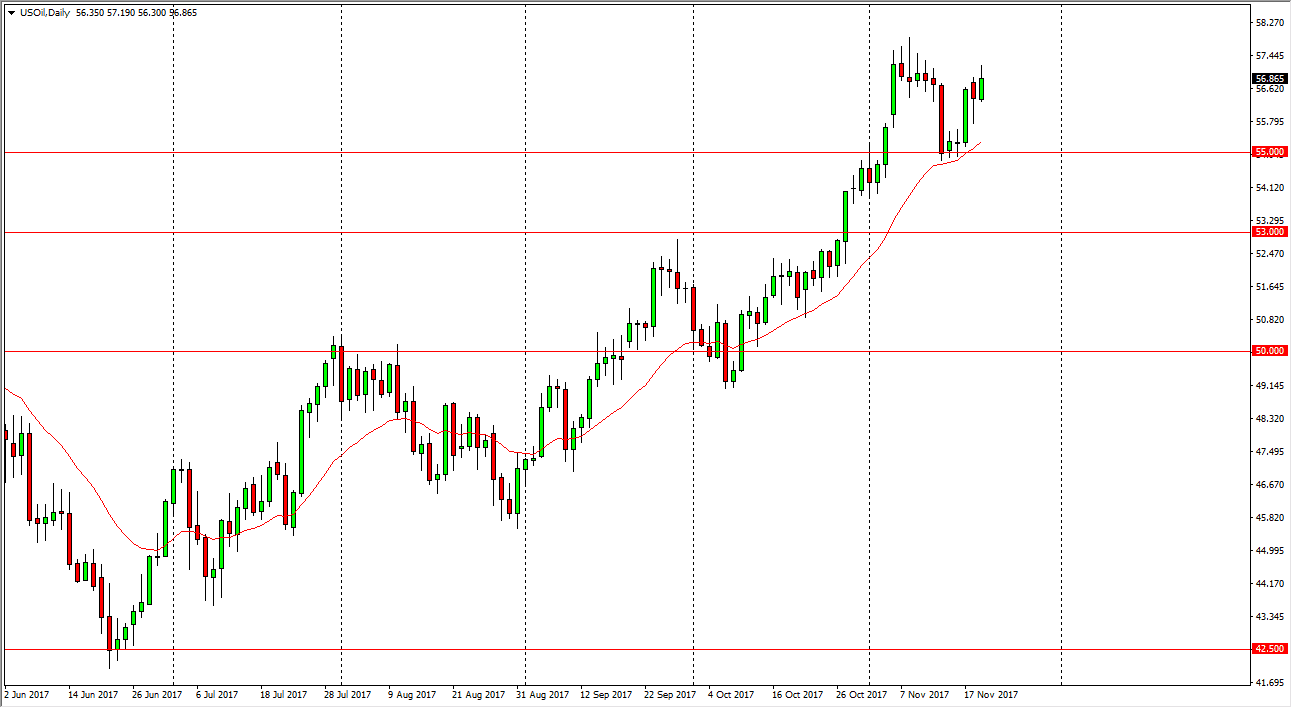

WTI Crude Oil

The WTI Crude Oil market rallied on Tuesday, breaking the top of the hammer that was formed on Monday. This is a very bullish sign, and it looks as if we will try to break out above the $58 level next. Once we do, the market will almost certainly go looking towards the $60 level above, which is a large, round, psychologically significant number, and it is of course structurally resistive in the past as well. I believe that the $55 level now acts as a bit of a floor in the uptrend, and that short-term pullbacks will offer value the people are willing to take advantage of as the tensions in the Middle East rise. Longer-term, I believe that there is far too much in the way of supply and of course threats from North America drilling to allow the market to stay elevated for too long.

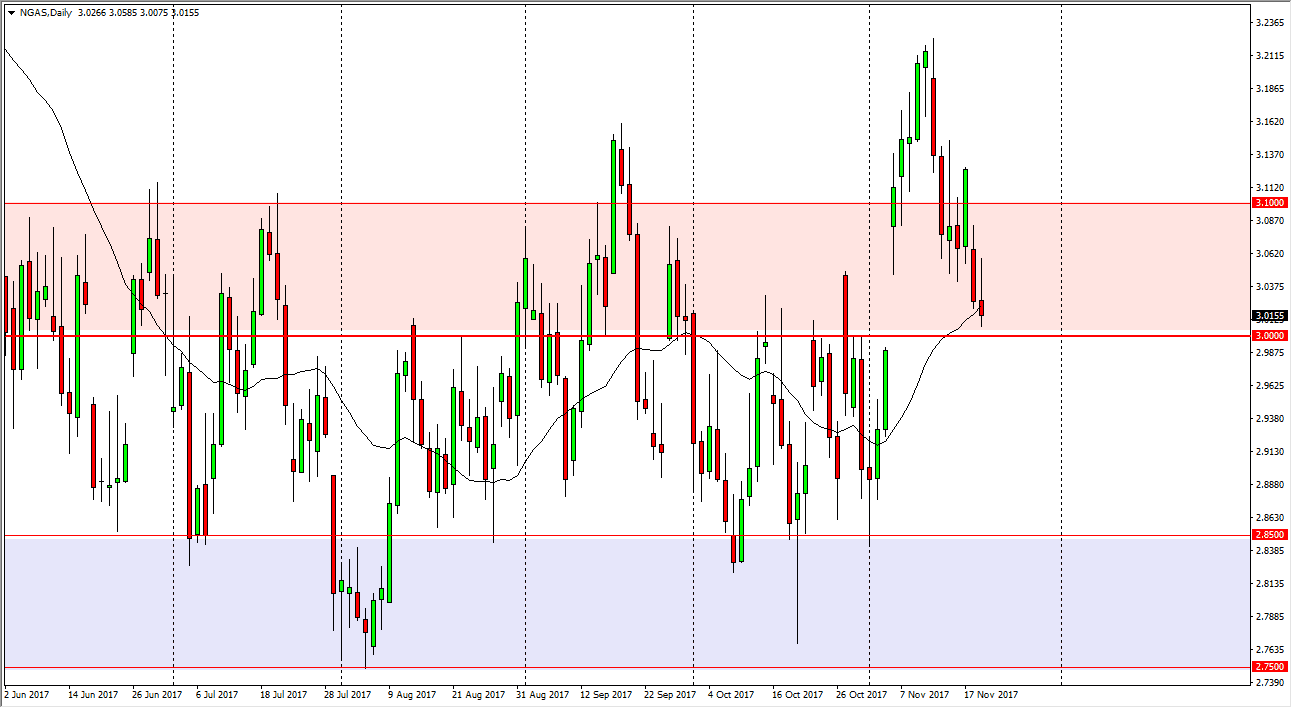

Natural Gas

Natural gas markets formed a very bearish looking candle by the time it was all said and done on Tuesday, initially surging higher, but once we closed we ended up forming a shooting star that sits on top of significant support. With this tells me is that if we break down below the $2.98 level, that would be catastrophic. At that point, I suspect that the $2.85 level would be targeted next, and that the typical seasonality of bullish pressure may not be coming this year. I am a bit surprised to see this reaction, but I would also point out that a break above the top of the shooting star from the session on Tuesday would be equally bullish, showing a complete capitulation by the sellers. I believe that the next 24 hours is going to be vital in this market, and I am a seller below the $2.98 level, and a buyer above the top of the range for the day on Tuesday.