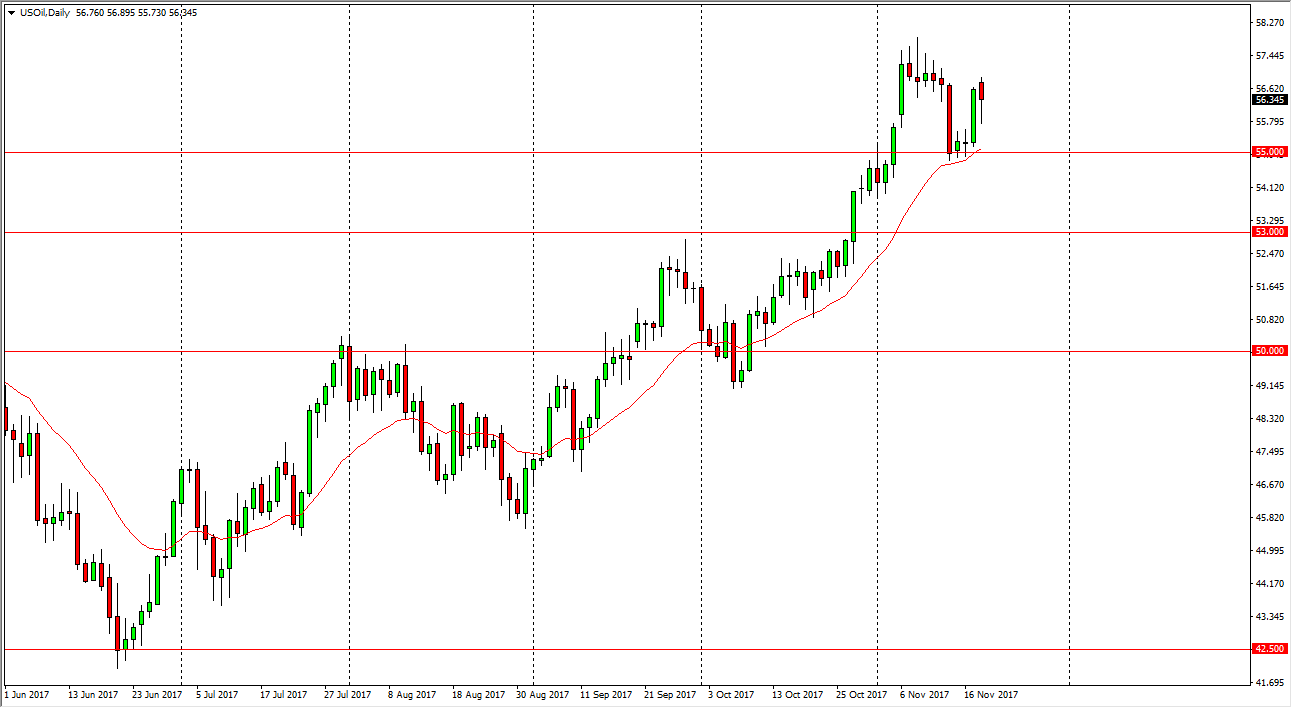

WTI Crude Oil

The WTI Crude Oil market spent most of the day falling on Monday, but bounced to form a bit of a hammer. Because of this, it looks likely that we are going to continue to see buyers in this market, and the $55 level underneath should continue to be massively supportive. I believe that the market could continue to find buyers every time it dips, because of the tension in the Middle East, and the possibility of production cuts coming out of that same region. However, I think that the upside is somewhat limited, as we will continue to find that US drillers will be more than willing to get involved and start supplying as prices rise. I think this is going to continue to be a major problem, and therefore the upside is somewhat limited. However, I certainly would not be interested in shorting at this point, and I think that short-term trading can still make profits on the bullish sign.

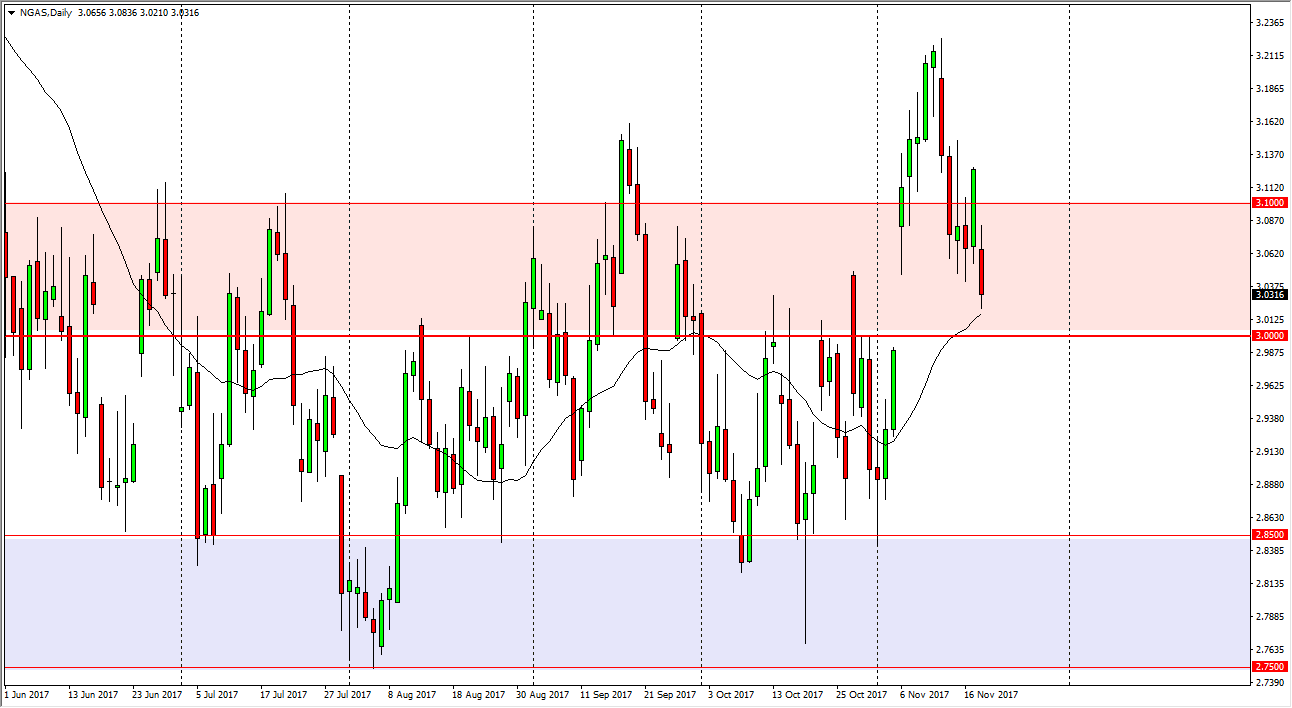

Natural Gas

Natural gas started the week very negatively, initially trying to rally but then broke down rather significantly. I think we are going to go ahead and look for support at the $3.00 level, so I’m waiting to see if we can get some type of bounce from that area that I can start taking advantage of what has typically been a very strong time of the year, and of course the gap that formed recently above the $3 level was a very strong sign as well. However, if we were going to break down below the $2.98 level, the market will probably go looking towards the $2.85 level. Meanwhile though, I believe that we are much likelier to see the $3.20 level again.