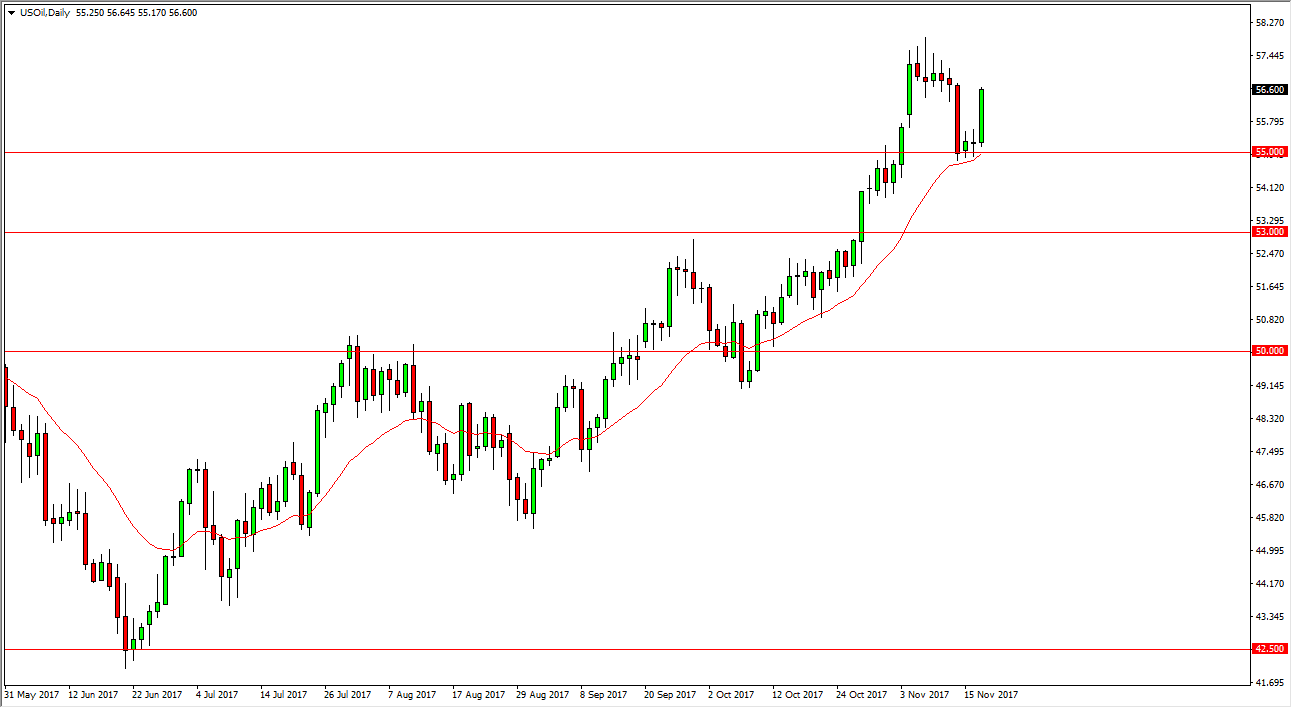

WTI Crude Oil

The WTI Crude Oil market has rallied significantly during the day on Friday, using the $55 level as support. It looks as if the $58 level above is going to be resistance, and I think that pullbacks will continue to offer buying opportunities. The $55 level should be the “floor” in the market for the short term, and I believe that we are going to go looking towards the $60 handle. A breakdown below the $54 level would be very negative, and send this market to the $53 level, followed by the $50 handle. While I believe that the sellers will return, it might be a while, so I think that in the short term it’s probably best to buy dips more than anything else. If we broke above the $60 handle, it would be a very bullish sign and could send this market much higher.

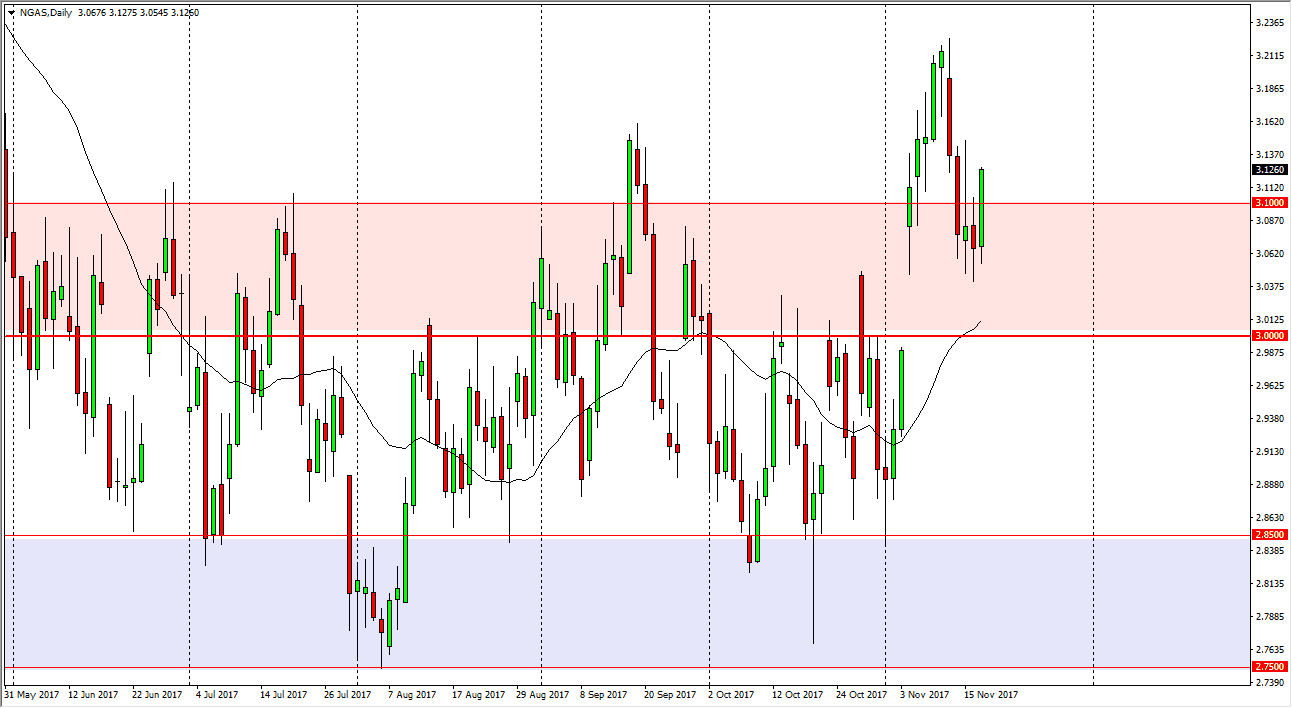

Natural Gas

Natural gas markets continue to be very volatile, as we initially fell, but then broke well above the $3.10 level on the daily chart. By closing above there, it looks like a very bullish sign, and it’s likely that we will continue to go to the $3.25 level. That’s an area that should be resistance, so I think that short-term buyers will continue to come in and try to pound that level, perhaps breaking above there. The $3.50 level above there would be the next target, as the longer-term charts signify those areas be an important. Pullbacks of this point could drop all the way to the $3.00 level. That is the “bottom” of the market and the time being, I look at that as a massive barrier. However, if we break down below there, I would become aggressively short as it goes against the seasonality of the market.