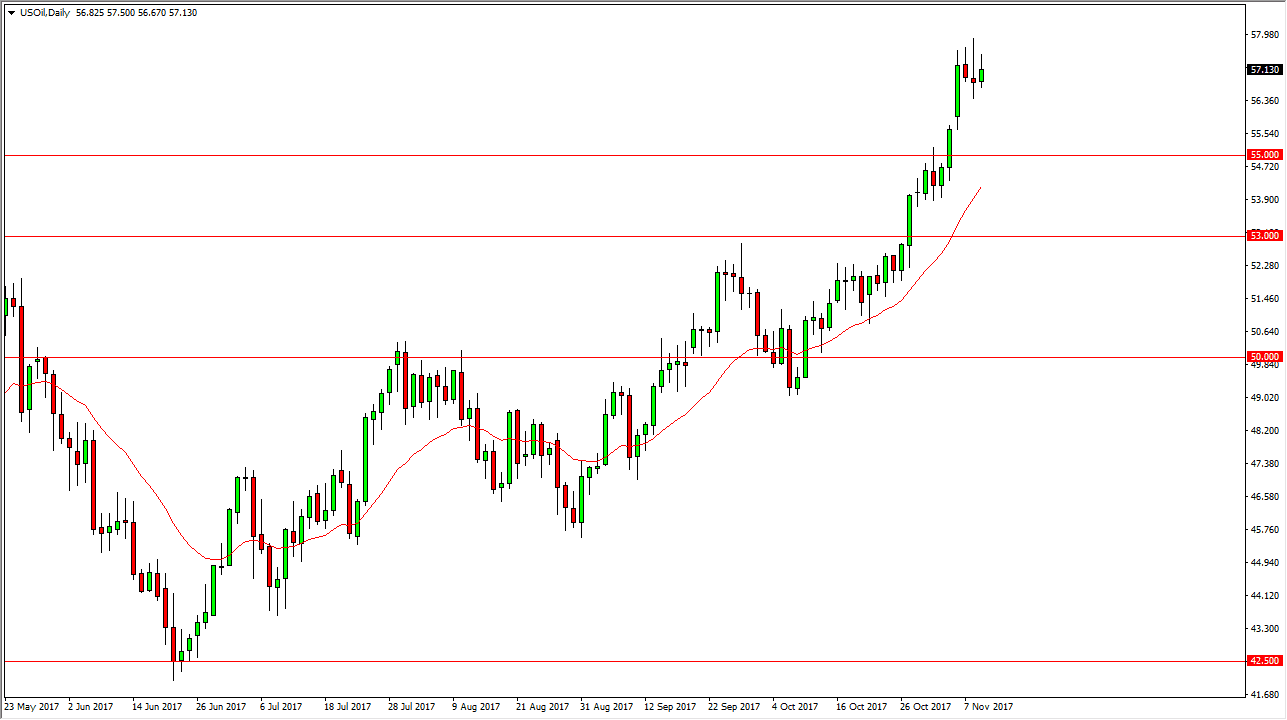

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the day, but quite frankly it’s Lenny overextended at this point, and it looks as if the $58 level is going to continue to cause issues. We formed a shooting star during the Wednesday session, so it could be a sign that we are getting ready to see a little bit of a pullback. Quite frankly, this is what we need to see, and I would welcome buying opportunities closer to the $55 level as it gives us an opportunity to pick up a little bit of value. If we break down below there, the $53 level would be the next target, and should be even more supportive. Overall, I expect volatility, but quite frankly the oil market has gotten ahead of itself short term, so it’s likely that the pullback will only cause more interest in going long.

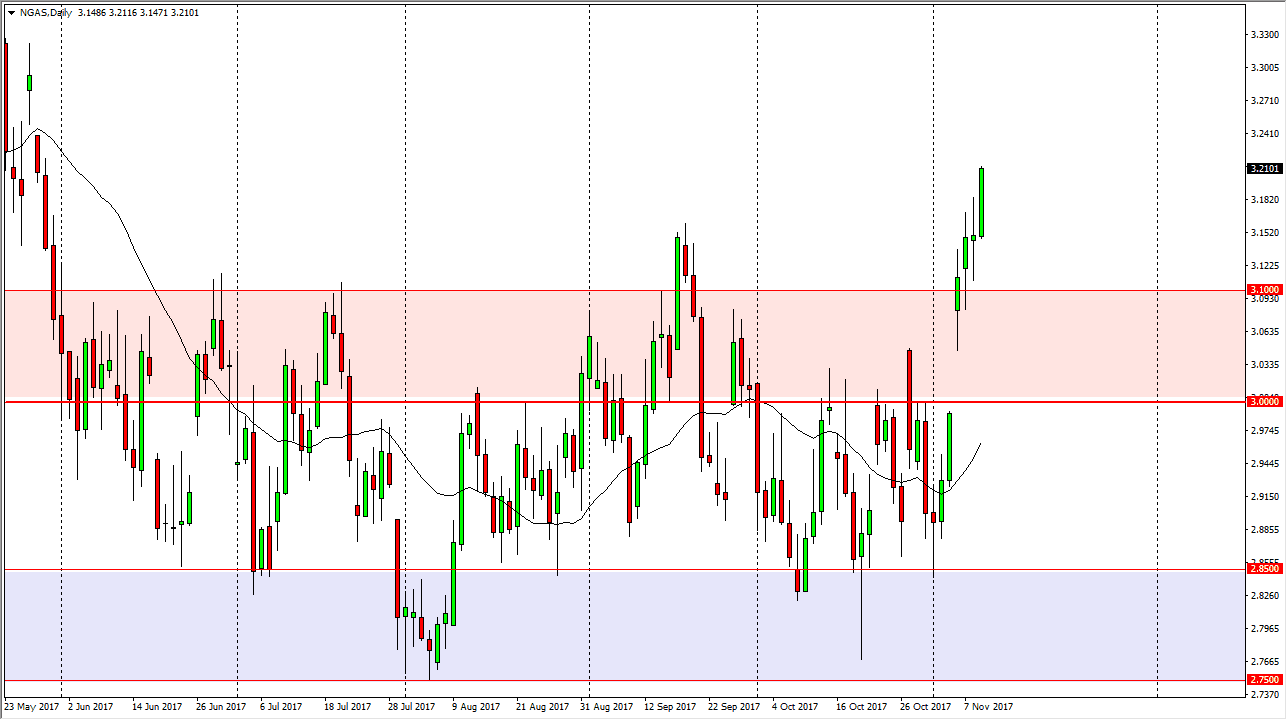

Natural Gas

Natural gas markets had a very explosive moved to the upside during the day on Thursday, as colder weather is heading towards the northeastern part of the United States. The $3.10 level looks to be a bit of a floor now, and I think that we are getting ready to go to the $3.33 handle. Move above there should send this market looking towards the $3.50 level, which is the longer-term resistance. Alternately, we could break down below the $3.10 level, as it should send this market down to the $3 level underneath. That is an area that should be rather supportive, and I believe that filling the gap will probably be a reason for buyers to come back into the marketplace. However, if we break down below there, the market should then drop significantly. Overall, looks like the seasonality of cold temperatures will be a major driver.