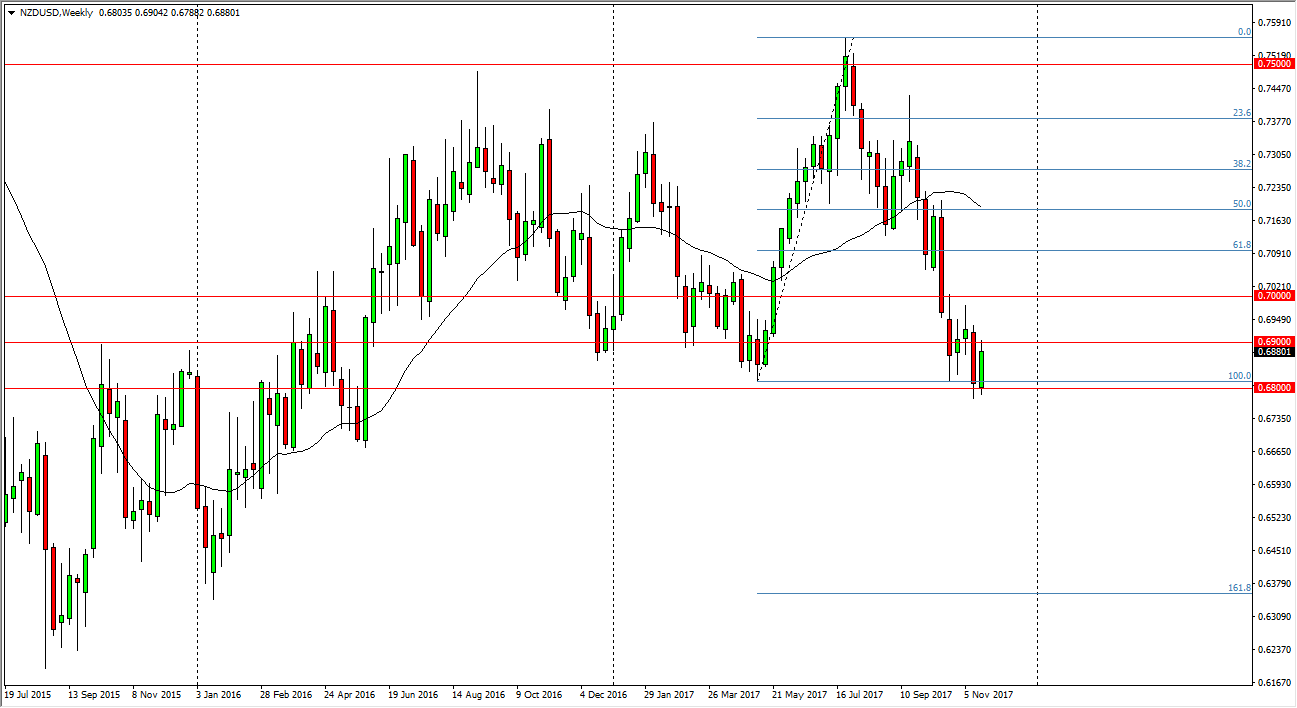

NZD/USD

The New Zealand dollar rallied during much of the week, but struggled at the 0.69 handle. I believe at this point; short-term traders are going to come in and sell this market every time they get a chance to. On a breakdown below the 0.68 level on a daily close, that would be a very negative sign, pushing this market much lower, perhaps down to the 0.65 handle, and then the 161.8% Fibonacci retracement level closer to the 0.6350 level. If we break above the 0.70 level, then I switch to bullish.

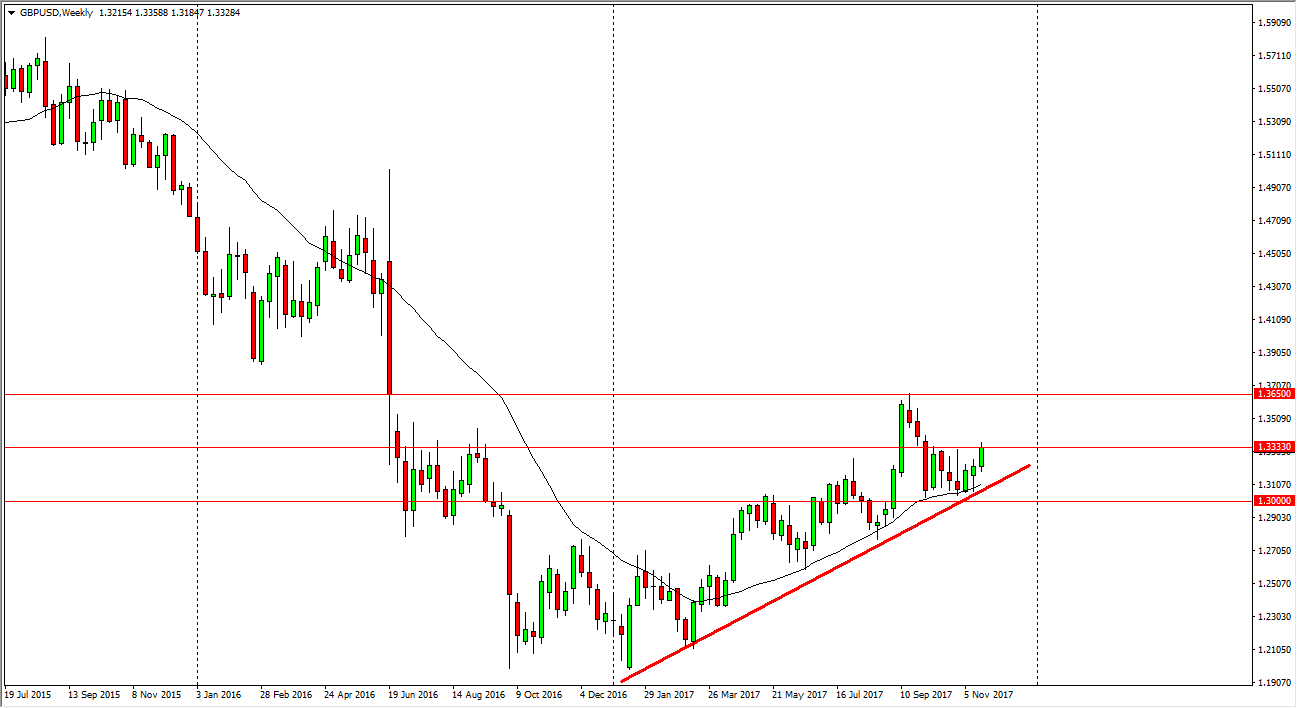

GBP/USD

The British pound rallied a bit during the week, testing the 1.3333 level, but failing to break through at the end of the day. However, I think if we can break above the top of the weekly candle, the market will then go looking towards the 1.3650 level above, which was the scene of a major gap lower. A break above that level freeze this market to go much higher. In the meantime, I would anticipate short-term pullbacks offering buying opportunities.

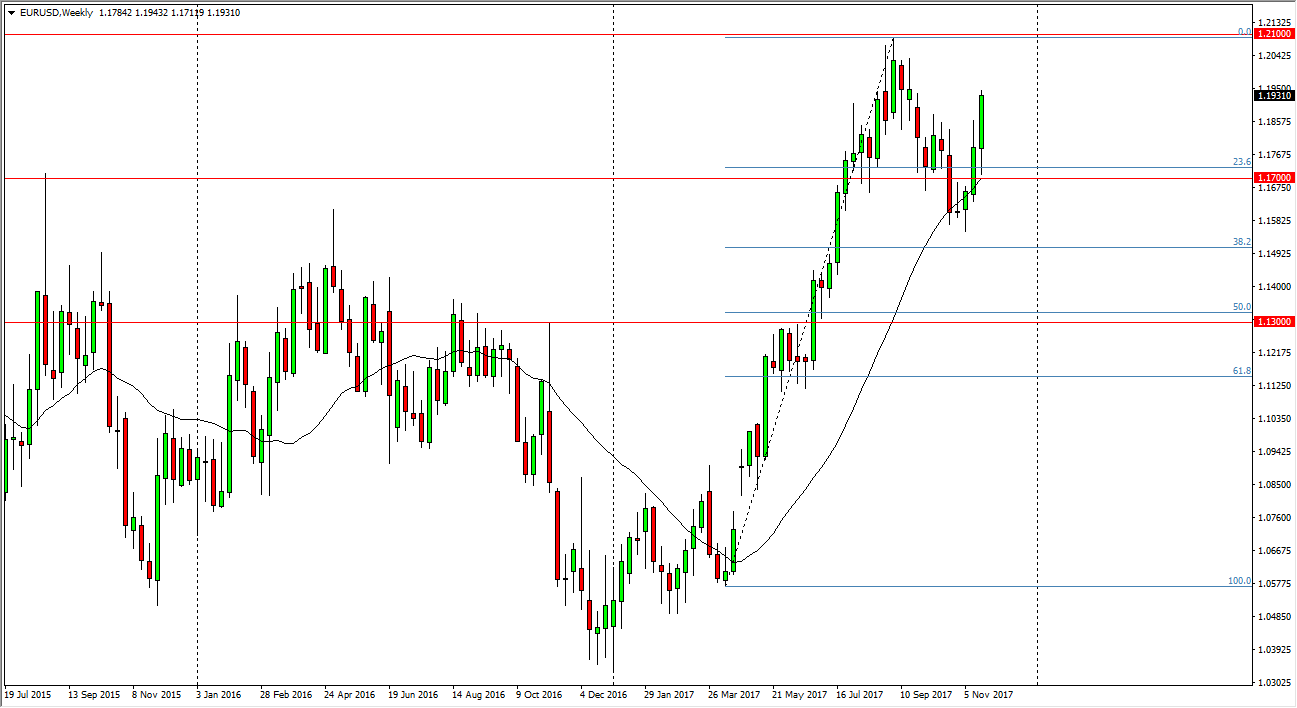

EUR/USD

With the EUR/USD pair breaking higher after initially falling during the week, it now looks as if we are going to continue to go much higher. With the US tax reform seeming less likely, I believe that the breaking of the top of what I see as a potential bullish flag could send this market to the 1.21 level over the next couple of weeks. Ultimately, we could go as high as 1.32 based upon the measurement.

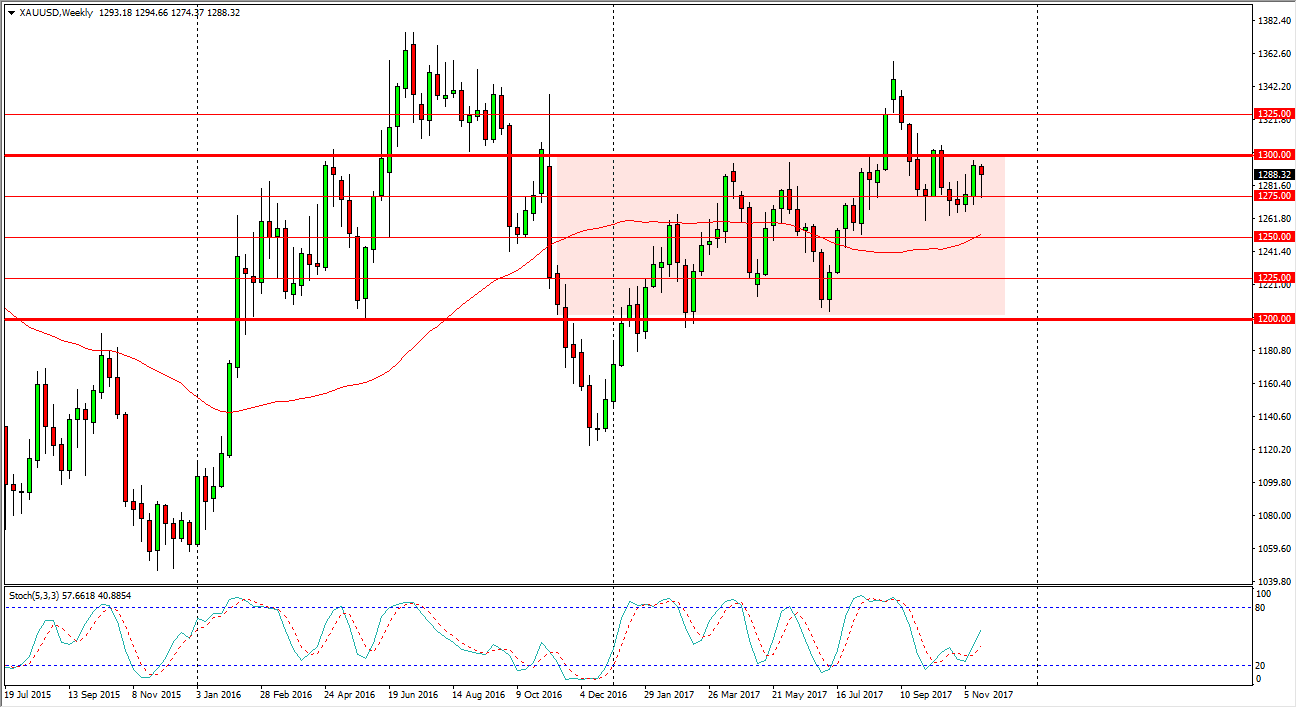

Gold

Gold markets fell during most of the week, but found enough support at the $1275 level to turn around and form a hammer on the weekly chart. If we can break above the $1300 level, and it certainly looks as if we are going to trying to, I believe the gold will go looking towards the $1325 level next. As I see weakness in the US dollar against many other currencies around the world, a rising gold makes quite a bit of sense.