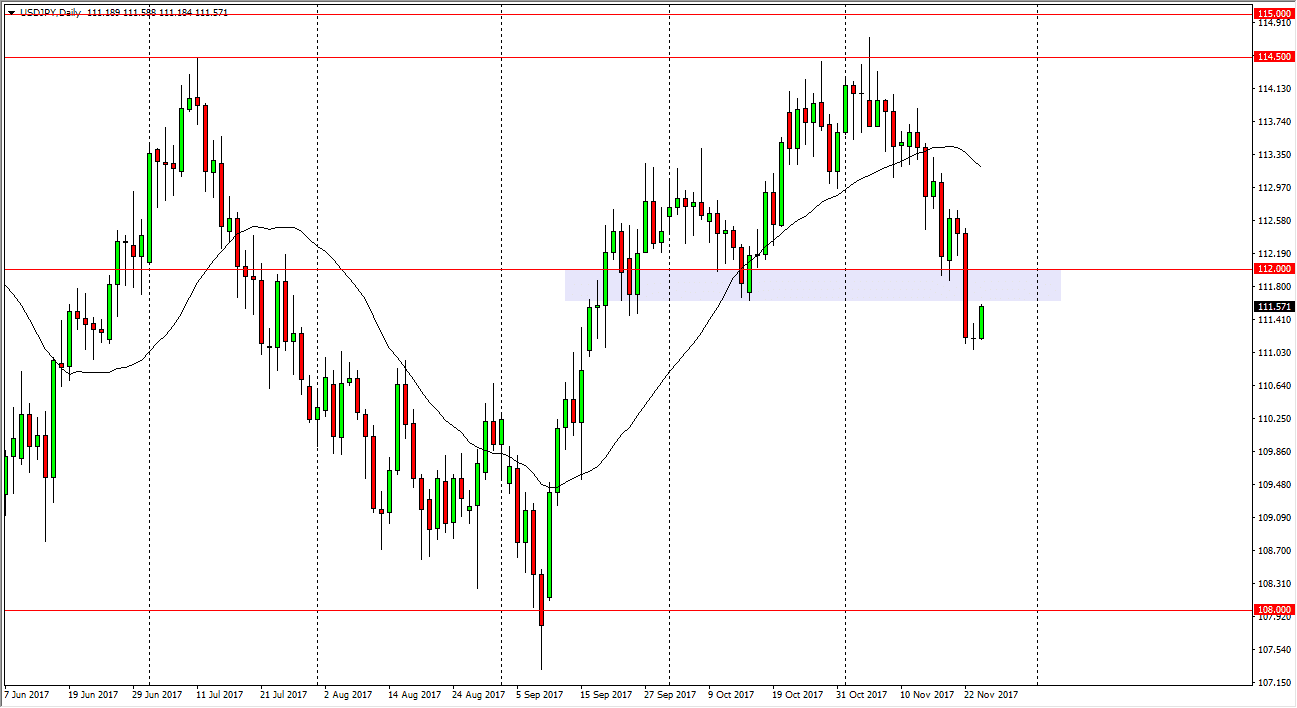

USD/JPY

The US dollar rallied against the Japanese yen during the trading session on Friday, but this would have been relatively light volume. I believe there is a significant barrier of resistance between current levels and the 112 level, so on the first signs of exhaustion I am more than willing to start selling. That could send this market back towards the bottom of the overall consolidation, near the 108 handle. Alternately, if we break above the 112.25 level, then I think the market will probably go looking towards the 114.50 level above which is the top of the overall consolidation that extends to the 115 handle. Pay attention to the volatility in the stock markets, because this market tends to focus on risk appetite in general, and of course interest rate market such as the 10-year note.

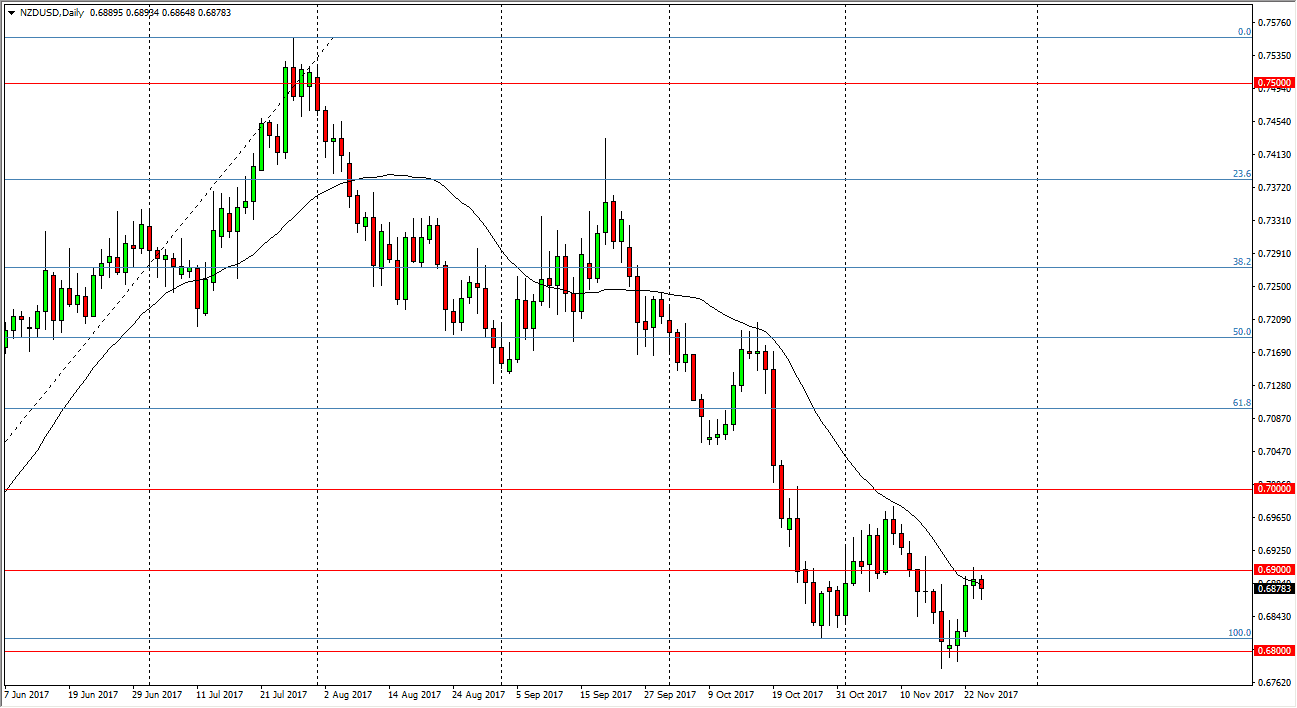

NZD/USD

The New Zealand dollar traders had a busy day, as we went back and forth but ended up forming a bit of a hammer. The hammer sits just below the 0.69 level, which is an area that we have seen both support and resistance. If we break above that level, then we will have an even more significant fight above, as the 0.70 level is even more resistant. If we break down below the bottom of the hammer for the day, that should send this market looking to the 0.68 level, which has been massively supportive. A breakdown below there frees the New Zealand dollar to go down to the 0.65 handle given enough time, and perhaps even down to the 0.6350 level based upon the 161.5% Fibonacci retracement level. Remember, this pair tends to be very sensitive to risk appetite.