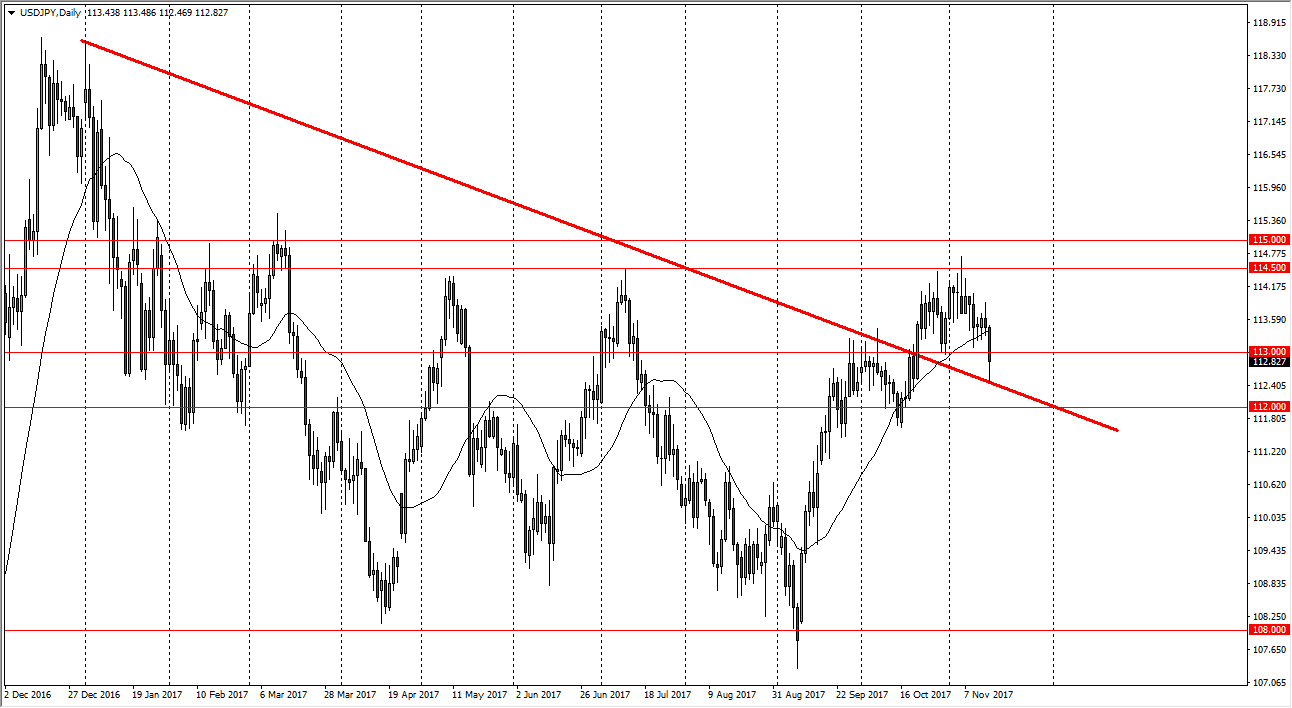

USD/JPY

The US dollar fell during the day on Wednesday, slicing through the 113 handle. The downtrend line from the downtrend in channel offered a bit of support, and the bounce makes a bit of sense as it should continue to find buying opportunities in this area. If we can break above the 113 handle, the market should then try to go back towards the 114.50 level. A break above the 115 handle is a longer-term “buy-and-hold” situation, perhaps allowing the market to go as high as 118 after that. I believe that if we break down below the 112 level, then things change, and we more than likely go looking towards the 108 level after that. Overall, this is a market that I think will find buyers given enough time, so be patient, you should have an opportunity to go long.

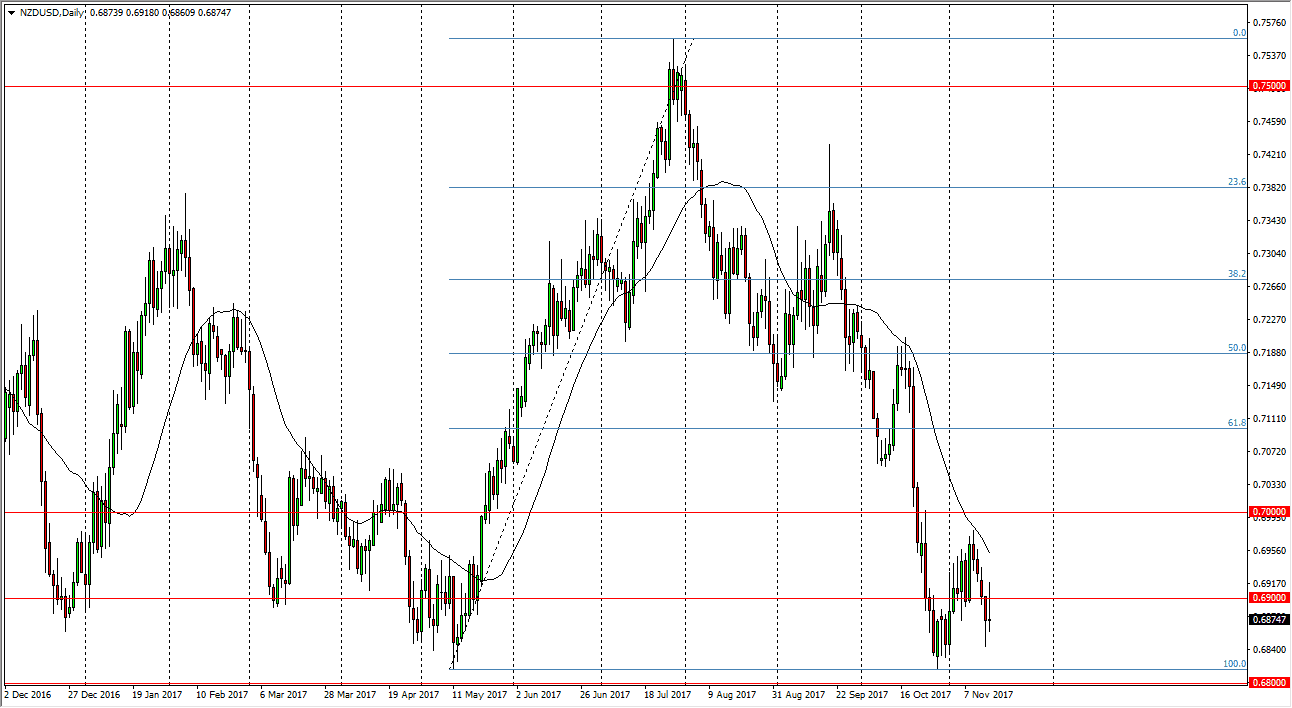

NZD/USD

The New Zealand dollar was very volatile during the day on Wednesday, trying to break above the 0.69 level. The market turned around to form a shooting star, and it looks as if we are going to reach down to the 0.68 level underneath. If we break down below that level, the market should then go looking towards the 0.65 handle underneath. Alternately, if we break above the top of the shooting star for the session on Wednesday, the market probably goes looking towards the 0.70 level after that. I believe that the market will continue to struggle though, because the “risk off” attitude has become a bit more apparent, and that continues to favor the downside for the kiwi dollar. Given enough time, we will probably break below the 0.68 handle, and accelerate to the downside.