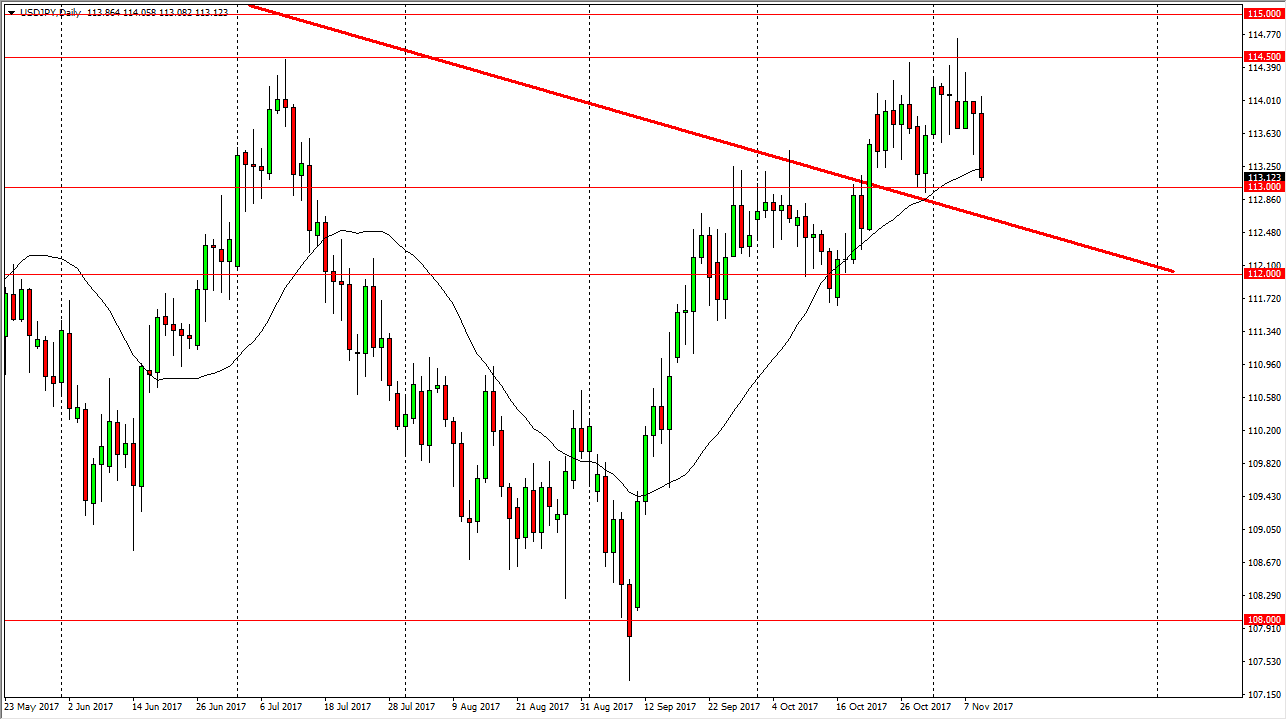

USD/JPY

The US dollar initially tried to rally during the session on Thursday but then rolled over towards the 113 handle. There’s likely a significant amount of support in this area, and of course the previous downtrend line that we have broken out. I believe that given enough time it’s likely that we will find buyers just below, and as a result I think we are trying to build up enough momentum to finally break out above the 114.50 level, which extends to the 115 handle. Once we get above there, the market goes much higher, and it becomes more of a “buy-and-hold” scenario. In the meantime, I like buying these little dips to add slowly to a larger core position. Overall, the interest rate situation in the United States continues to favor the dollar over the yen, so unless we get some type of panic, this market should go higher eventually.

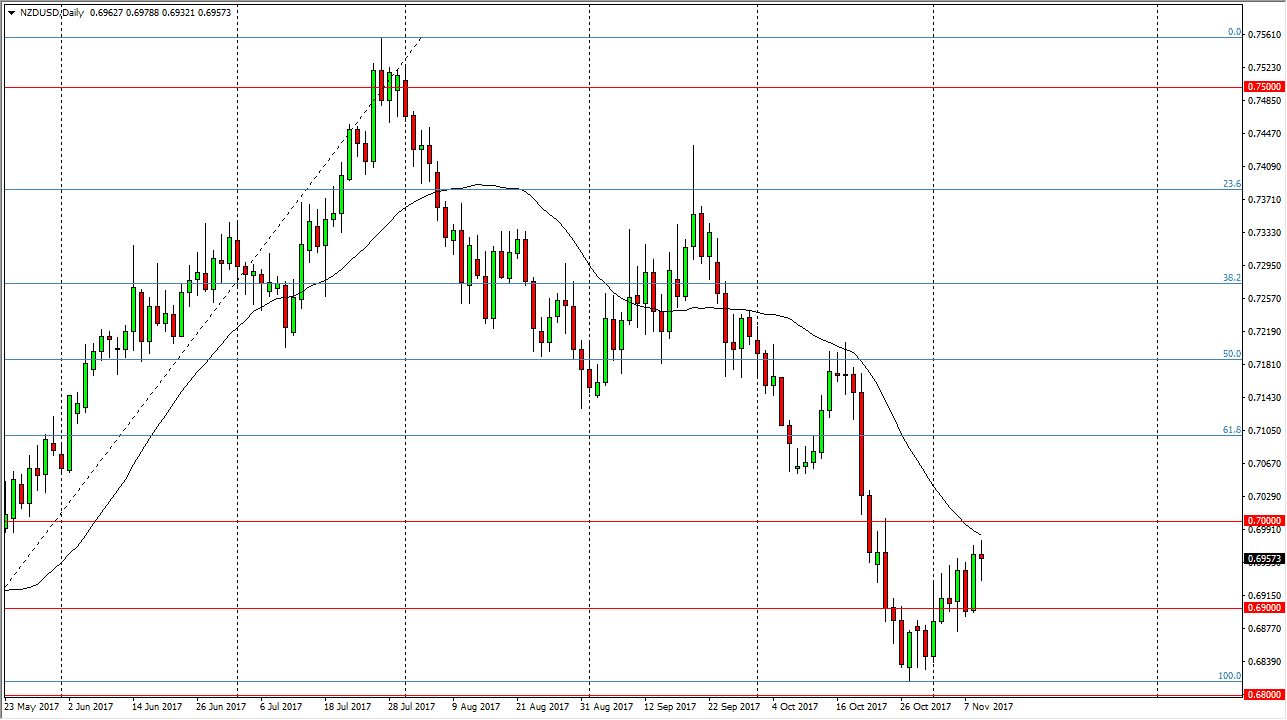

NZD/USD

The New Zealand dollar went back and forth during the day on Thursday, as we are hovering around the 0.6950 level. The 0.70 level above should be resistive though, because it was the scene of the 2nd leg lower on the most recent move, but of course it is also a large, round, psychologically significant number. Ultimately, the market should find enough selling pressure to roll over towards the 0.68 level, unless of course there is a sudden surge in commodities, something that I don’t see happening beyond the oil market. I believe that the New Zealand dollar was a bit oversold after the surprise election, but quite frankly higher spending out of Wellington will continue to concern people, and this should continue to weigh upon the value of the kiwi dollar overall. Beyond that, if the Federal Reserve continues to look likely to raise interest rates, and makes sense that we would fall as well.