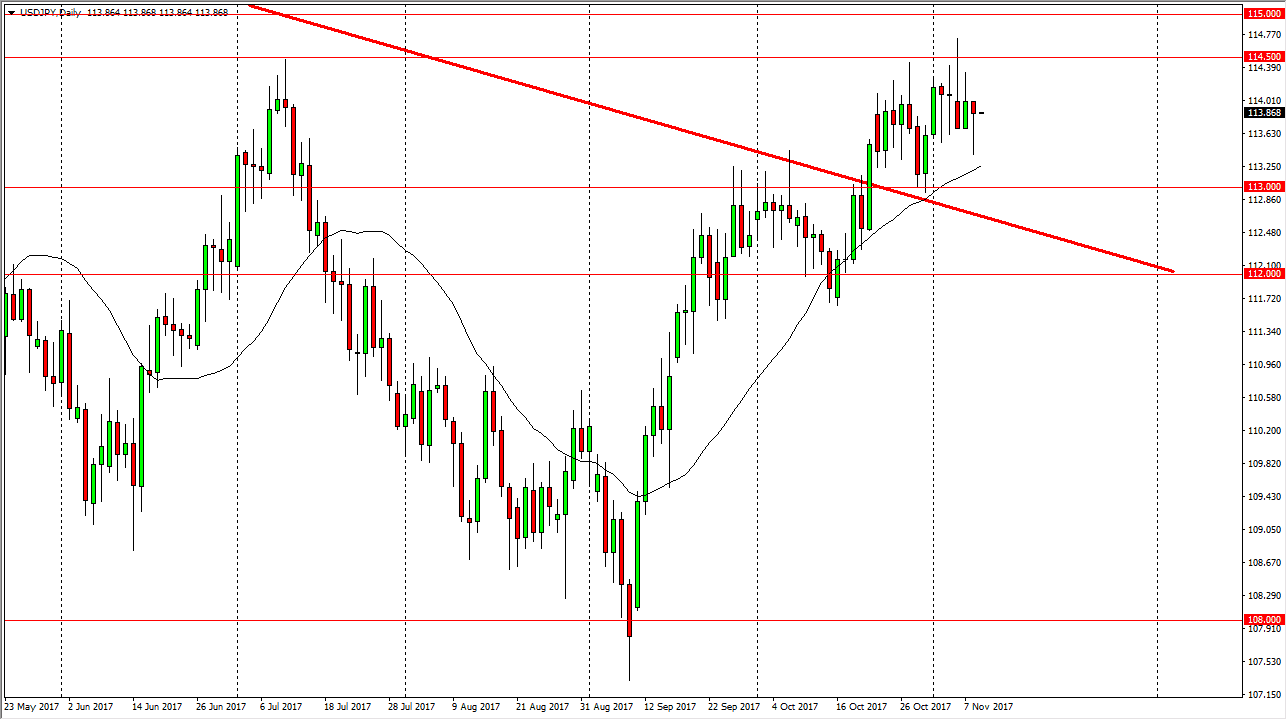

USD/JPY

The US dollar initially fell against the Japanese yen, but has turned around to form a hammer during the Wednesday trading session. This shows to me that we are going to continue to be in the “buy the dips” mode, as the 113 level looks very supportive. I think we need to break above the 115 handle to go higher for the longer-term, and that every time that we pull back we are trying to build up momentum to finally break out to the upside for a longer-term move, perhaps to the 118 handle. The US dollar should continue to pick up buyers, because the US Dollar Index is showing signs of strength, and of course the interest rate markets in the United States starting to look as if they are going to rise. If that’s the case, it’s only a matter of time before we get the break out.

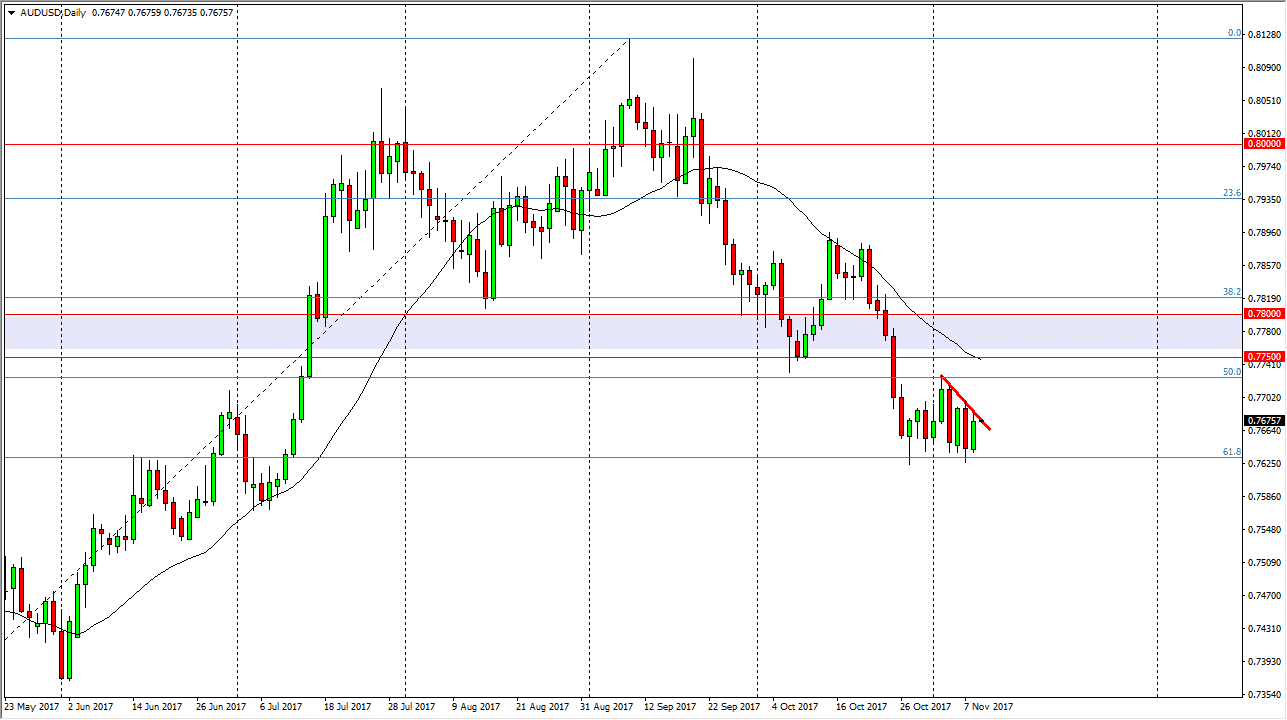

AUD/USD

The Australian dollar tried to rally during the day but continues to struggle with a downtrend line. Even if we break above there, I think there is more than enough resistance above, and extending to at least the 0.78 level to keep the market lower. If we break down below the 0.7625 handle, the market probably goes to the 0.75 level given enough time, because of the 61.8% Fibonacci retracement level breaking down. Overall, I believe that the Australian dollar will continue to struggle, because even though we have seen a bit of strength in the gold market, there is still a massive amount of resistance above and that market as well. I believe in selling rallies, and it’s only a matter of time before we get an exhaustive candle that we can take advantage of. It might even be a market that you need to look to short-term charts to trade.