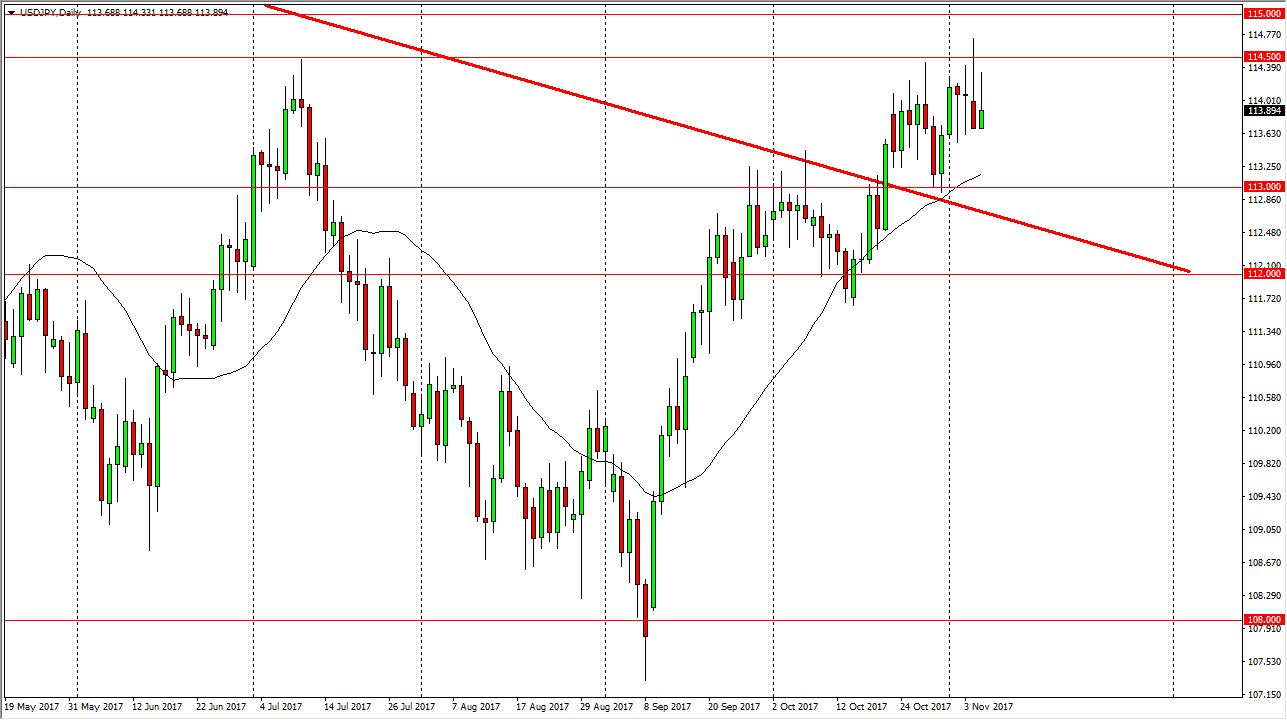

USD/JPY

The US dollar rallied initially during the trading session on Tuesday, but found enough resistance at the 114.50 level to turn around and form a bit of a shooting star again. I would not be surprised at all to see a pullback from here, perhaps reaching towards the 113-level looking for support. I see a massive amount of resistance above, especially near the 115 handle, so I think it’s going to take a bit of momentum building to finally have the break out. With this, I look at pullback opportunities as a way to pick up value, and therefore I believe that we will continue to see value hunters coming back in as interest rate expectations in the United States continues to rise. At the same time, we have the baby Japan looking very dovish, as we continue to see a divergence between interest rate and monetary policies.

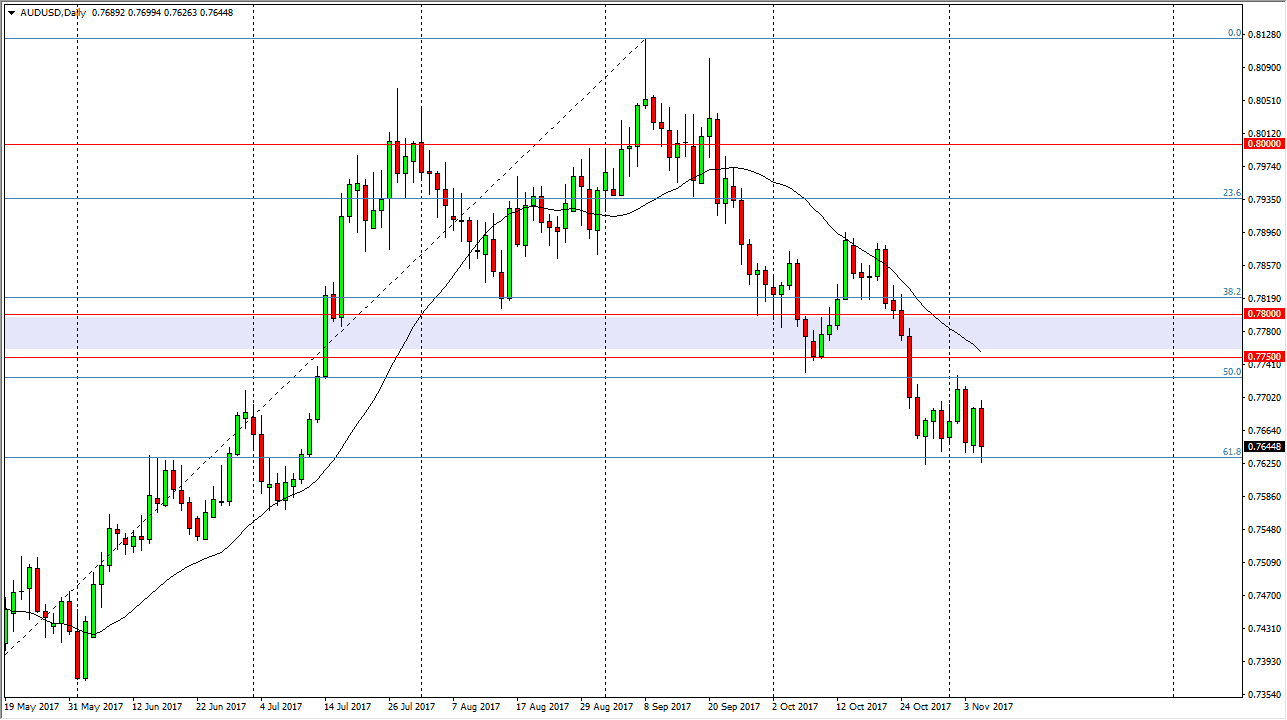

AUD/USD

The Australian dollar fell during the trading session on Tuesday, reaching towards the 61.8% Fibonacci retracement level as well. The market breaking down below this level, and essentially the 0.7625 level, the market should then go down to the 0.75 handle, which is an area that should continue to be interesting for traders in general, because quite frankly it’s a large, round, psychologically significant number and of course has had a certain amount of structural importance to it as well. Gold markets course will have their usual influence on this market, but I think we also have another external influence, the Royal Bank of New Zealand, and its monetary policy statement today. If they look very soft, that should continue to put bearish pressure on the Aussie dollar, as it tends to move very tightly correlated to the kiwi dollar itself. In general, I think we continue to sell rallies.