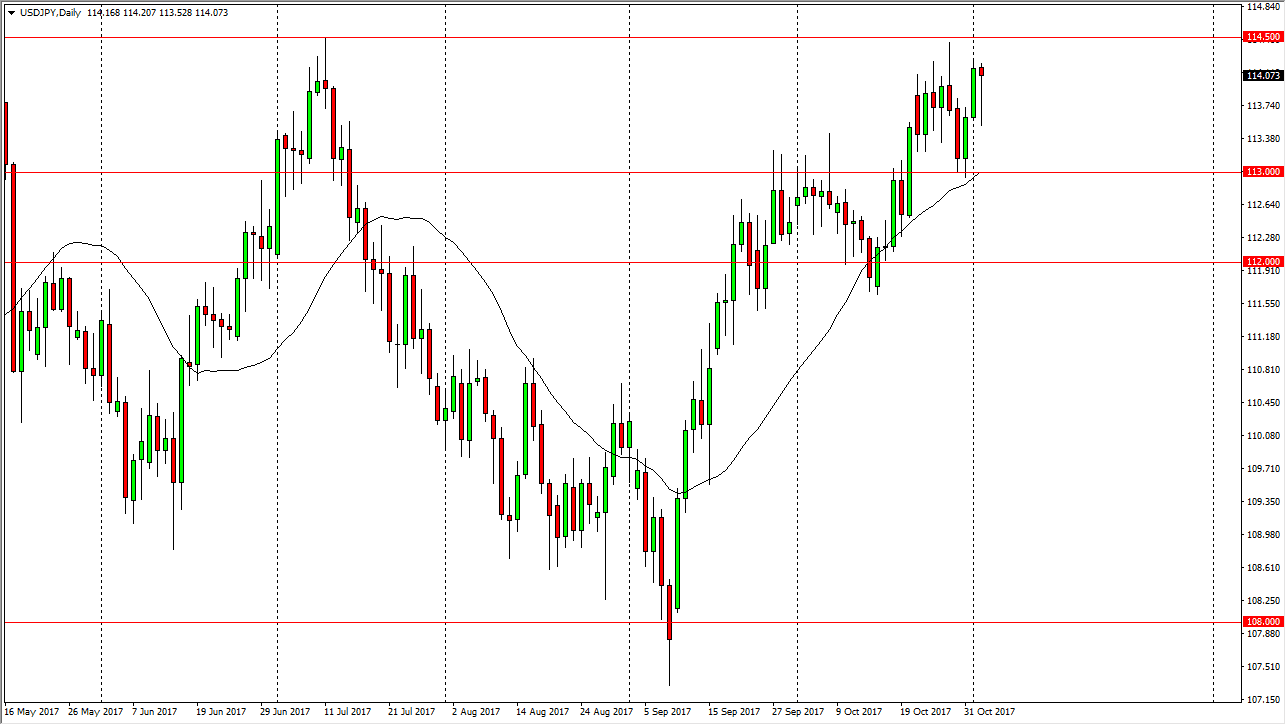

USD/JPY

The US dollar initially fell during the trading session on Thursday, but turned around to form a hammer. The hammer is facing significant resistance just above, in the form of the 114.50 level. A break above there sends the market looking towards the 115 handle after that, which I think is a massive barrier. If we can clear the 115 handle, the market then feels much like a market that is ready to go to a much higher level, which I suspect is the 118 handle. I also look at the market as one that could offer value on pullbacks, as I think there is a significant amount of support at the 113 handle. Keep in mind that today is the Nonfarm Payroll announcement, and that of course has a massive influence on the pair. If the number is better than anticipated, it quite often will send this market higher. We are anticipating 310,000 jobs at it for the month of October, so keep that in mind. Overall, I think it’s only a matter of time before we rally anyway.

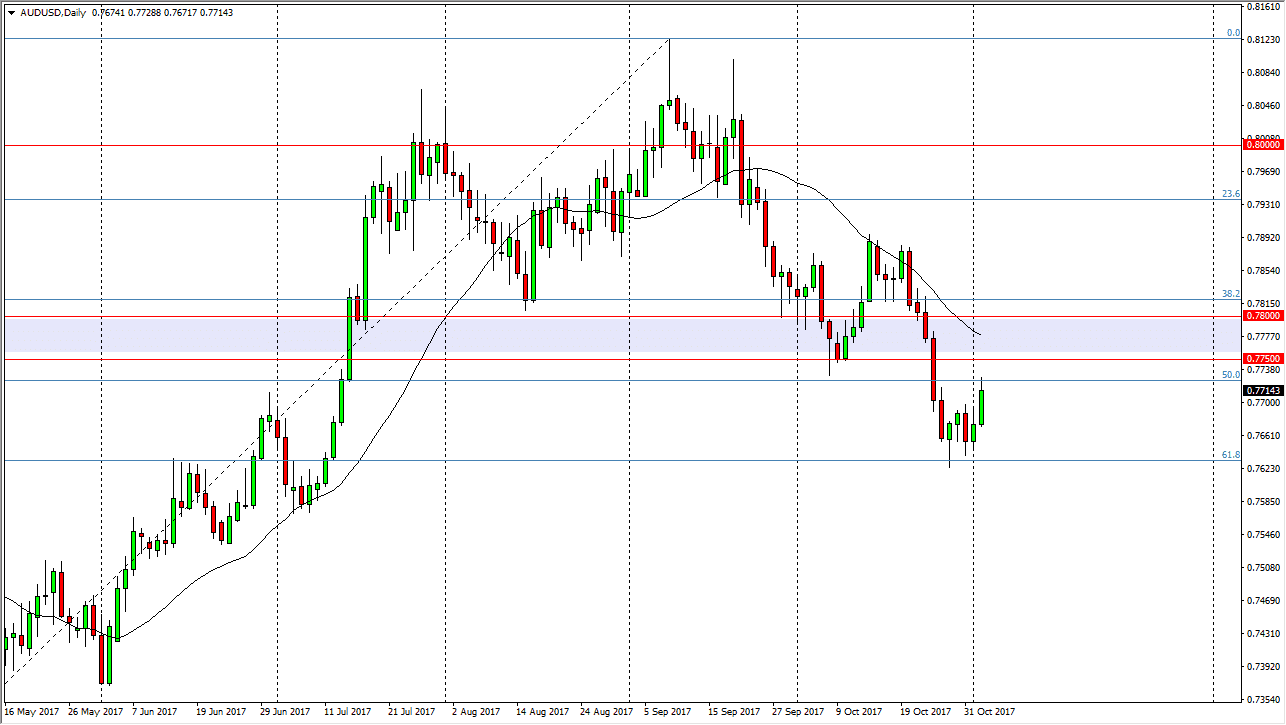

AUD/USD

The Australian dollar broke out to the upside during the day on Thursday, reaching towards the 0.7750 level. That’s an area that has significant resistance build around it, reaching towards the 0.78 handle. If we can break above the 0.78 handle, the market should then go to the 0.80 level after that. That’s an area that I think will offer significant resistance though, so break above there would be saying something. I believe that the Australian dollar will continue to show signs of trouble, as the US dollar continues to be favored. The interest rate situation in the United States should continue to lift the dollar in general, so I think that a retest of this area should be expected, but it also should fail.