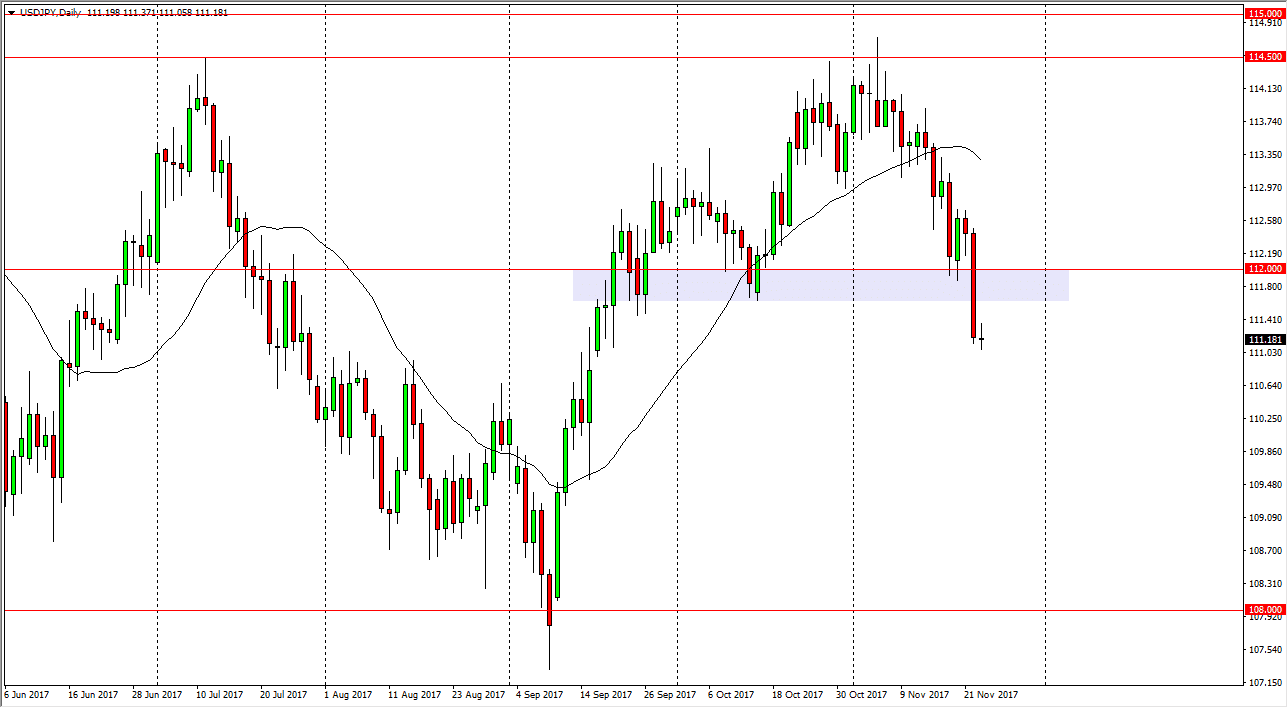

USD/JPY

The US dollar did very little against the Japanese yen during the trading session on Thursday, which would not be a huge surprise considering that the Americans would have been away for Thanksgiving. After a massive move to the downside on Wednesday, and more importantly a slice below the 112 handle, it looks likely that the market is ready to go towards the bottom of the overall consolidation longer term. The 108 level is the bottom of the consolidation, and I believe that the 114.50 level above is the beginning of significant resistance. Because of this, I think that this market is going to offer a trading opportunity to the downside, at least for the next couple of weeks.

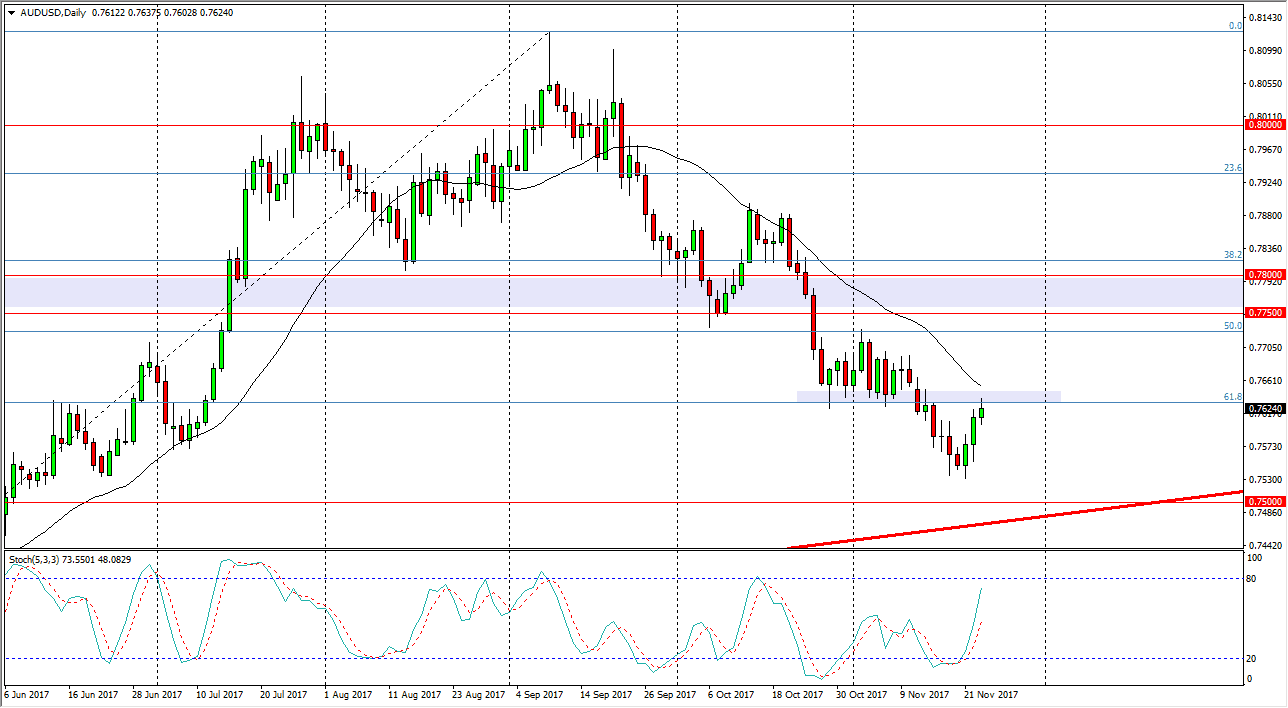

AUD/USD

The Australian dollar had rally during the day on Thursday, reaching towards the previous support level at the 0.7650 level. By doing so, we found quite a bit of selling pressure. By turning back around, we ended up forming a bit of a shooting star. A breakdown below the shooting star is a negative sign, sending this market back towards the 0.7525 handle. Eventually, I would like to see this market break down below the 0.75 level to give a “long-term selling position”, and should send this market down to the 0.7350 level. Alternately, a breakout above the highs from the session on Thursday, the market would probably run into massive resistance at the 0.7750 level. Although we could get there, I feel much more comfortable shorting this market as gold hasn’t done much to support the value of the Aussie, and of course until that happens, it’s difficult to imagine this market taken out.