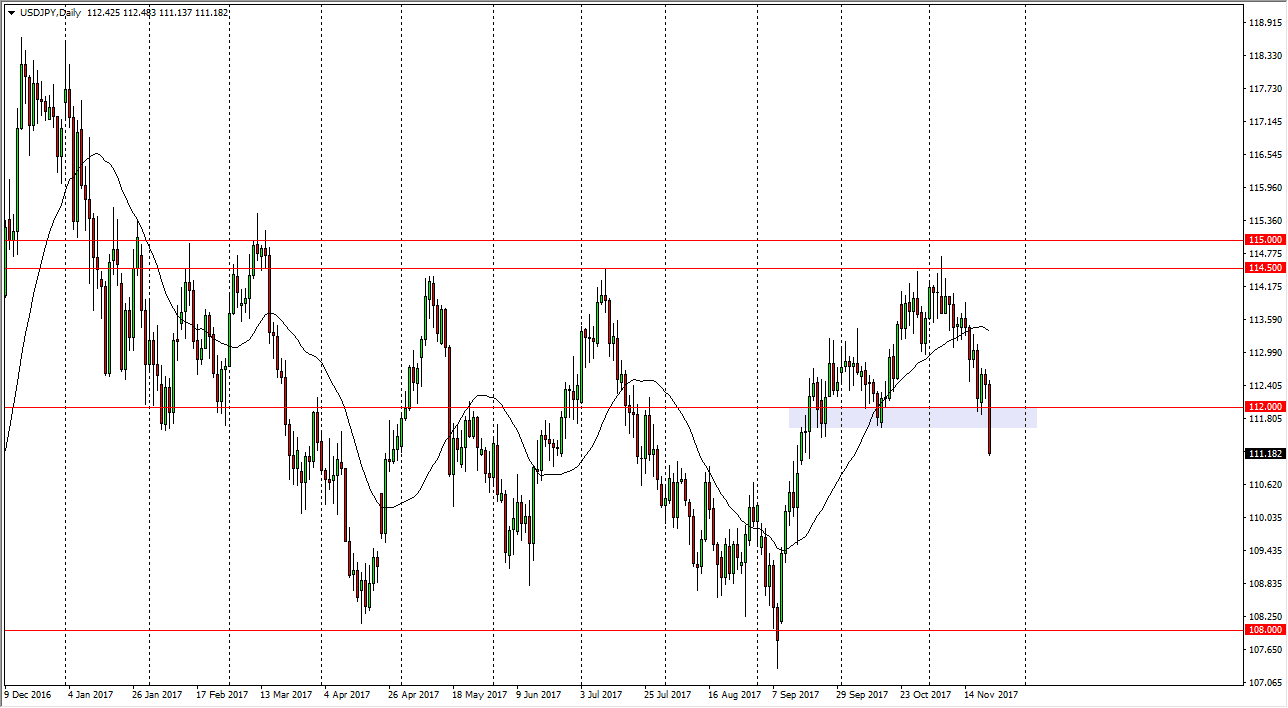

USD/JPY

The US dollar fell significantly against the Japanese yen during the trading session on Wednesday, slicing through the 112 level. Now that we have broken down significantly below there, I think we’re going to continue to see a lot of negativity, as the Americans are away at Thanksgiving, and of course people are concerned about Congress being able to pass tax reform. Because of this, it’s likely that we go down to the bottom of the overall consolidation area, which is the 108 handle. I expect to see buyers in that general vicinity, but right now I think we continue to see negativity until we get down there. Alternately, if we were to break above the top of the candle for the Wednesday session, then it would be a very bullish sign. However, to me it looks very likely that the Japanese yen picks up.

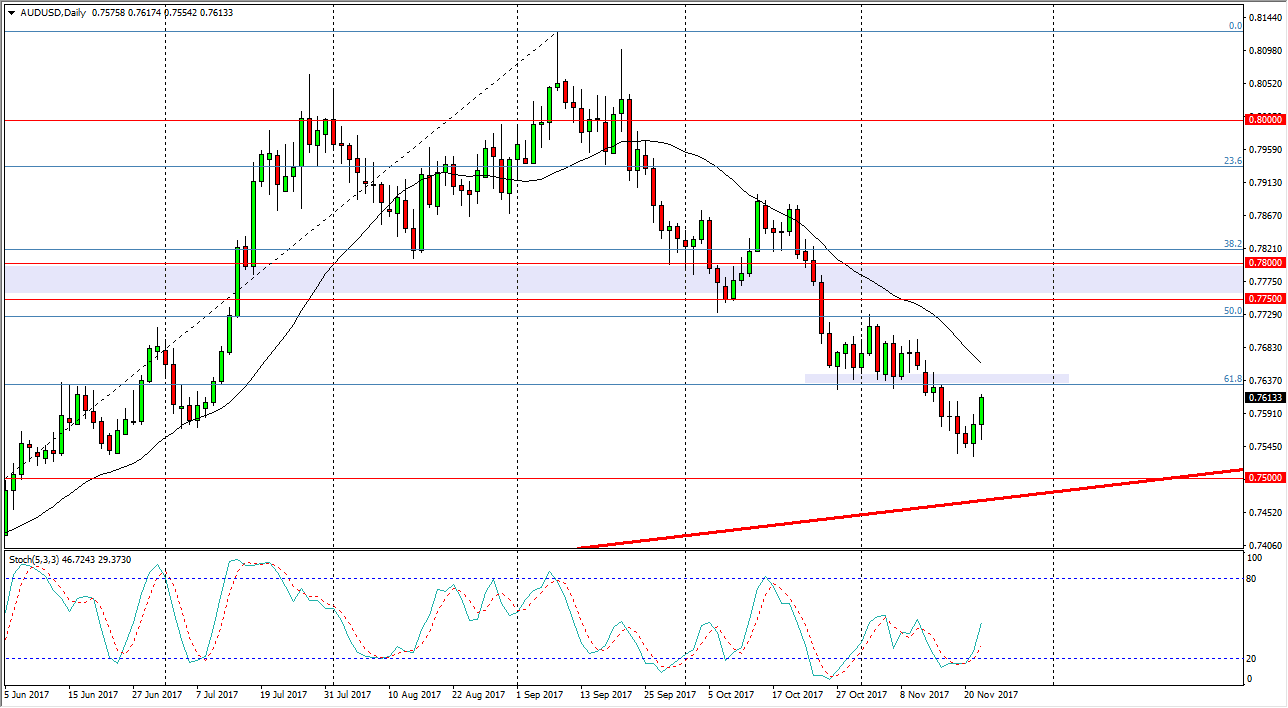

AUD/USD

The Australian dollar fell initially during the session on Wednesday, but then turned around to rally towards the resistance barrier at the 0.7650 level. A lot of this comes down to US dollar negativity more than anything else as there are still concerns about Congress passing tax reform. I think that the market will be very thin during the next couple of days, but clearly this will be headlined driven as congressional members will probably use the next couple of days to give out blurbs on news channels to push the market around. I think that the 0.75 level underneath is massively supportive, so if we can break down below there I think that the market will continue to go much lower. Alternately, if we break above the 0.7650 level with momentum, we could go to the 0.7750 level. In general, this continues to be very noisy market.