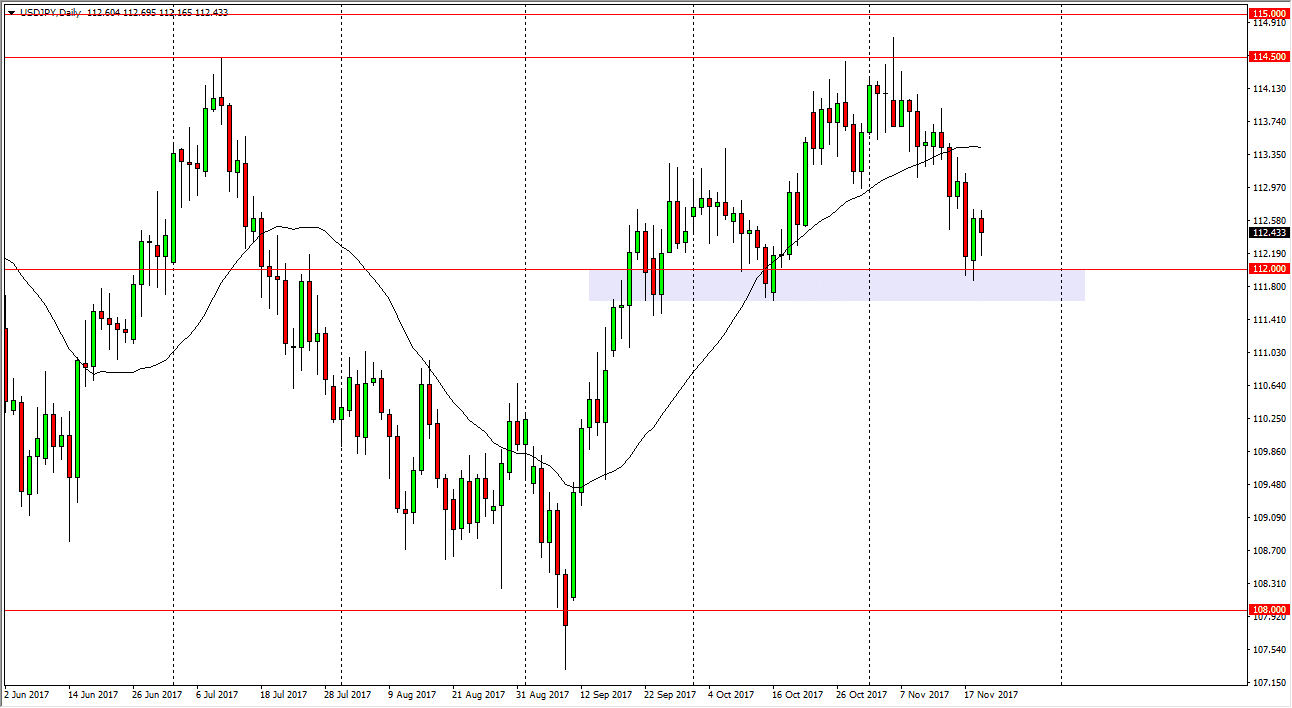

USD/JPY

The US dollar initially fell during the trading session on Tuesday, but continues to find support near the 112 level, an area that I think is trying to keep the market afloat. We have been consolidating between the 115 level above, and the 108 level below. However, the 112 level looks to be a bit of an outlier, and if it does continue to hold the market, this means that we are trying to build up enough pressure to finally break out to the upside. With the rising interest rates in the United States, this is my longer-term thesis, but I also recognize that a breakdown below the 111.75 level would more than likely signal a pull back to the 108 handle and a resumption of the longer-term sideways action that we have seen. Ultimately, once we break out I believe that we go to the 108 handle.

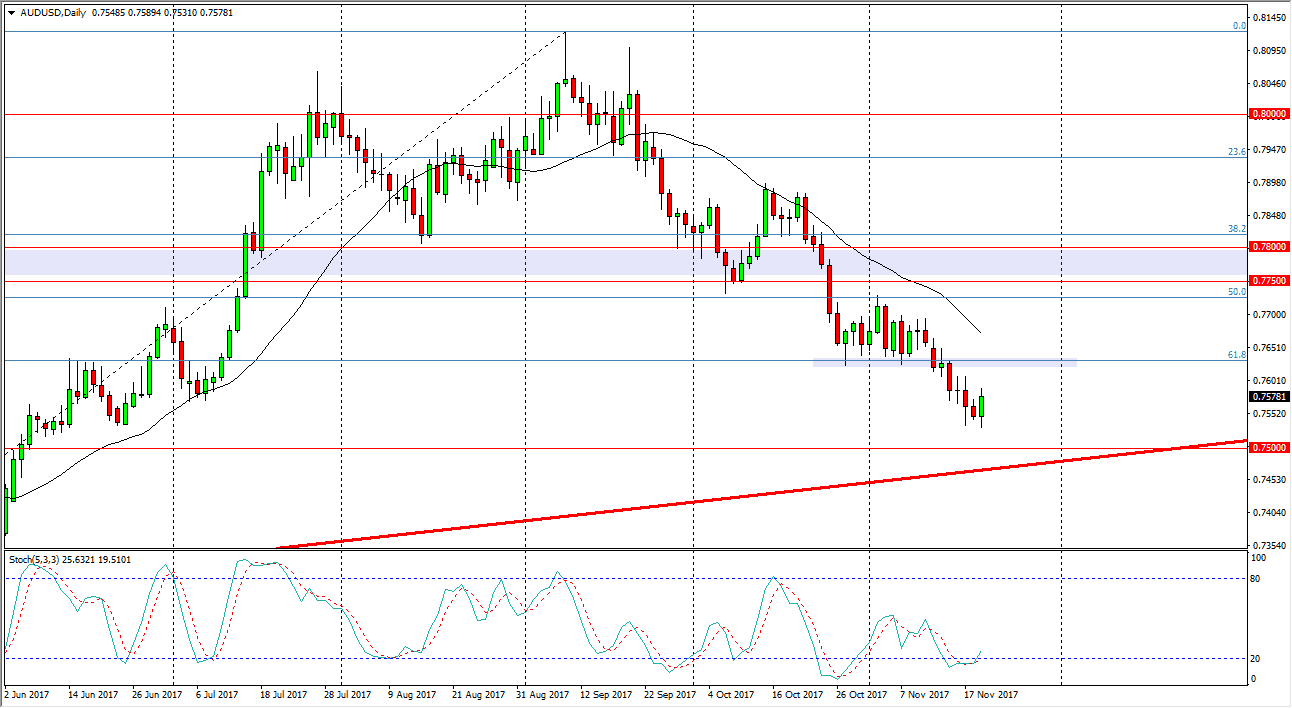

AUD/USD

The Australian dollar get a bit of a reprieve during trading on Tuesday, reaching towards the 0.7575 level. The 0.76 level above is resistance, and I think there’s even more to be found near the 0.7650 level. Because of this, I look at short-term rallies as opportunities to sell this market, as I continue to favor the US dollar in general, as there will be more of a run towards the central bank as they raise interest rates over the next couple of months. Treasury markets also suggest that the US dollar should continue to strengthen against the Aussie, so I am bearish of this pair. It’s not until we get above the 0.78 level that I think the US dollar runs into trouble. In the short term, I believe that rallies are to be sold on the first signs of exhaustion, and a breakdown below the 0.75 level, it would be a very negative sign and would have me aggressively shorting.