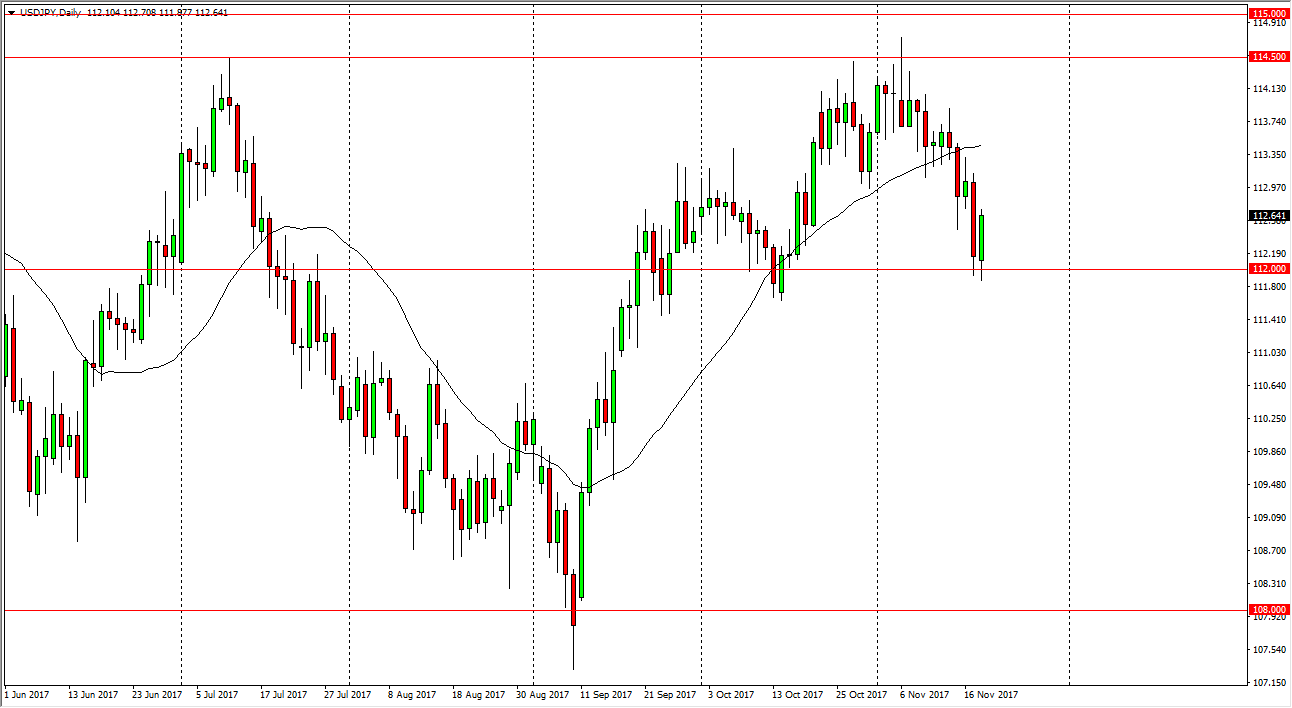

USD/JPY

The US dollar fell during the trading session on Monday, slicing through the 112 level. However, we turned around to bounce significantly, breaking above the 112.50 level. By doing so, it looks as if we are ready to continue towards the 114.50 level above which is the beginning of significant resistance, extending to the 115 handle. I believe that the market should continue to be very volatile, but if we can stay above 100, I have no interest in shorting this market, as we should see a significant amount of correlation with risk appetite as per usual, and therefore you should pay attention to the stock markets. They tend to move in the same direction longer-term, and the correlation between the S&P 500 and this pair is very high. If we break down below the 112 level, then I think we could drop all the way down to the 108 handle, but that would almost have to be in concert with negativity in the stock markets.

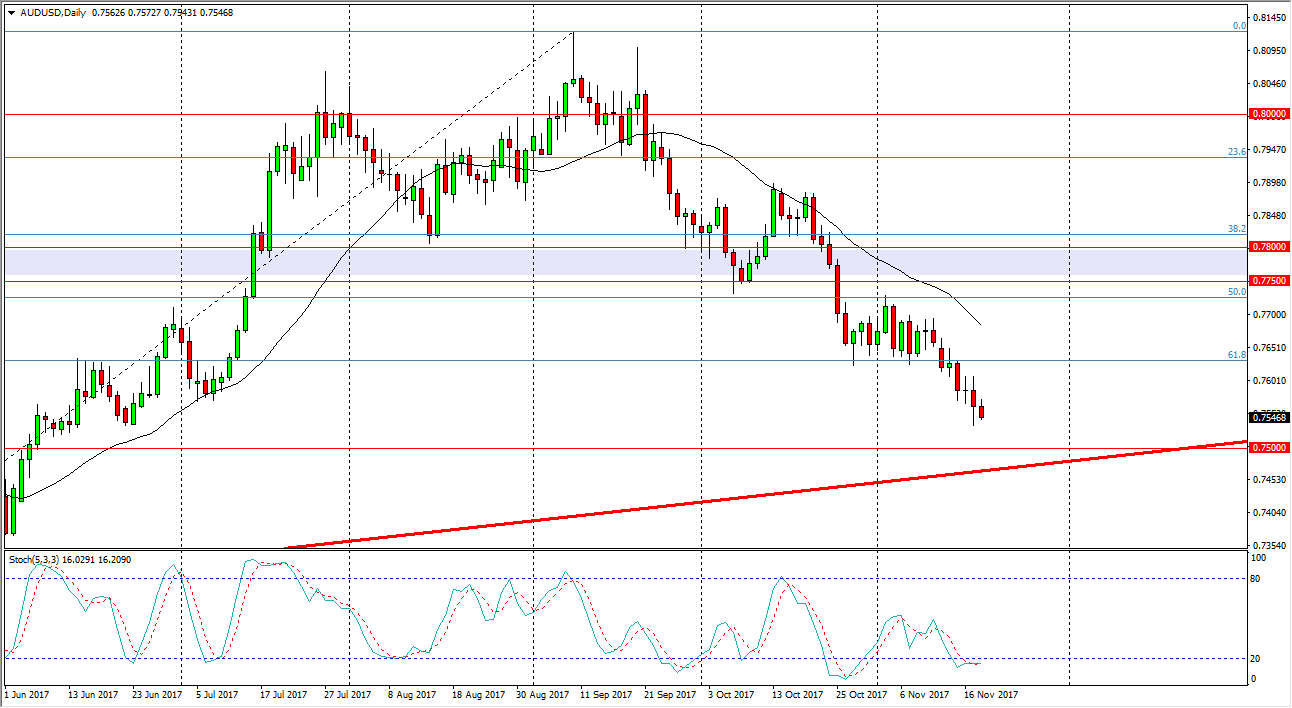

AUD/USD

The Australian dollar continues to look very soft, gradually drifting lower. However, we have a RBA meeting minutes release coming out today, so that of course can have a massive effect on what happens next. If we break down below the 0.75 level, and more importantly closable there on a daily close, then I would short this market, looking to go down to the 0.7350 level. At this point, I believe that rallies are to be sold, least until we can break well above the 0.78 handle, something that I don’t think is going to happen in the near term. I remain bearish of the Aussie dollar, and don’t have much in the way of interest in going long.