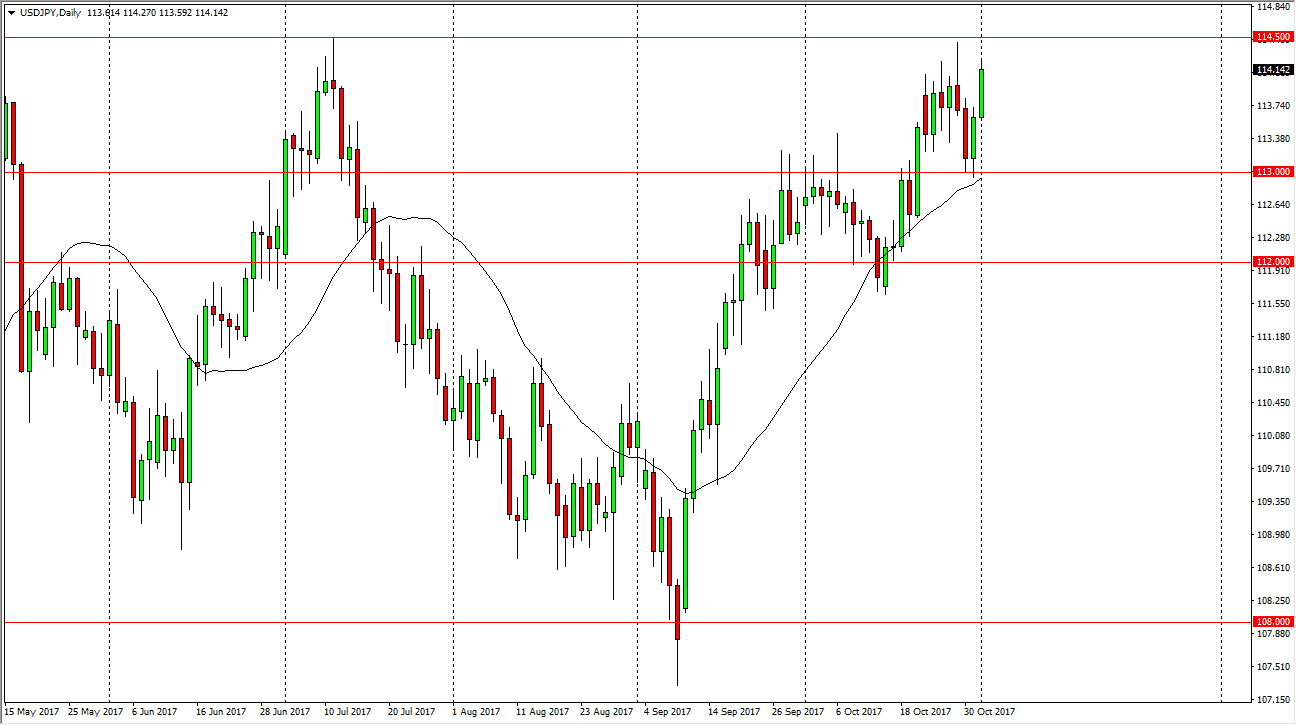

USD/JPY

The US dollar rallied significantly during the session on Wednesday, reaching towards the 114.50 level above. This is the beginning of the major resistance that extends to the 115 handle. Breaking above the 115 level should send the market much higher, perhaps reaching towards the 118 level eventually. The market should pull back occasionally, but quite frankly I think that is a nice buying opportunity. I believe that the 113-level underneath should be massively supportive, and the 112 level is also supportive. Ultimately, the market continues to look likely to rise with interest rates, and I believe that we are going to get to break out eventually. Adding on short-term pullbacks gives me the ability to build a large position and take advantage of what I think will eventually be a longer-term “buy-and-hold” situation.

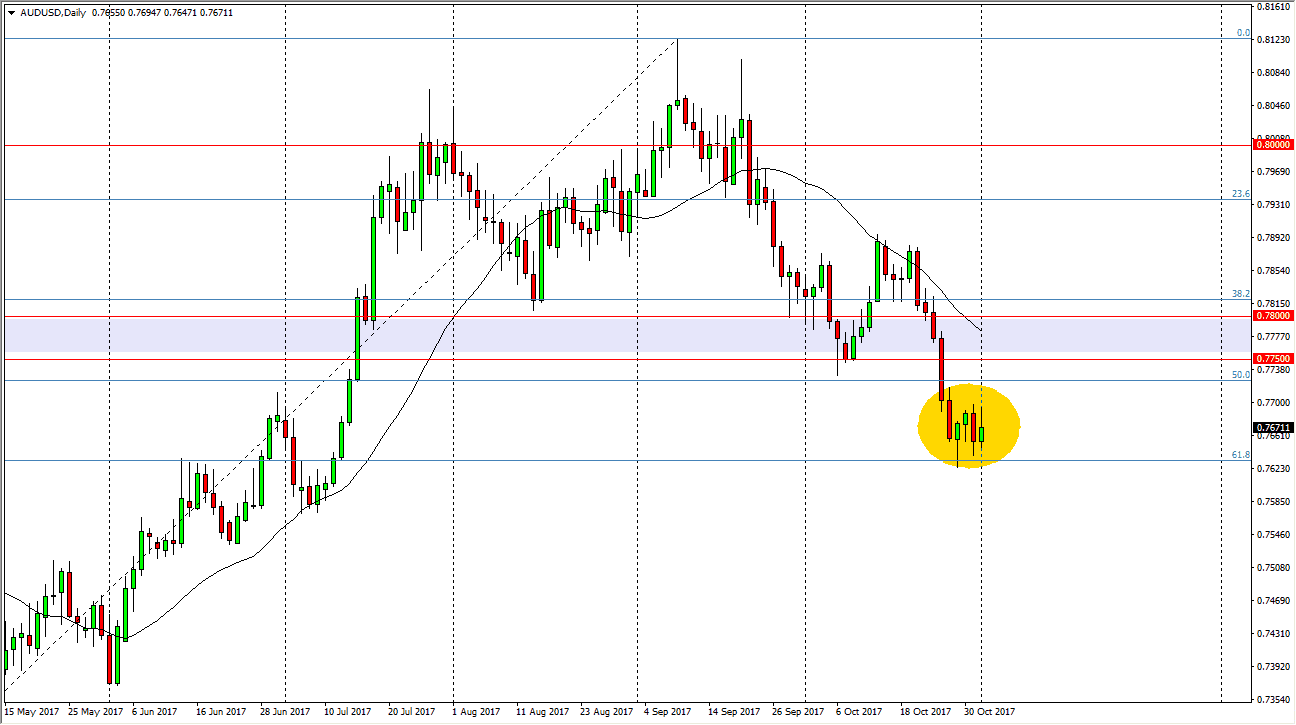

AUD/USD

The Australian dollar rallied during the day on Wednesday, showing signs of resistance at the 0.77 level, and then pulling back. I think that the market is currently trying to figure out where to go next, with the 61.8% Fibonacci retracement level being just below, it makes sense that we would have buyers. If we can break down below there, the market could drop to the 0.74 level, perhaps even the 0.73 level. Alternately, if we break above the 0.78 level, then I’m willing to start buying the Australian dollar but I need to see gold markets to also rally to be comfortable. I believe that eventually, we will probably see sellers, but if we break above the 0.78 level, then the target becomes the 0.80 level above. Overall, volatility is probably going to be a mainstay in the market. The US dollar is starting to catch a bid, and the Aussie is showing it as well.