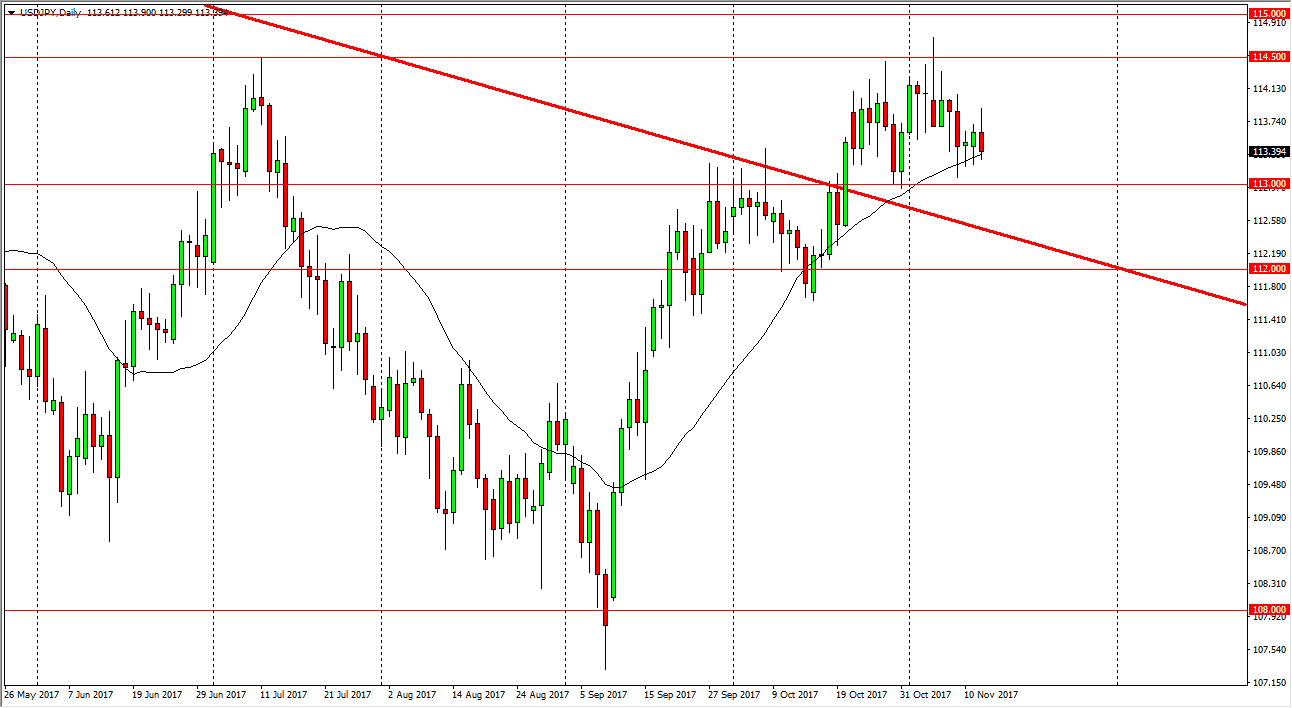

USD/JPY

The US dollar went back and forth during the trading session on Tuesday, as we continue to see a lot of support just below at the 113 handle. The 113 handle is of course a large round number, and an area where we have seen interest in the past. The downtrend line from the previous downtrend in channel is now offering support, and I believe that eventually the buyers will return. I’m looking for some type of supportive candle to go long, or a bounce that I can take advantage of. I believe that the 114.50 level above is the beginning of significant resistance that extends to the 115 handle. Once we clear that area, it should be a longer-term “buy-and-hold” situation. If we were to break down below the 112 level, we could fall down to the 108 handle rather quickly.

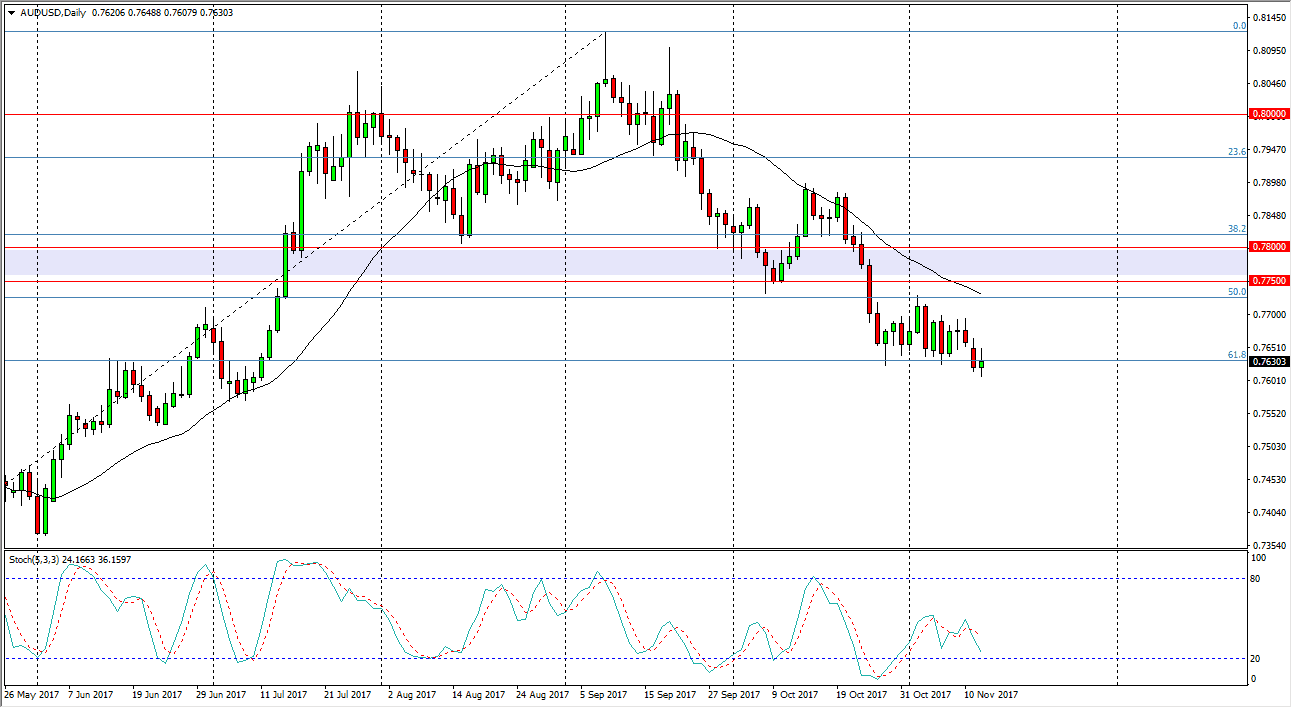

AUD/USD

The Australian dollar continues to go back and forth, forming a slightly positive candle for the session on Tuesday. If we can break down below the candle for the day, I think that continues the downward grind in this market. A breakdown below the 0.76 handle should send this market looking for the next large, round, psychologically significant number - the 0.75 level. I have no interest in buying this market, and I believe that short-term rallies should be selling opportunities at the first sign of exhaustion. The 0.7750 level starts a resistance barrier that extends to the 0.78 handle above. Until gold markets can rally, it’s almost impossible to imagine buying the Australian dollar for any length of time, as I believe that we are going to continue to see more of a “risk off” attitude to this currency pair.