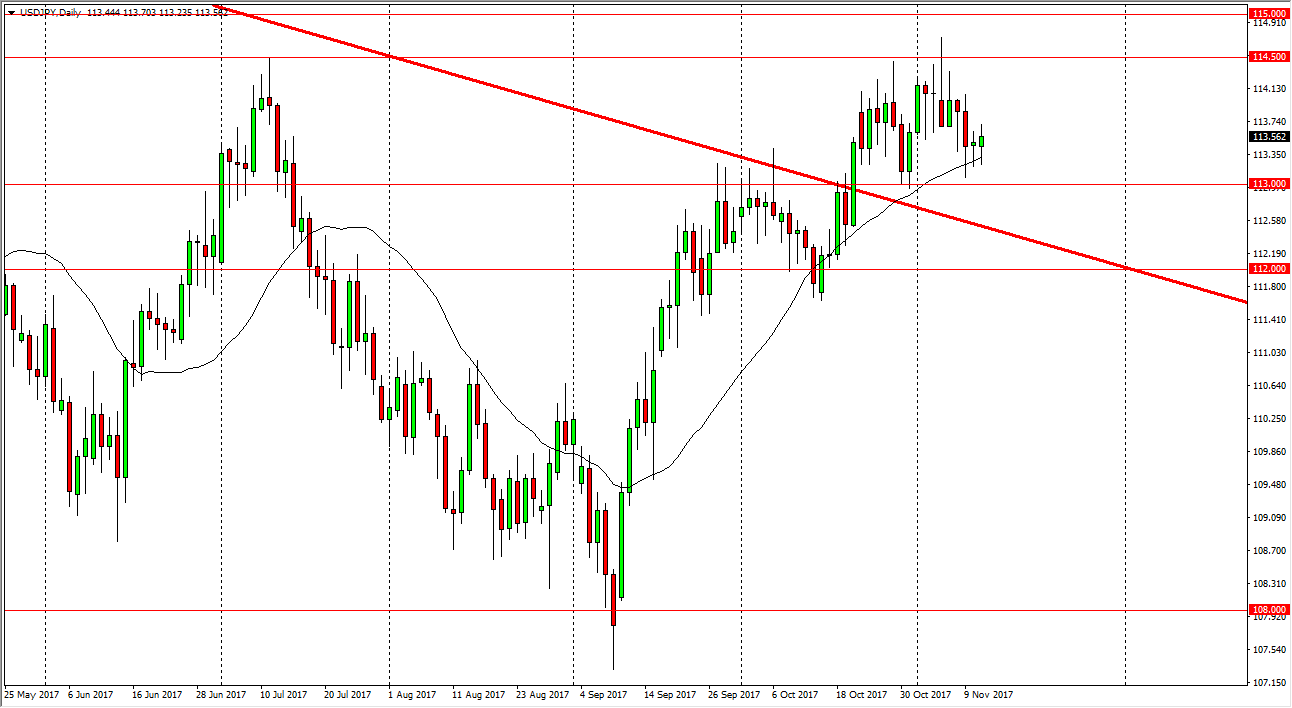

USD/JPY

The US dollar initially fell against the Japanese yen during the Monday session, but continues to find support just above the 113 handle, as we build up pressure to perhaps continue to rally. If we can break above the 115 handle, the market would be free to go much higher, but at this point it seems unlikely that we will be able to do so in the short term. However, I think that the 113 level continues to offer nice support, and therefore I am willing to buy dips. Even if we break down below there, the previous downtrend line that coincides with 112.50 should also offer support. Interest rates continue to look likely to go higher in the United States, and therefore that should help this pair as well.

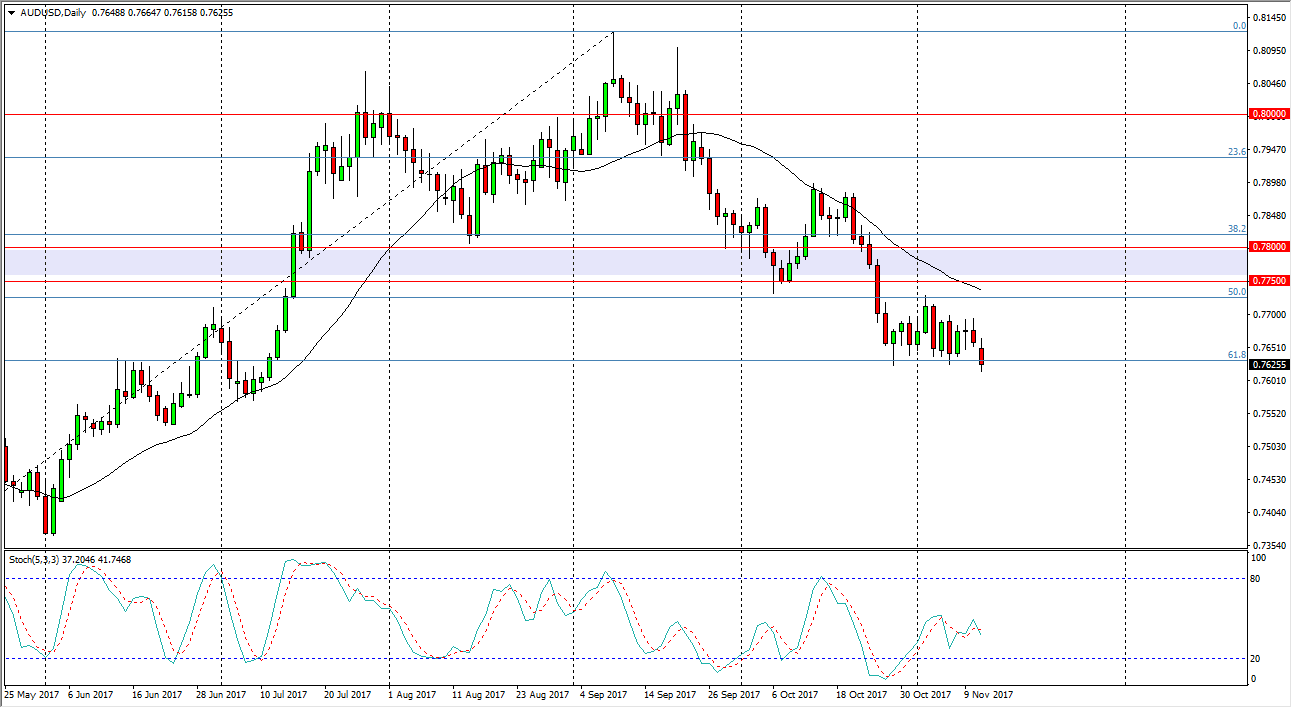

AUD/USD

The Australian dollar has softened a bit after gapping lower on Monday, a sign that we should continue to drop from here. Breaking down below the 0.76 level is a very negative sign, and I think at that point I would be more than willing to start selling again, perhaps reaching towards the 0.75 handle. Overall, I believe that the US dollar will continue to strengthen due to a general “risk off” feeling that we are getting around the world, and of course gold is not doing anything to help the Australian dollar. I think that a complete return of the initial search higher is likely, so therefore I believe that we go below the 0.75 handle and probably look towards the 0.7350 region after that. I have no interest in buying this market currently, although I believe that a break above the 0.78 handle would change a lot of things. Longer-term, the 0.80 level looks to be a hard ceiling.