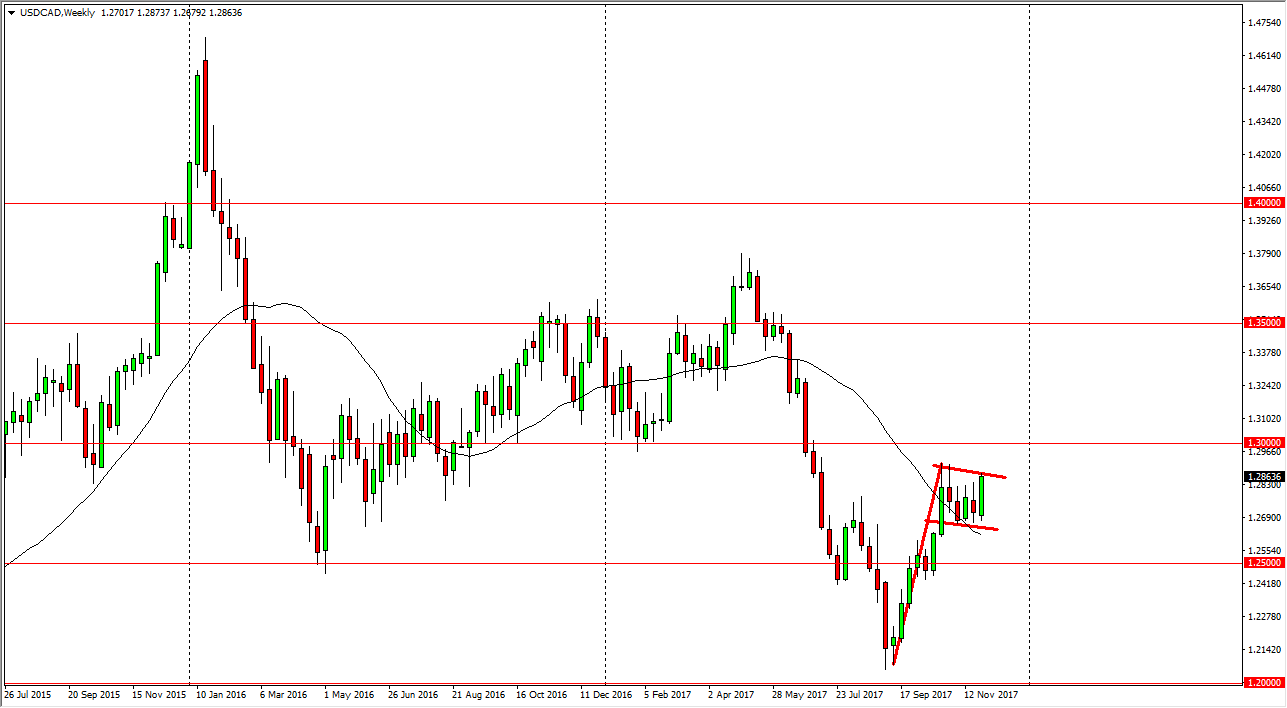

The USD/CAD pair has been very choppy during the course of the month of November, but is starting to look likely to finish on a very strong note. When I look at the weekly chart, it’s likely that we have a bit of a bullish flag going, and at this point I feel that if we can break above the 1.29 handle, the market will eventually break above the 1.30 level, which of course will cause a bit of noise. By fulfilling the measurement of the flag, we could be looking at a move towards the 1.36 handle above, which was the recent high that we fell from early this past spring. I think once going to be very interesting is the oil market, as I think we are starting to have concerns about whether OPEC can continue to force production cuts from member countries.

I look at short-term pullbacks as buying opportunities, and I do think that eventually we will go higher. However, if we were to break down below the 1.2650 level, that negates most of this, and we will probably go down to the 1.25 level underneath. A breakdown below there sends this market towards the 1.20 level but needs the oil markets rally significantly to make that happen. One of the things that people are not paying attention to that will eventually be a significant problem is the housing market issues in the greater Toronto area. The GTA is currently in one of the biggest bubbles in North America, and for those who have never been to Canada, a huge portion of the population. Because of this, I think we could continue to see a lot of concerns with the Canadian dollar. Again though, typically it’s oil that pushes the envelope.