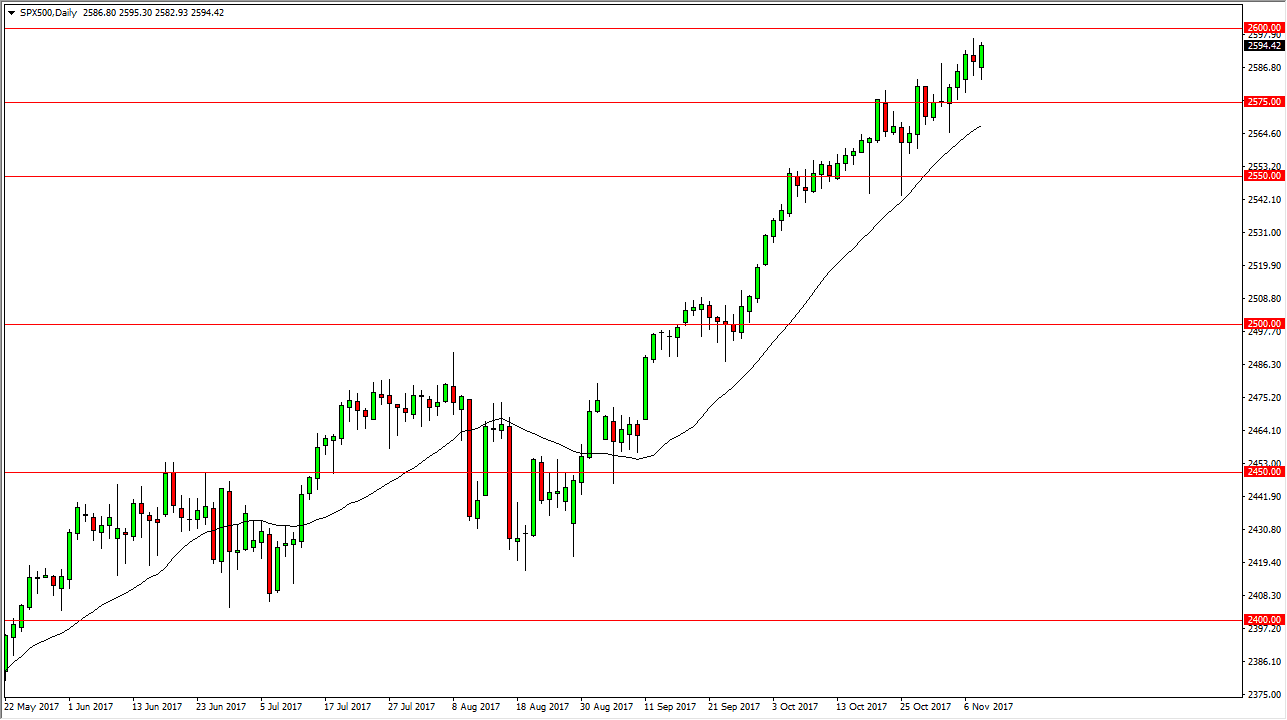

S&P 500

The S&P 500 initially fell during the trading session on Wednesday, but turned around to form a bullish candle. We have been grinding relentlessly towards the 2600 level, and I think that area is certainly the short-term target. The problem of course is that the market has not had a significant pullback in quite some time. Because of this, I think that it is only a matter of time before we get that pullback, perhaps reaching down to the 2550 handle. So, in the short term, I believe that the market will continue to rally, but I also recognize that a pullback must have been relatively soon, otherwise the market could be setting itself up for a very drastic pullback. At this point, I am very suspicious of the rally, although I certainly wouldn’t be a seller.

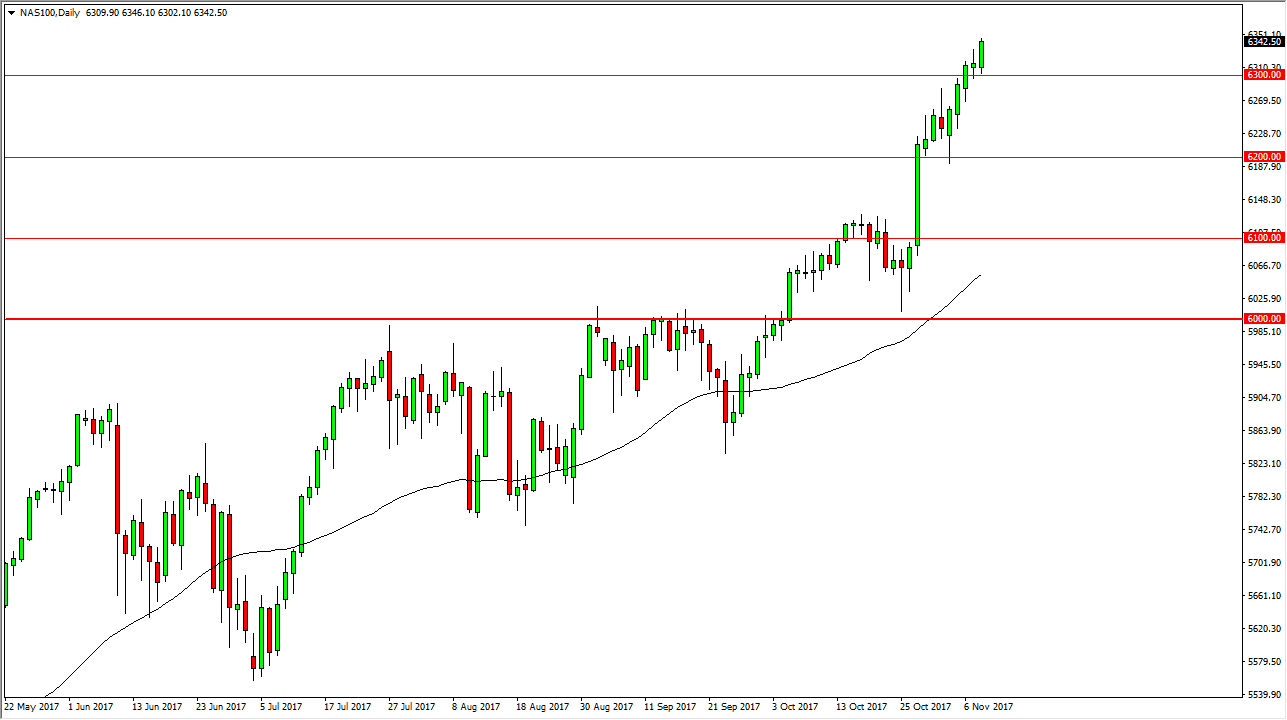

NASDAQ 100

The NASDAQ 100 initially fell during the session as well, but found the 6300 level to be supportive enough to send the market rallying yet again. We broke above the top of the shooting star during the trading session on Tuesday, so that is a very bullish sign. This could be the beginning of a “blow off top” waiting to happen. I think that we are getting ahead of ourselves, and I suspect it’s only a matter of time before we get a significant pullback. However, I don’t have any interest in selling this market, as I believe that there is more than enough support underneath to turn this market back around. I think that waiting for the pullback is probably necessary to find enough value to get involved in the market. If you are not involved yet, certainly this is not a time to jump in as you would be chasing the trade.