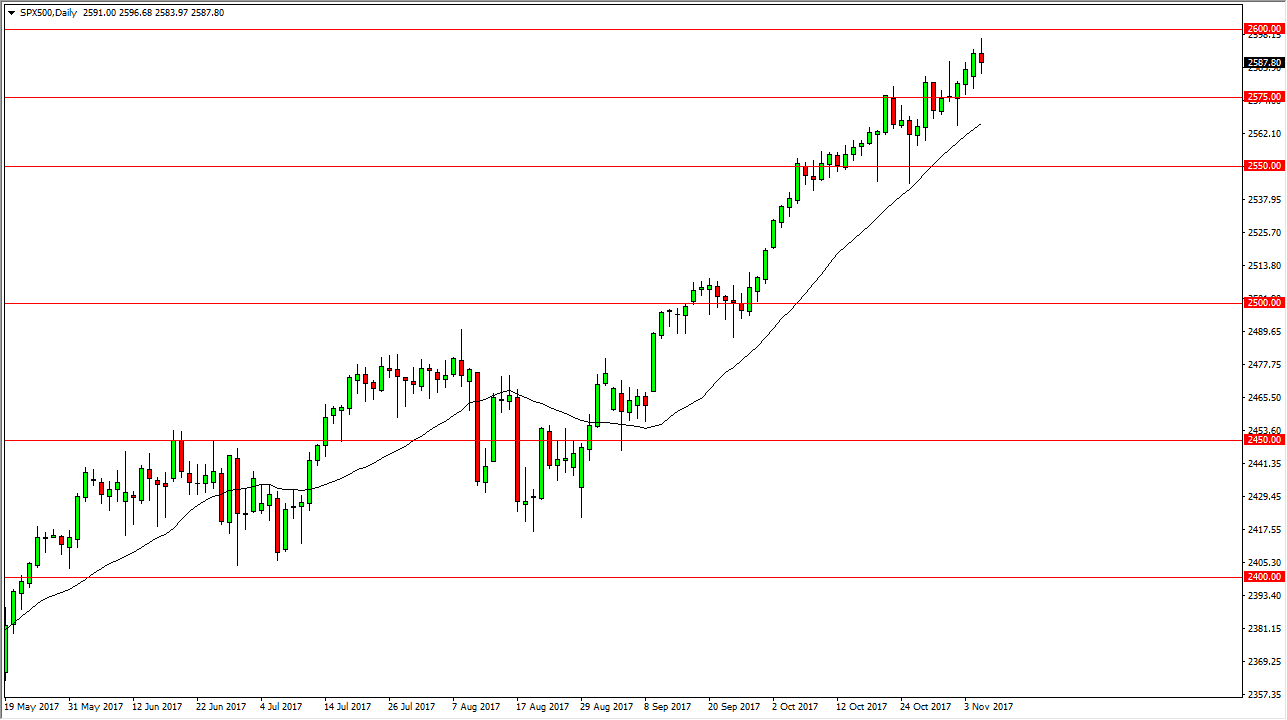

S&P 500

The S&P 500 went back and forth during the trading session on Tuesday, as the 2600 level was a bit too much to overcome. I believe that a pullback is necessary, and quite frankly a welcome sign. I think that the 2575 level underneath is support, but even a breakdown below that level would not have me looking to short this market. In fact, I would become even more interested at the 2550 level. It makes quite a bit of sense to me that the market would have to pull back, because we have been so overly extended. Longer-term, I do think that we break above the 2600 level and go looking towards the 2700 level next. The market is very bullish, but again very overbought. I believe that if we can stay above the 2500 level, the uptrend is still intact, so therefore I believe that value investors are waiting below.

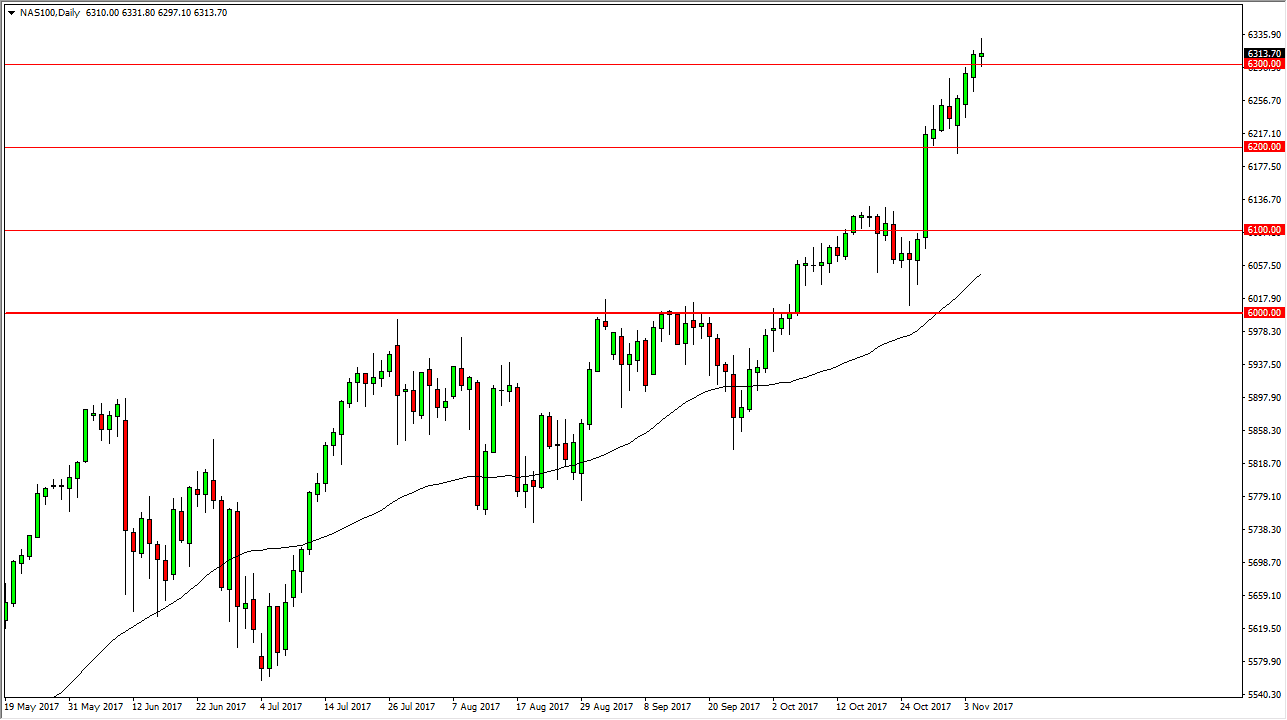

NASDAQ 100

The NASDAQ 100 has formed a bit of a shooting star during the trading session on Tuesday, sitting just above the 6300 level. A breakdown below the candle sends this market down towards the 6200 level, which should be supportive. I would love to see that pullback, because the impulsive move might’ve been a bit too much as of late. Earnings season has been decent, but beyond that we are in a longer-term uptrend anyway. I believe that eventually the market will go looking towards the 6500 level, but currently we need to find value. Value hunters should be sitting around underneath, and I believe that if the market stays above the 6000 level, we are still very much in an uptrend that is extraordinarily strong. If we were to break down below the 6000 handle, it would be catastrophic for the bullish momentum.