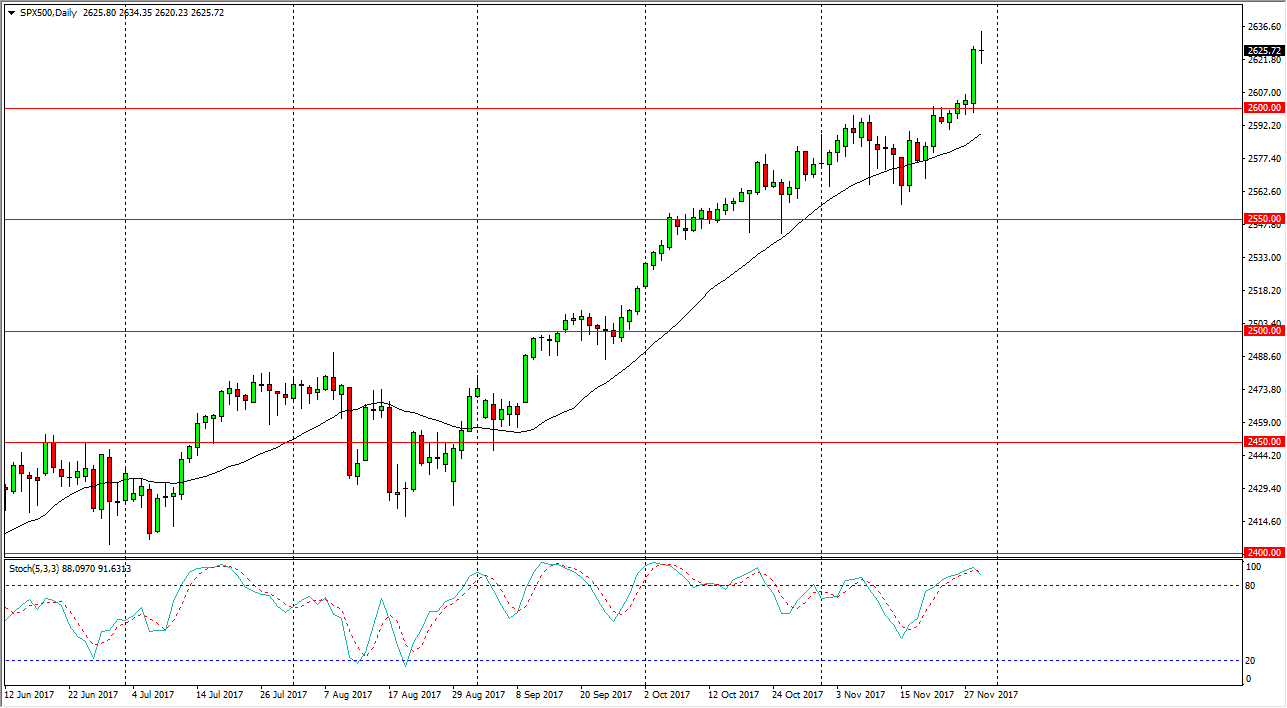

S&P 500

The S&P 500 went back and forth during the trading session on Wednesday, initially breaking out to the upside, but turning around to form a shooting star. The shooting star of course is a very negative sign, and I believe that we could see a bit of a pullback. The 2600 level underneath should be massive support as it was previous resistance, and the market of course has been a bit overbought. I believe that a break above the top of the shooting star for the day would be a bit of a blow off top, but we are crossing on the Stochastic Oscillator in the overbought area, so I think it makes quite a bit of sense that we pull back, looking for some type of support, and of course offering traders value below. If we break down below the 2590 handle, the market probably goes even lower, perhaps down to the 2550 level.

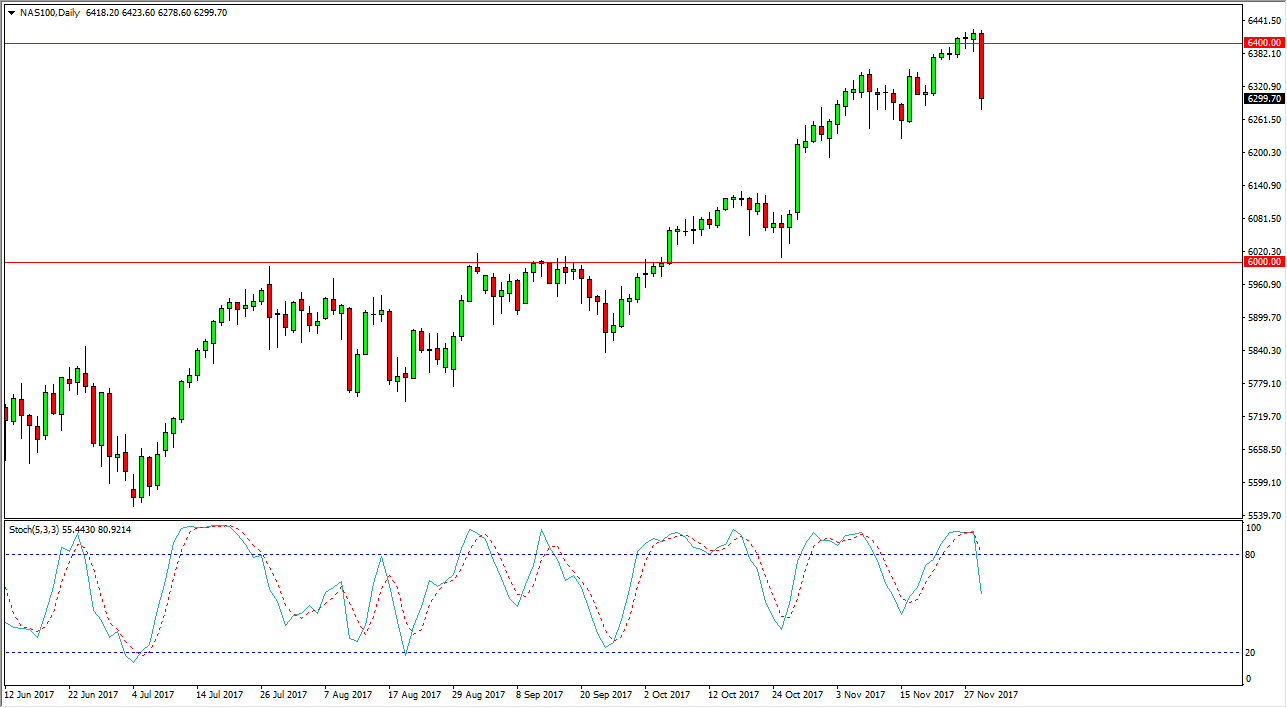

NASDAQ 100

The NASDAQ 100 fell significantly during the trading session on Wednesday, slicing through 6400 like it wasn’t even there. Because of this, it’s likely that the market may go looking for support underneath, perhaps near the 6250 handle. A breakdown below there then sends the market even lower, perhaps as low as 6000. We have crossed on the Stochastic Oscillator in the overbought area, and it now looks very likely that we could get a bit of follow-through. The 6400 level above will be resistive, and it’s not until we break above the top of the candle for the session on Wednesday that I would be comfortable buying, unless of course we get some type of opportunity underneath based upon support. Regardless, I think you can take your time as there are plenty of questions.