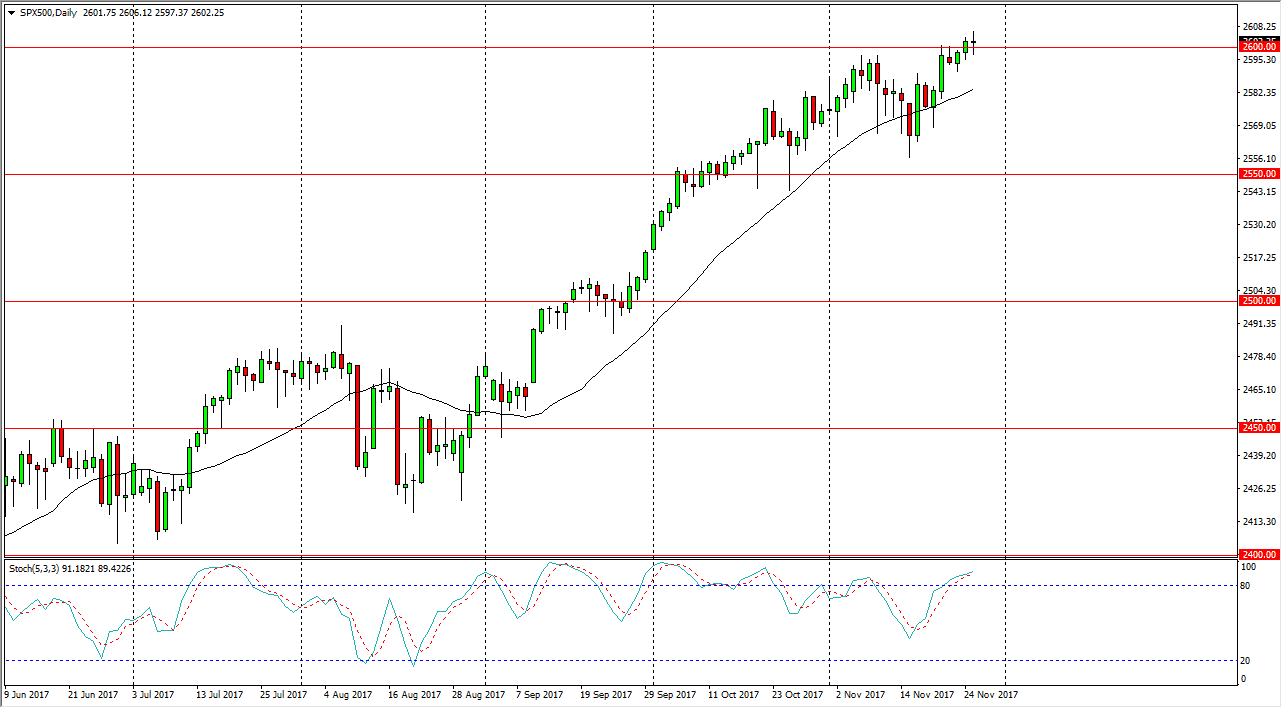

S&P 500

The S&P 500 went back and forth during the trading session on Monday, as we have broken above the 2600 level, but have also stagnated. The resulting neutral candle suggests that we are going to struggle a bit, but as we have cleared a resistance barrier, I think it’s more likely that we will find buyers on dips. After all, algorithmic traders continue to buy the market every time pull back, as it’s been the only game in town. I believe that there is a significant amount of support extending down to at least the 2550 handle, and every time this market pulls back it’s only a matter of time before the machines turn on and start buying again. A break above the top of the range is also a buying opportunity, as it should send this market looking towards the 2625 handle, and eventually the 2650 level.

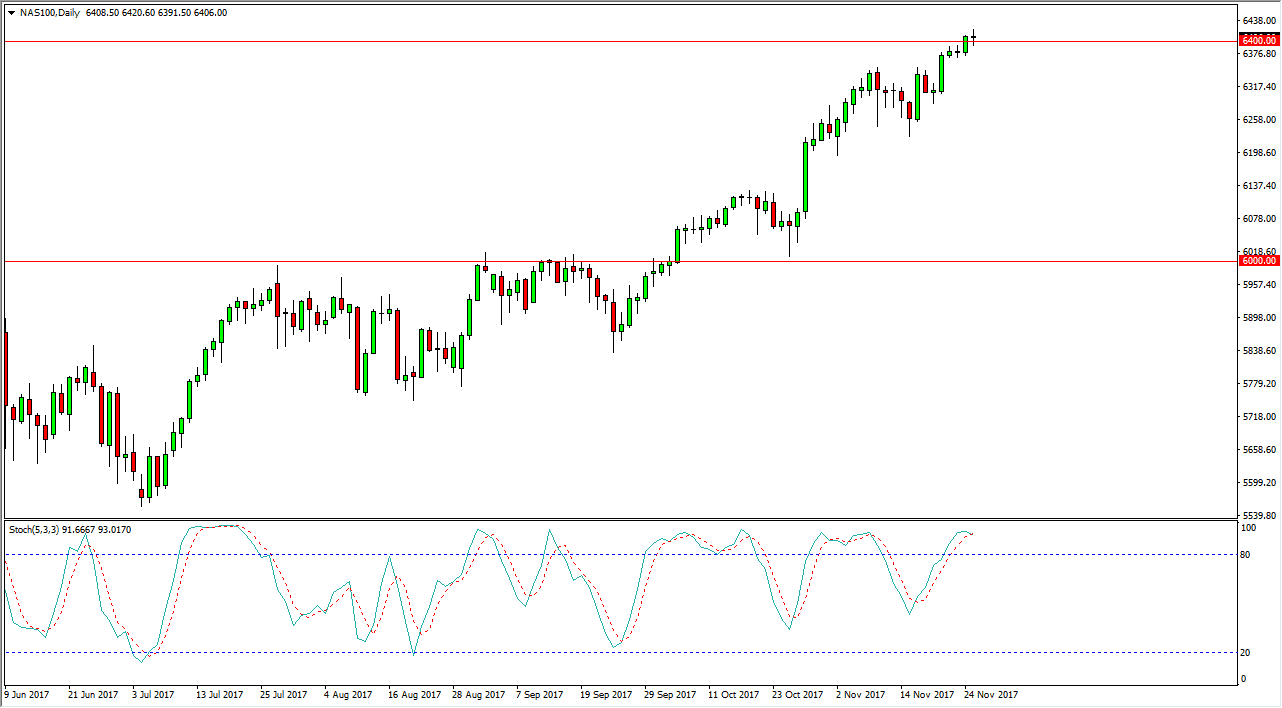

NASDAQ 100

The NASDAQ 100 has been going back and forth as well, showing signs of extreme volatility on a relatively choppy day. The range hasn’t exactly been exciting either, so I think the market is trying to discern whether the 6400 level will offer support. I think it will, but I think this support extends down to at least the 6300 level as well. Again, this is just like the S&P 500, where machines come in and buy dips every time they appear. Ultimately, a break above the top of the range for the day is also reason enough to go long as well. I have no interest in shorting, least not until we are well below the 6300 level on the daily close, and even then I think there are plenty of buyers underneath just waiting to pick up value.