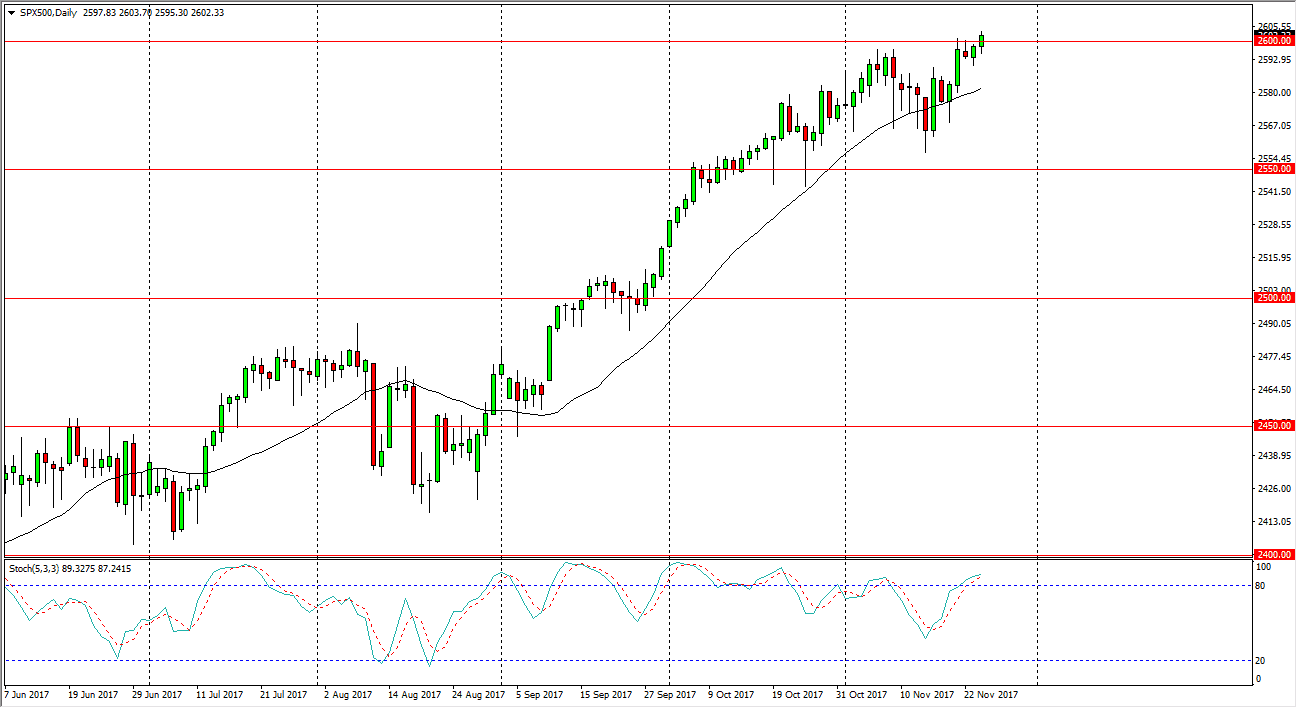

S&P 500

The S&P 500 initially pulled back on Friday, but then broke above the 2600 level. This is a significant move, and breaking to a fresh, new high suggests that the buyers are going to continue to go much higher, perhaps reaching towards the 2650 level next. I think short-term pullbacks continue to be buying opportunities, but the one thing that I would worry about is that volume would’ve been very thin and limited trading on Friday. Because of this, don’t be surprised at all to see a short-term pullback below the 26 are level, but I think at the first signs of a bounce, it’s time to start buying again. I specifically see the 2590 level as offering support. I have no interest in shorting this market, and believe we are in an uptrend in all the way down to the 2500 level underneath.

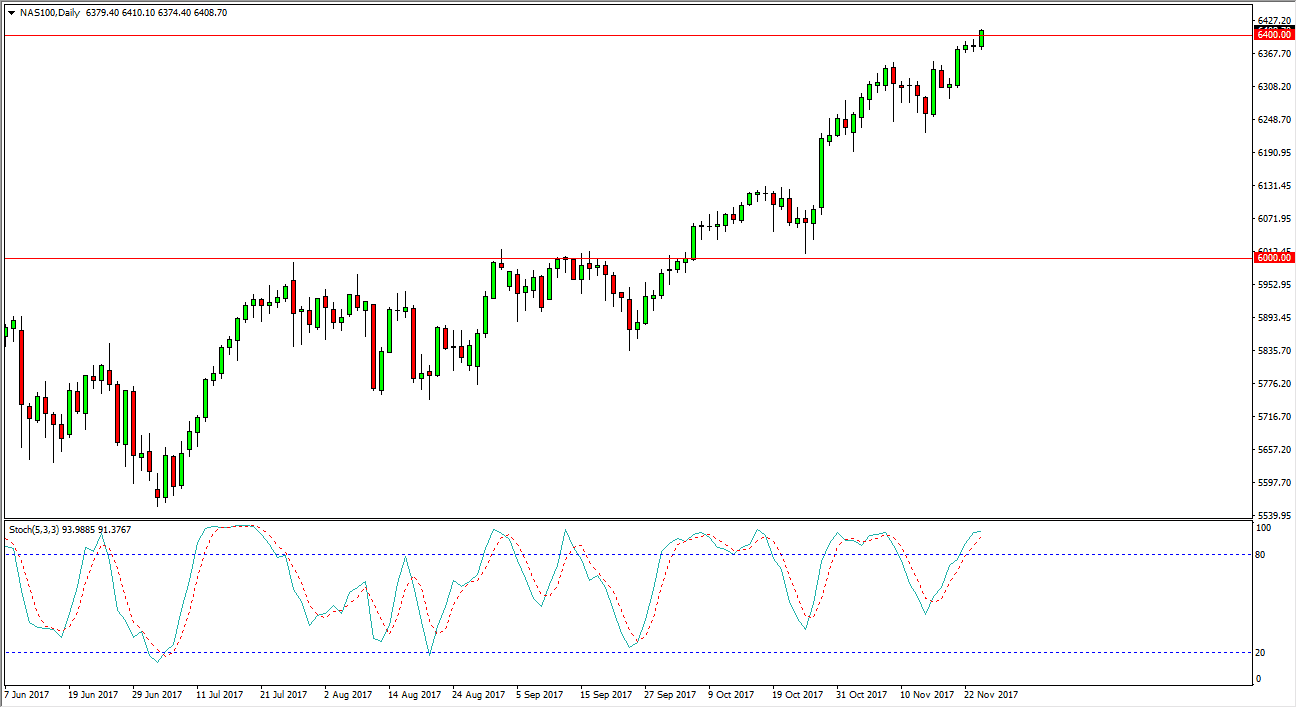

NASDAQ 100

The NASDAQ 100 broke above the 6400-level showing significant bullish pressure. Now that we are the fresh, new high and have cleared the large, round, psychologically significant level, I think that the market is probably going to continue to go higher, reaching towards the 6450 handle, and then eventually the 6500 level after that. Short-term pullbacks, as well as a break above the top of the range for the session give me reasons to start going long. I believe that the 6350-level underneath is massively supportive, and therefore I have no interest in shorting. The NASDAQ 100 has lead the way for other US indices of the longer term, and I think that is going to continue to be the case going forward. Pullbacks represent value that I am more than willing to take advantage of.