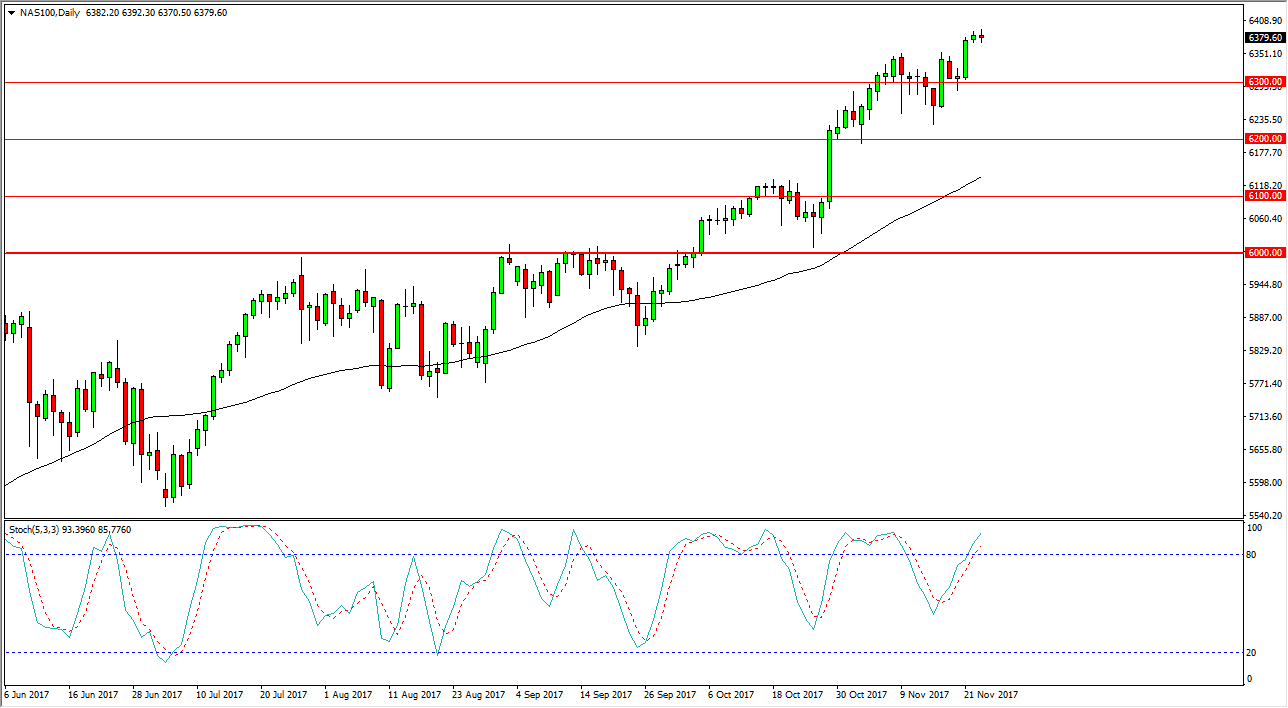

S&P 500

The S&P 500 market initially fell during the trading session on Thursday, but turned around to reach towards the 2600 level. Keep in mind that the Americans were away celebrating Thanksgiving, so the movement in the CFD was based upon the CFD market itself. We do get some electronic trading during the session today, but it is going to be very short-lived, and of course going to be thin volume to say the least. I believe that given enough time, we will break above the 2600 level, so that is my proclivity, to buy breakouts, and of course pullbacks that show signs of support down to the 2550 handle underneath. Longer-term, I think we are going to the 2650 level.

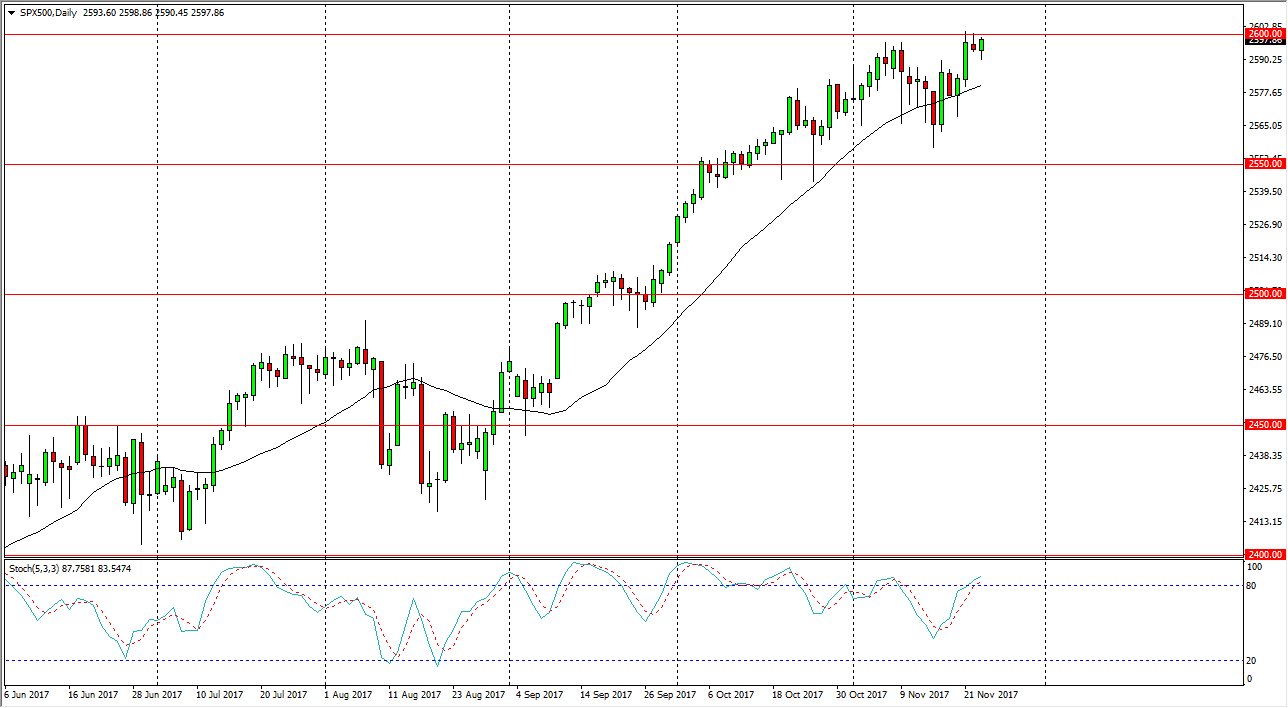

NASDAQ 100

The NASDAQ 100 was of course in the same situation, so I look at the CFD market as a representation of where we want to go, not necessarily where we are going. I recognize that the overall trend is up, and I also look at the 6300 level as the “floor” currently. As long as we can stay above that level, I am comfortable going long. I think that short-term pullbacks offer buying opportunities, and with the thin bowling today we may have to wait until Monday to get the necessary move. Nonetheless, I do think that we will be buyers sooner rather than later. Longer-term, I anticipate that the NASDAQ 100 is going to go looking towards the 6500 level above, as it is a large, round, psychologically significant number, and also a place that should attract a lot of attention. If we were to break down below the 6300 level, I think the market then goes looking towards the 6200 level after that.