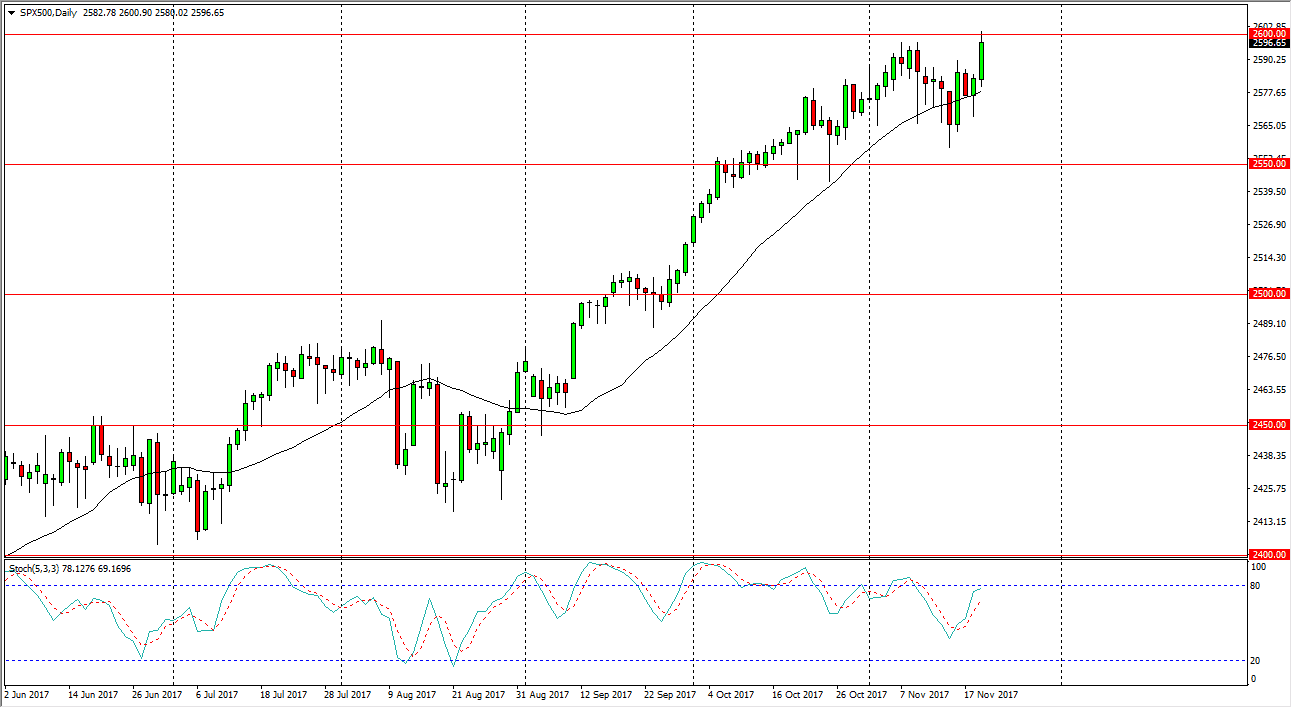

S&P 500

The S&P 500 broke higher during the trading session on Tuesday, reaching towards the 2600 level during the day, but did pull back slightly at the close. Because of this, I think we may need to pull back to build up the necessary momentum to break out, and with today being the last trading day before Thanksgiving, it’s very likely that it will be quiet. Because of this, I look at a pullback as simply a reaction to traders leaving the market. If we were to break above the 2600 level, then I think we are free to go much higher, but probably not until after the holiday, and I certainly wouldn’t put money into the market until after the holiday. At best, I think that waiting for a pullback is the best to you can do right now, but if we were to break out, then it’s just simply a longer-term “buy-and-hold” signal.

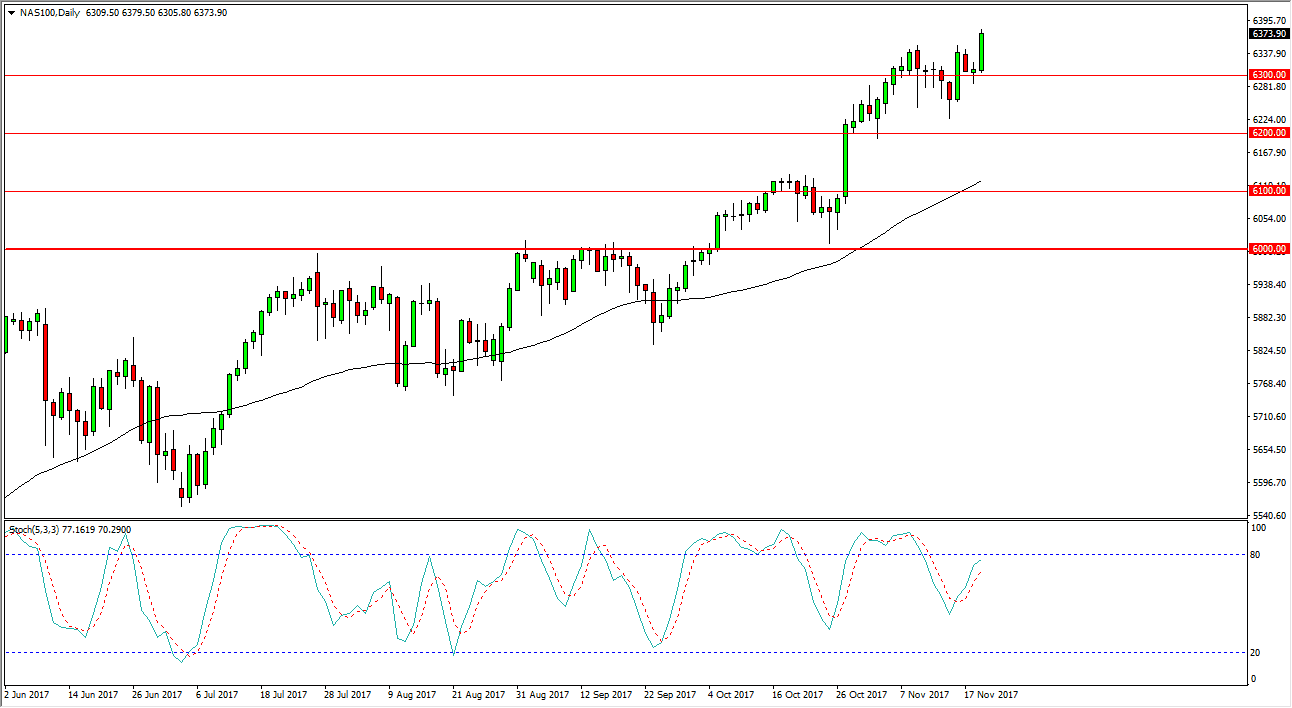

NASDAQ 100

The NASDAQ 100 has broken out yet again, and closed the day on Tuesday to fresh, new high. I believe that short-term pullbacks will continue to offer value the traders are more than willing to take advantage of, and that the 6250 level should be now the “floor” of the uptrend, but quite frankly I would not be surprised at all to see the 6300-level offer just as much support. I think that we are eventually going to break out to the upside in drag the rest of the US indices with us, as the NASDAQ 100 tends to lead the way overall. I have no interest in shorting this market, so waiting for pullbacks to show signs of support or an extension of the uptrend to put money back to work. Longer-term, I anticipate seeing the market go towards 6500.