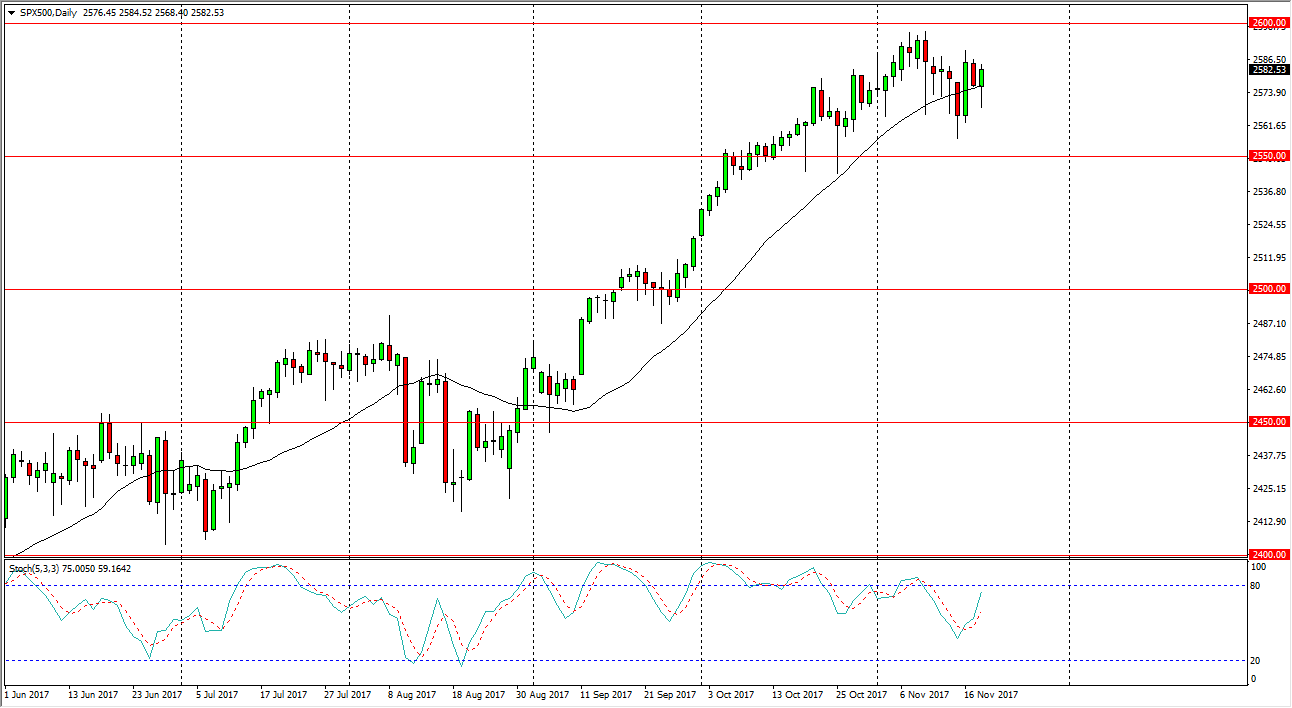

S&P 500

The S&P 500 initially fell during the trading session on Monday, but found enough support underneath to turn around to form a hammer. The hammer of course is a bullish sign, and it looks likely to continue to go back and forth and trying to build up enough momentum to finally break above the 2600 level. However, I like the idea of buying pullbacks more than anything else, because the market has been a bit overextended for some time. Ultimately, I think that the markets will break out, and I believe that the market will go looking towards the 2650 handle. If we were to break down below the 2550 level, the market will probably go looking towards the 2500 level, which I see as the “floor” in the market overall. I believe that shorting is almost impossible right now, because quite frankly it’s far too difficult to fight this type of bullish pressure.

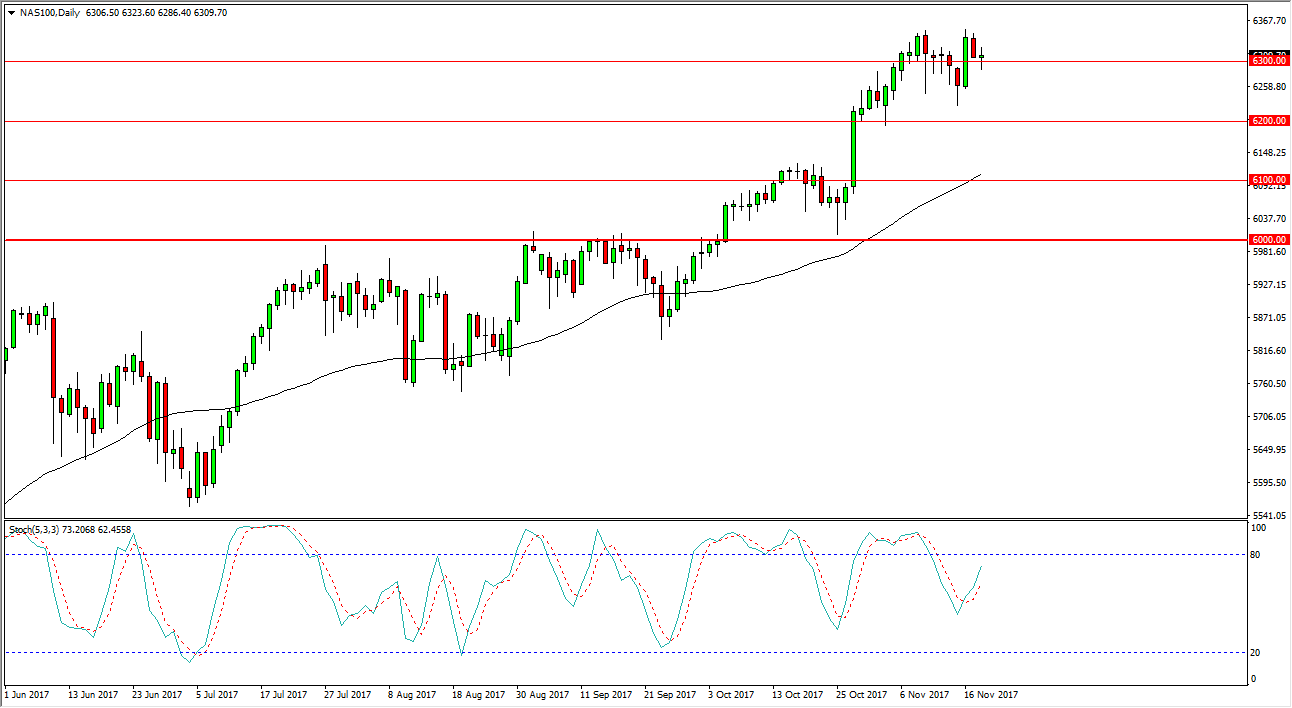

NASDAQ 100

The NASDAQ 100 went back and forth during the trading session on Monday, dancing around the 6300 level. I believe that the market should continue to see bullish pressure longer-term, but I think that pullbacks probably looking attractive at this point, as although it is a bullish market, we are overextended. Ultimately, this market has a “floor” at the 6000 level, and if we remain above there, I am “by only.” I believe that longer-term, we will go looking towards the 6500 level above, which of course has a certain amount of psychological importance. I have no interest in shorting, I think that every time we pull back you should look for supportive candles and of course think of them as potential value that you can take advantage of.