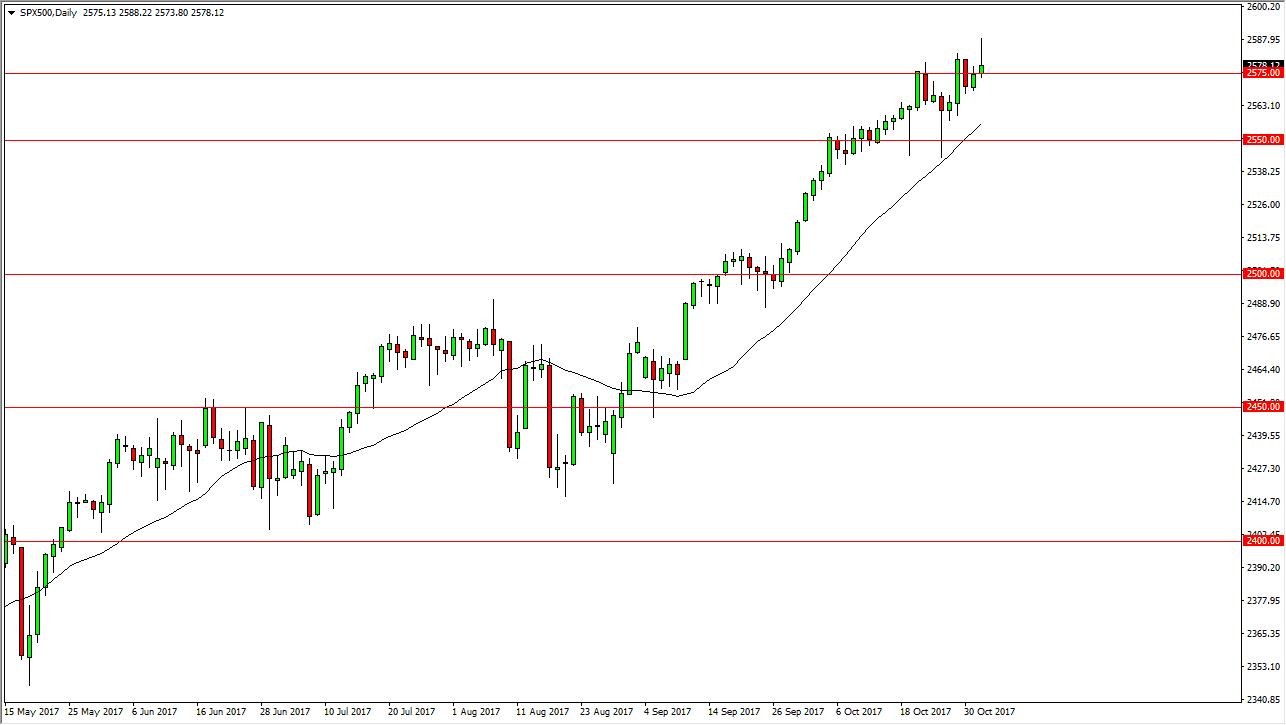

S&P 500

The S&P 500 rallied a bit during the day on Wednesday, reaching to all-time highs again, but rolled over to form a shooting star. The shooting star tells me that perhaps we are trying to roll over a bit, and perhaps are getting a bit too overextended at this point. I think that the 2550 level underneath should be supportive, and I think that falling from here should only attract buyers underneath. Longer-term, I still believe that we go to the 2600 level above. This pullback should offer value, and I am waiting to see signs of support underneath to take advantage of what has been an extraordinarily strong uptrend. Given enough time, I think that value hunters continue to return to what has been a very reliable uptrend.

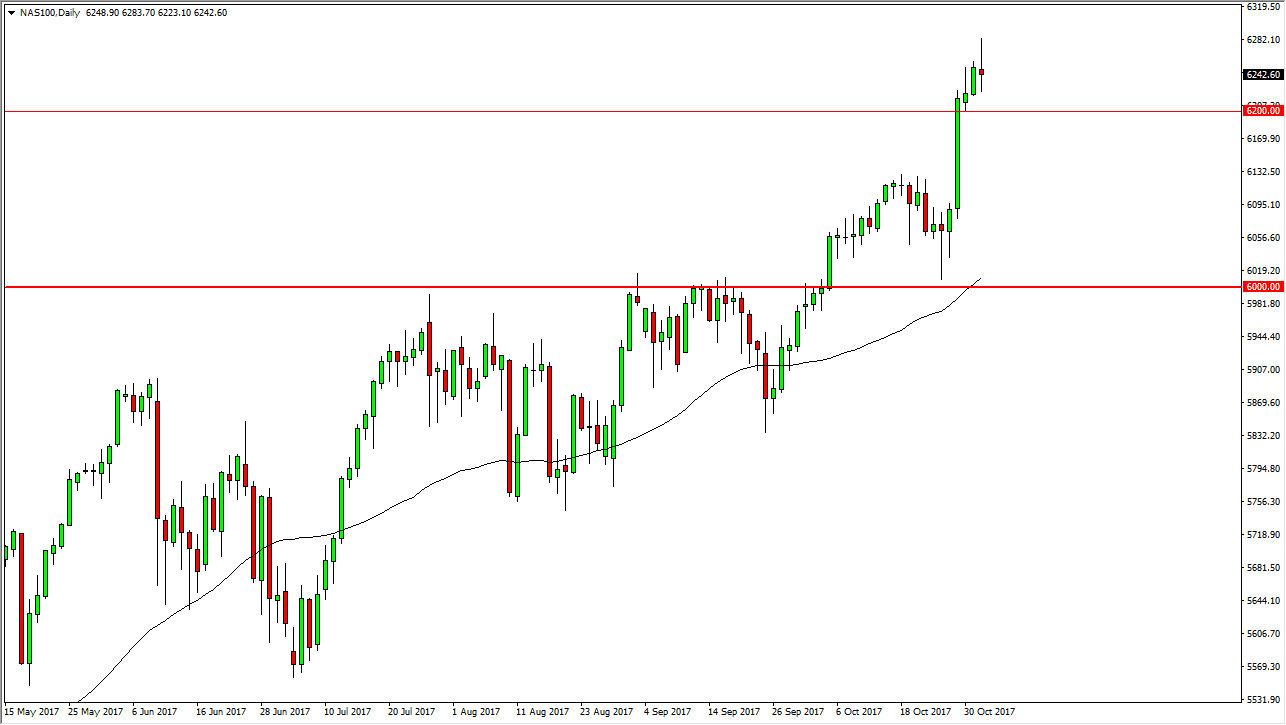

NASDAQ 100

The NASDAQ 100 was also turned around to form a shooting star. The shooting star looks likely to show signs of exhaustion and the NASDAQ 100 yet again. After all, the Monday candle ended up forming a shooting star as well, so I think that given enough time we are looking at a pullback just waiting to happen. I think that the 6200 level will be supportive, but pullbacks to the 6100 level would make quite a bit of sense. I think that level should be supportive, and most certainly the 6000-level underneath is even more supportive. After all, that was resistance in the past. Given enough time, I believe that the market goes to the 6500 level above. I think that the overall attitude of the market is positive, but we have most certainly been a bit too overextended recently, so this pullback is probably necessary to continue the uptrend.