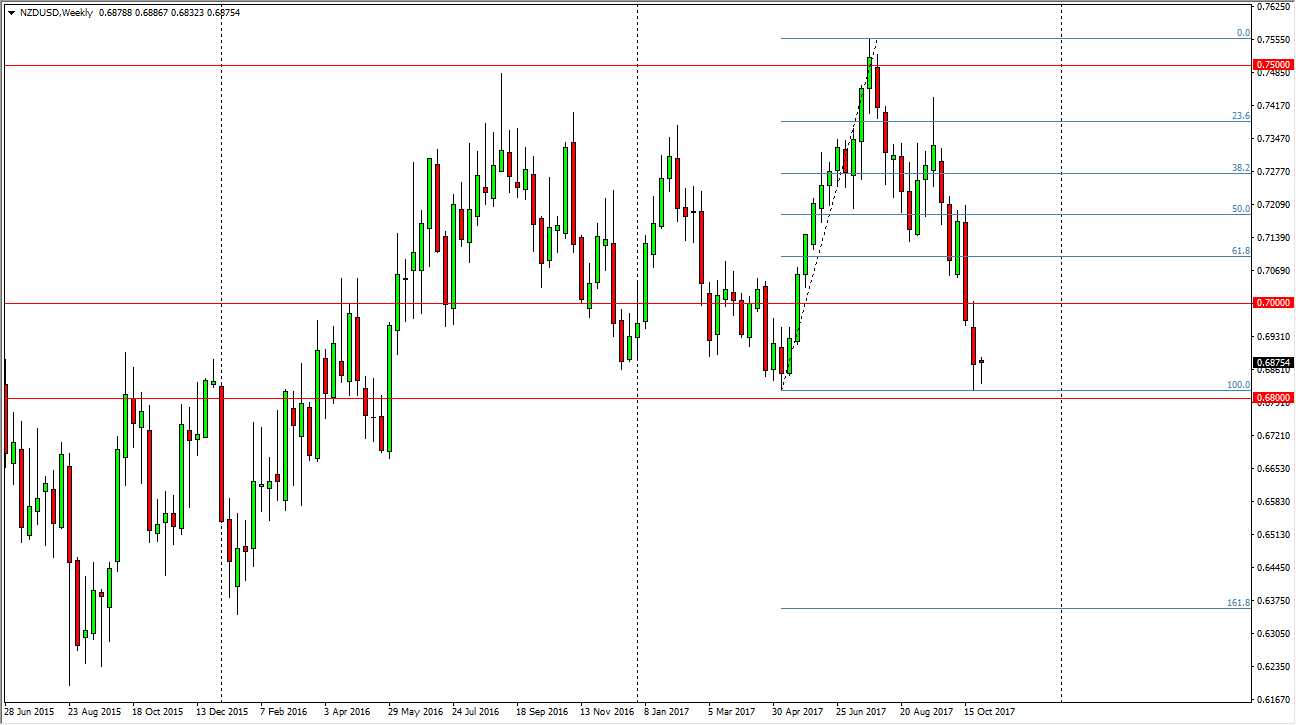

The New Zealand dollar was very negative during the back half of October, as the election results poured in from New Zealand. The Labour Party gained the Prime Minister position, and it’s likely that traders around the world are worried about New Zealand spending. Because of this, we not only sliced down through the 61.8% Fibonacci retracement level from the search higher, we have completely wiped out the gains. As I write this article, we are testing the 0.68 level, and if we can break down below there, I think we suddenly find ourselves in serious trouble. The US dollar should continue to strengthen against the New Zealand dollar anyway, because quite frankly the Royal Bank of New Zealand looks very unlikely to tighten monetary policy, while at the same time the Federal Reserve is already known to be doing so.

The 0.70 level above should continue to be resistive, so it’s not until we break above there that I think it’s even likely that we can go higher. I think that the 0.70 level will offer significant resistance, and perhaps lead the market lower, perhaps even trying to break down below the 0.68 handle. Below there sends this market to the 0.65 level underneath rather rapidly, but a move above the 0.70 level should send this market looking for the 0.72 handle. I think there are a couple of different scenarios that could play out this month, we either punish the New Zealand dollar for perceived spending increases, or we turn the market around as it has perhaps gotten a bit oversold. It comes down to the attitude of the trading community on the whole, so pay attention to this pair, I think it could be one of the big movers for the month. Never forget the “risk appetite” aspect as well, as the New Zealand dollar does better when traders are feeling more comfortable.