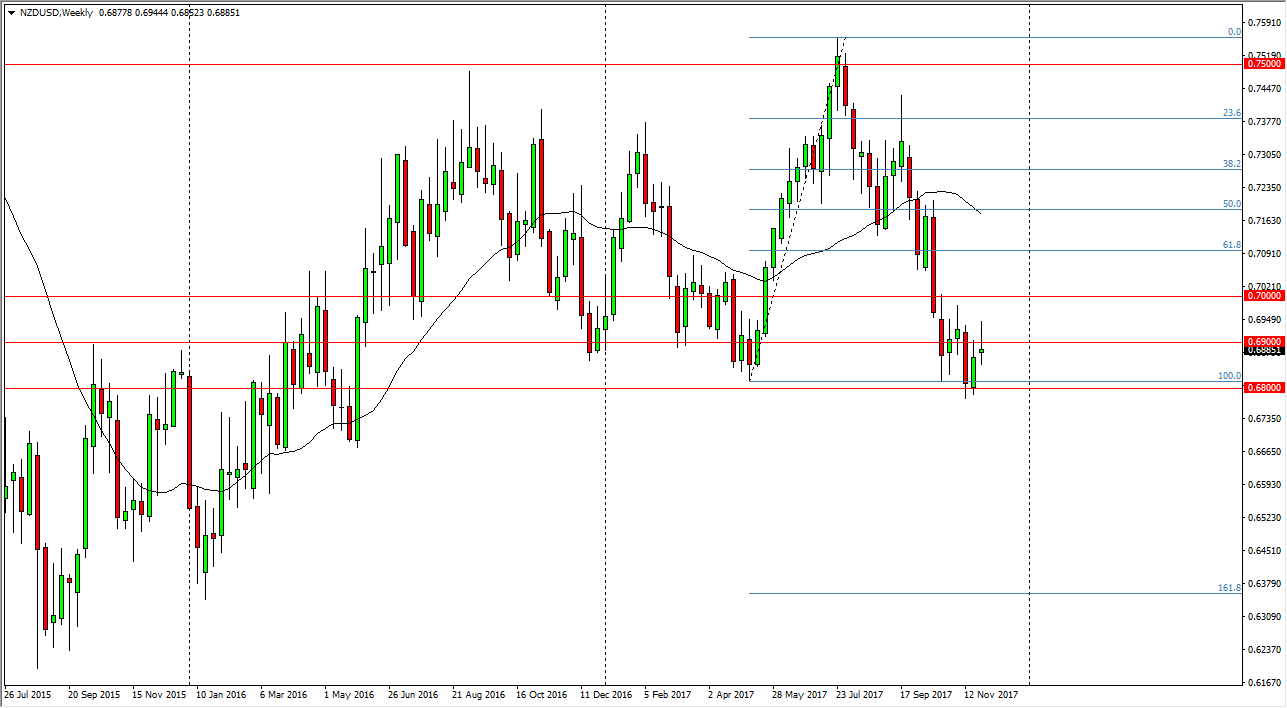

The New Zealand dollar has been very choppy over the last month, after dropping rather significantly. This is not a huge surprise to me though, because the 0.68 level has been massive support in the past. The last week of November ended up forming a shooting star though, and because of this I think it shows that the market is desperately trying to break down from here, and below the psychologically and structurally important 0.68 level. If it does, then the next target will more than likely be a move to the 161.8% Fibonacci retracement level, which is roughly 0.6350 below. That would be a longer-term move, and I don’t necessarily think that we will get there during the month of December, but it could be a story for 2017.

Alternately, if we were to break above the 0.70 level, that would be a very bullish sign, as it negates a lot of negativity. That being the case, we would probably go back towards the 0.7350 level, but at this point I think that the market favors the downside, because quite frankly there are a lot of concerns with the Labour Party taking control in New Zealand, as the general consensus is that the spending will increase. I think that if the US Congress ends up passing a strong tax bill, that will only have more money flowing to the United States. Keep an eye on commodities, they have the usual effect on the New Zealand dollar as well, so I think there are a lot of things to pay attention to. During this time year, liquidity becomes an issue, so it would not be a huge surprise to see this market crumble and deteriorate rapidly.