Gold prices rose $3.39 an ounce on Tuesday as a retreat in the dollar helped the metal trim a portion of the previous day’s losses. Gold also benefited from some safe-haven buying after the Trump administration intensified pressure on North Korea. Traders are waiting for minutes from the U.S. Federal Reserve's last meeting. It seems that a rate hike in December is roughly priced in but very hawkish minutes may provide a headwind for the market.

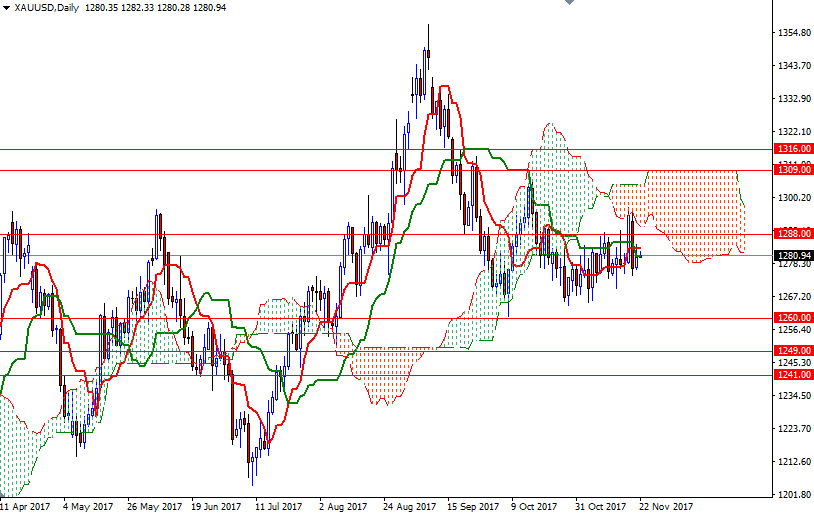

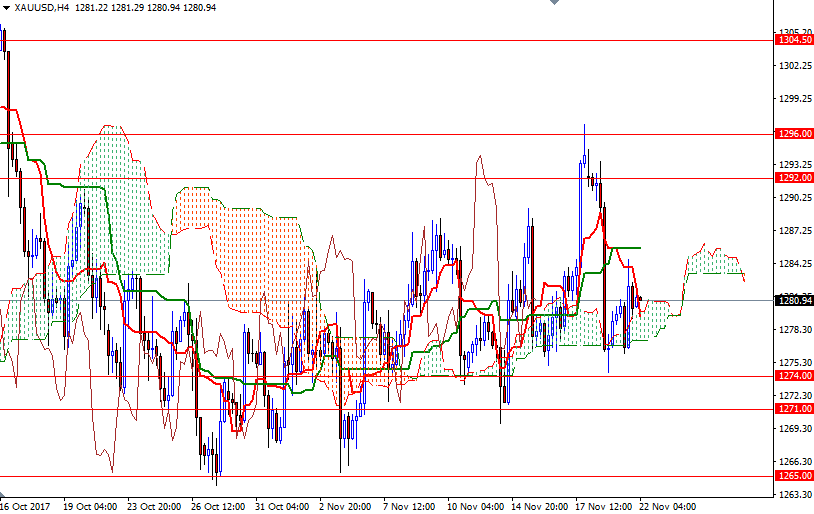

XAU/USD headed back to the 4-hourly Ichimoku cloud after a failure to sustain a push above 1283.50 weighed on the market. Prices are still above the weekly cloud, however, the daily and the 4-hourly charts continue to point opposite direction. Besides, the market remains within the trading range of the previous week.

To the upside, the initial resistance stands at 1283.50, which also happens to be the daily Tenkan-sen (nine-period moving average, red line), followed by 1285.60. A successful break above 1285.60 could send prices to 1288. The bulls have to produce a daily close above 1288 to tackle 1296/2. On the other hand, if the intra-day support at 1276 is broken, then the 1274 level will be the next target. Breaking below 1274 would indicate that 1271 might be the next port of call. The bears have to pull prices below 1271 so that they can find a chance to test 1267/5.