The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 19th November 2017

Last week, I saw the best possible trades for the coming week as long GBP/USD, and long of Crude Oil in U.S. Dollar terms. The overall result was very slightly negative, as the GBP/USD currency pair rose by 0.18%, and Crude Oil fell by 0.40%, producing a small average loss of -0.11%.

The Forex market over the past week has continues its bearish turn on the U.S. Dollar. Last week brought little news to move the Forex markets, although this week’s schedule looks more eventful. I have little confidence that the short-term direction of the U.S. Dollar can be forecasted, and there are very few powerful trends anywhere right now.

The news agenda this week is almost certainly going to be dominated by some items of important U.S. economic data, mostly the FOMC Meeting Minutes, but there are also some important items concerning the British Pound and Australian Dollar. as there is no real central bank input due from any of the major global economies. There is continuing political speculation about the survival of the current U.K. government, which might keep the British Pound in its current state of high volatility.

The American stock market is in a strong long-term bullish trend, but it looks to be weakening and does not seem poised to run higher in the short-term.

Following the current picture, I see the highest probability trades this week as long of the GBP/USD currency pair, short of AUD/USD, and long of Crude Oil in U.S. Dollar terms. There are very few clear strong trends in the Forex market now, but there is momentum in favor of Crude Oil and against the Australian Dollar.

Fundamental Analysis & Market Sentiment

There is very little clear sentiment in the market right now, or any outstanding fundamental factors which have emerged from last week’s relatively quiet schedule. There is news of more arrests of key figures in Saudi Arabia, which may boost the price of Crude Oil as markets are nervous of any indications of potential instability in the Kingdom and in the wider Middle East region.

Technical Analysis

U.S. Dollar Index

This pair printed a bearish candlestick, and it looks as if there is resistance at 12087 holding the price down from 12087, shown in the chart below. There is also support at 12012 which has successfully held the price up over the past week, suggesting a period of narrow consolidation might be ahead. It would not be a surprise if we begin a period of consolidation and uncertainty following the end of the recent bearish trend, so it is hard to be very confident in the Dollar’s short-term direction.

GBP/USD

This pair is a slow long-term upwards trend, and although the flow has a lot of deep retracements, it is clearly gradually rising. The weekly candle is a bullish candlestick. Recent days have seen the price make a move up, but it has been unable to make a decisive bullish breakout. The bullish case is strengthened by the fact that the price bottomed out close to the psychologically important level of 1.3000. For these reasons, I am cautiously bullish for the coming week.

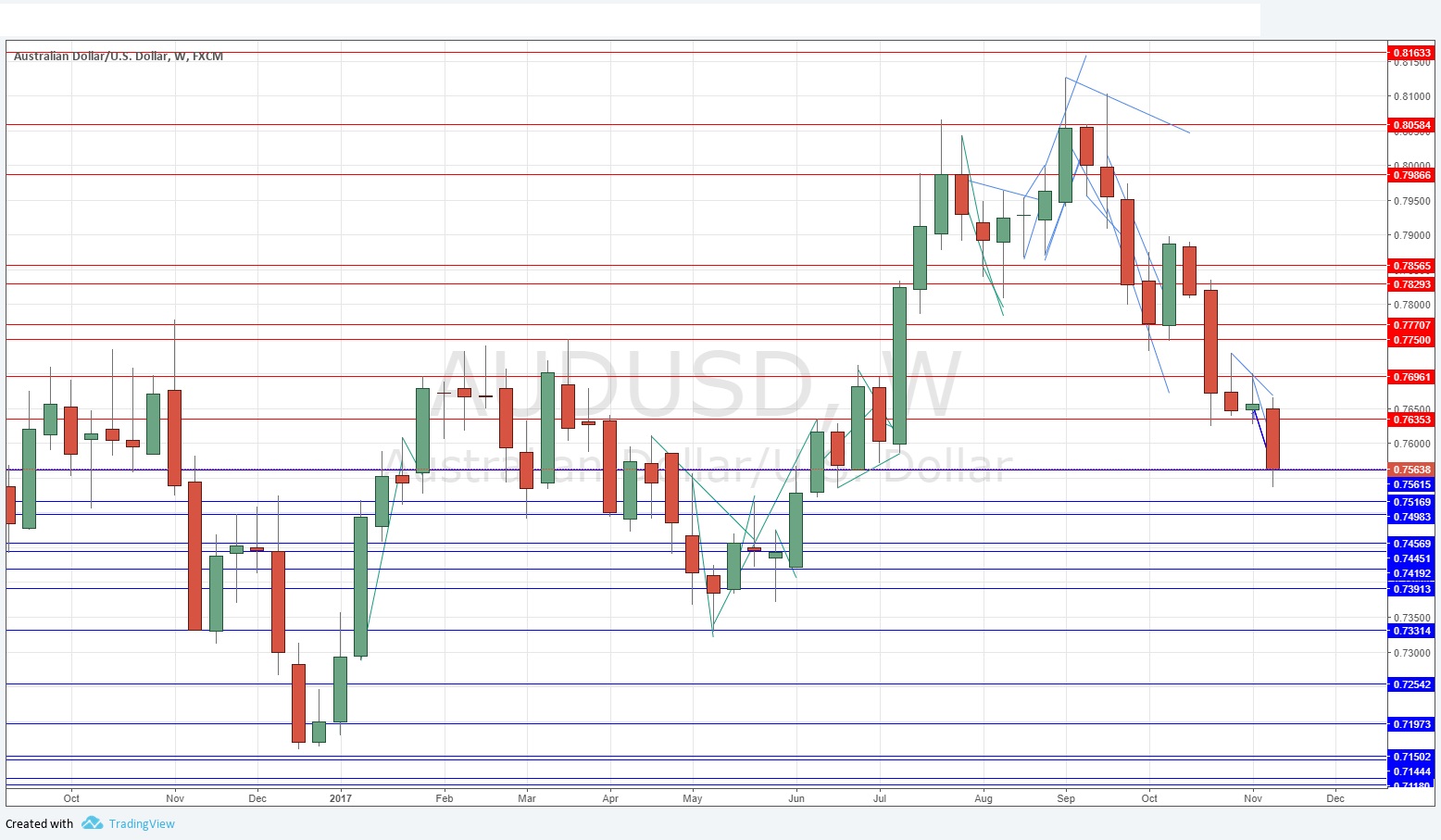

AUD/USD

This pair is in a long-term downwards trend, and although the price has reached an area of support, the weekly chart below suggests there is enough momentum for at least one more week of downwards movement. The weekly candle is strongly bearish. There is some key central bank input due this week on the Aussie, which could help drive the price down if it is dovish overall.

Crude Oil

This commodity has been making new 2-year highs after a strong bullish breakout. Last week printed a bullish pin candlestick with a lot of strong bullish momentum at the end of the week. If the price begins to make new highs again, it looks likely to continue to rise. The advance will be helped along by any new threats being made in the middle east, if they emerge in the coming days, between the Saudi and Iranian axes. Resistance will probably begin to be felt at $58.50.

Conclusion

Bullish on the British Pound and Crude Oil; bearish on the Australian Dollar.