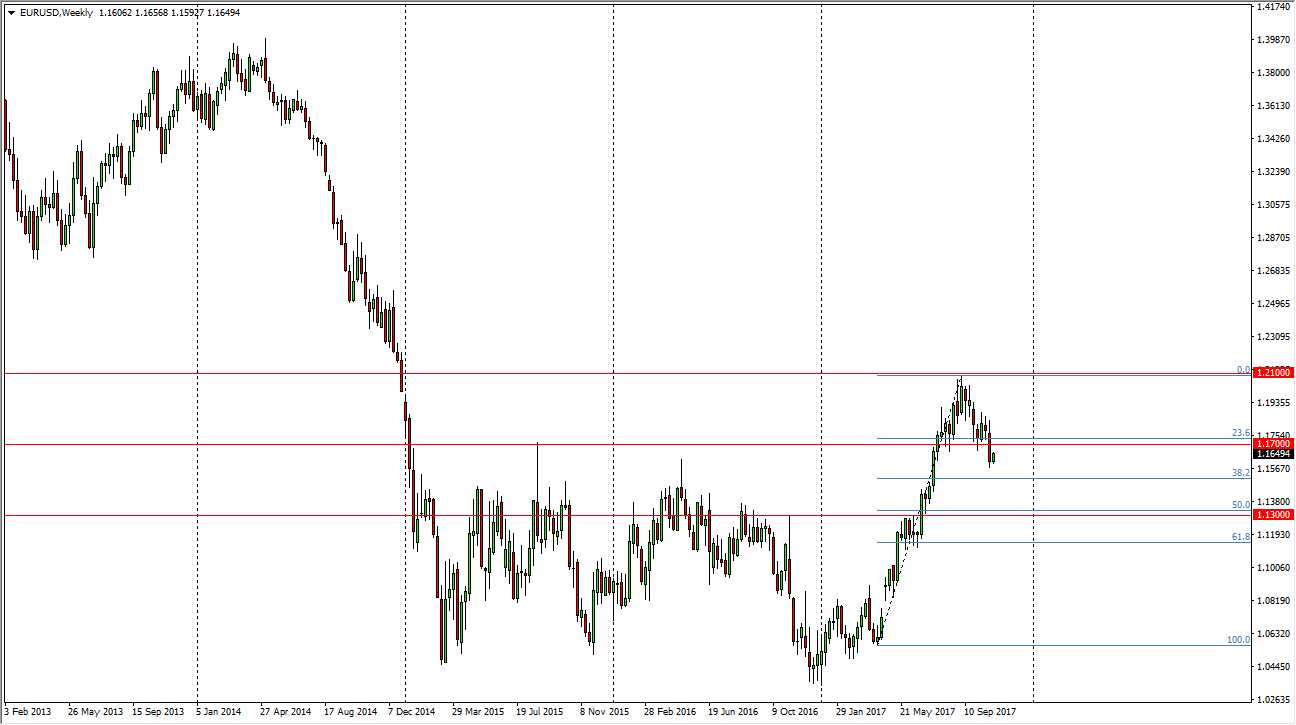

The EUR/USD pair has recently broken down below a head and shoulders pattern on the daily chart, which had a neckline near the 1.17 level. Because of this, I think it’s only a matter of time before we drop from here and go looking towards the 1.13 level, which is the measured move from the head and shoulders. If you look at the weekly chart, you can see that the 1.13 level is essentially the 50% Fibonacci level from the entire impulsive move, and an area that has been of interest in the past. Because of this, I think that we will probably struggle at the 1.17 level above, and could roll over from there. However, if we were to break above the 1.17 level, the market should then go to the 1.20 level. I think overall, November is going to be a bit negative for the Euro, but ultimately this is a market that will be choppy.

I think it’s likely that the pullback is coming, but I also think it’s just as likely that we will have some type of quick negative move, followed by stabilization near the 1.13 level. Longer-term, I believe that the pair will continue to go higher, and reach towards the 1.21 level above. A break above there sends this market much higher, but we have rallied so much that it’s obvious we need to build up momentum to go higher, and this pullback should end up being healthy for the bullish traders. If we do break down below the 1.13 level, the market will more than likely go down to the 1.08 level below, which was the scene of a significant gap overall, I expect a little bit of both directions playing out this month, with somewhere towards the back end of November seeing the buyers return.