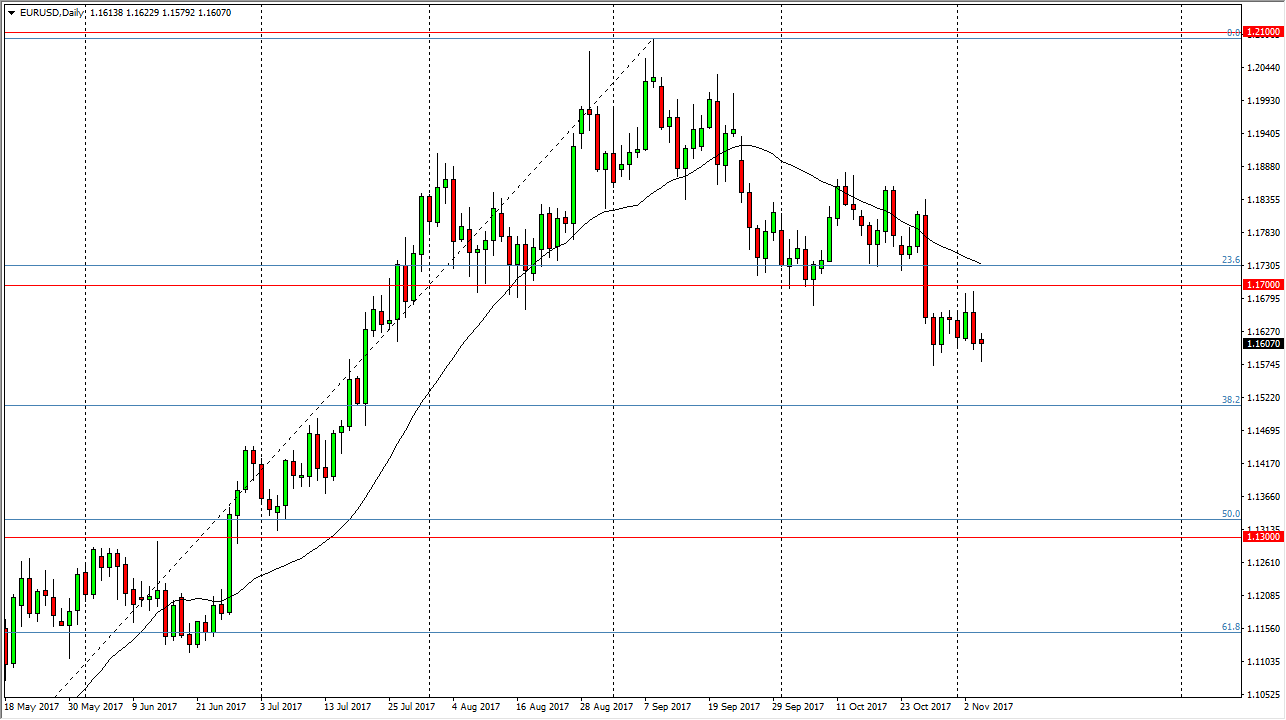

EUR/USD

The Euro initially fell on Monday, reaching down below the 1.16 level. However, by the time the Americans were done trading we had seen the market turned around to form a hammer. The hammer of course is a bullish sign, and a sign that perhaps we will go higher from here. However, I see a significant amount of resistance above at the 1.17 level, which was the previous

from the head and shoulders pattern. I think that short-term rallies should end up being a selling opportunity, and I believe that the market should continue to go much lower. Alternately, if we were to break down below the hammer for the session on Monday, that could signal for the weakness, and perhaps a run down to the 1.13 level underneath, which is the target based upon the head and shoulders pattern that we had seen previously. If we were to close on the daily chart above the 1.18 level, that would wipe out the head and shoulders pattern.

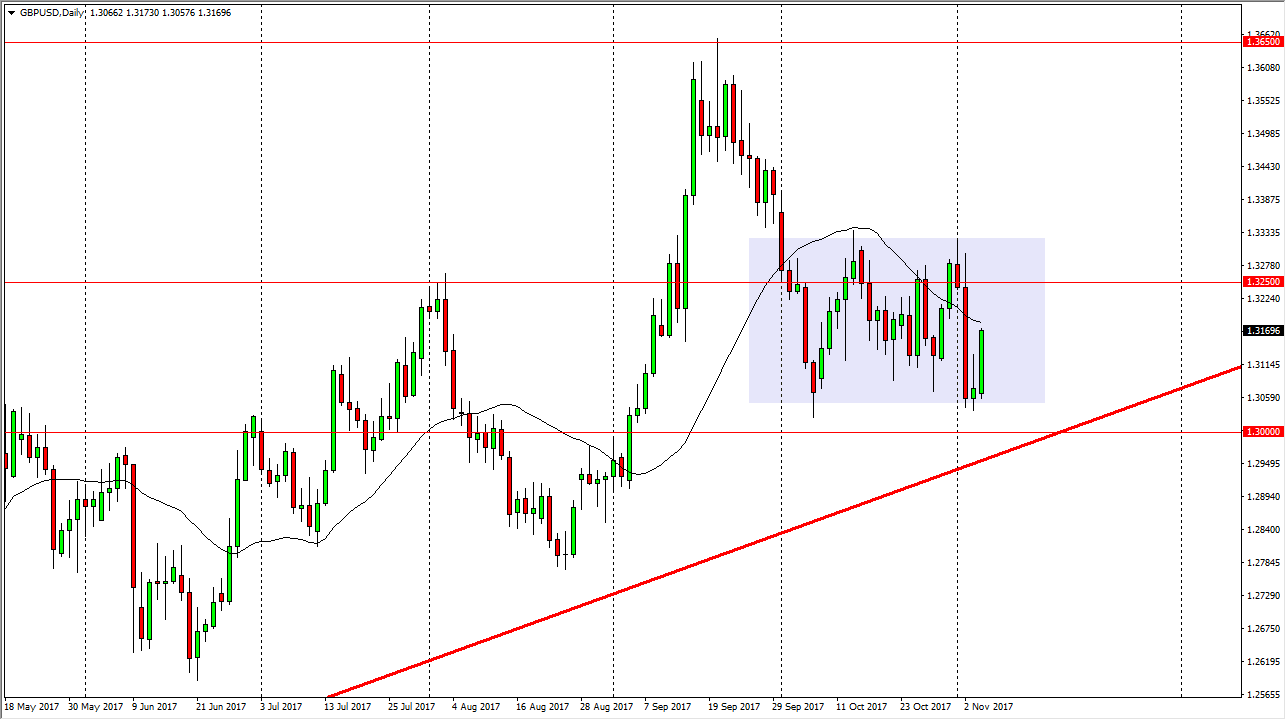

GBP/USD

The British pound exploded to the upside during the day on Monday, clearing the top of the shooting star that had formed on Friday. This wipes out the negativity of that candle, and suggests that we continue to see plenty of support underneath, especially based upon the 1.30 support level and the uptrend line that I have marked on the chart. I believe that a break above the 1.3333 level is a sign that the market is ready to go much higher, perhaps reaching towards the 1.35 handle, and then the 1.3650 level. This is a market that should continue to favor the bridge pound in general, because we do have inflationary pressure in the United Kingdom. However, the Federal Reserve also looks likely to raise interest rates, so I think this continues to be a very volatile pair, but I do prefer to the upside if we can stay above the 1.30 in the meantime.