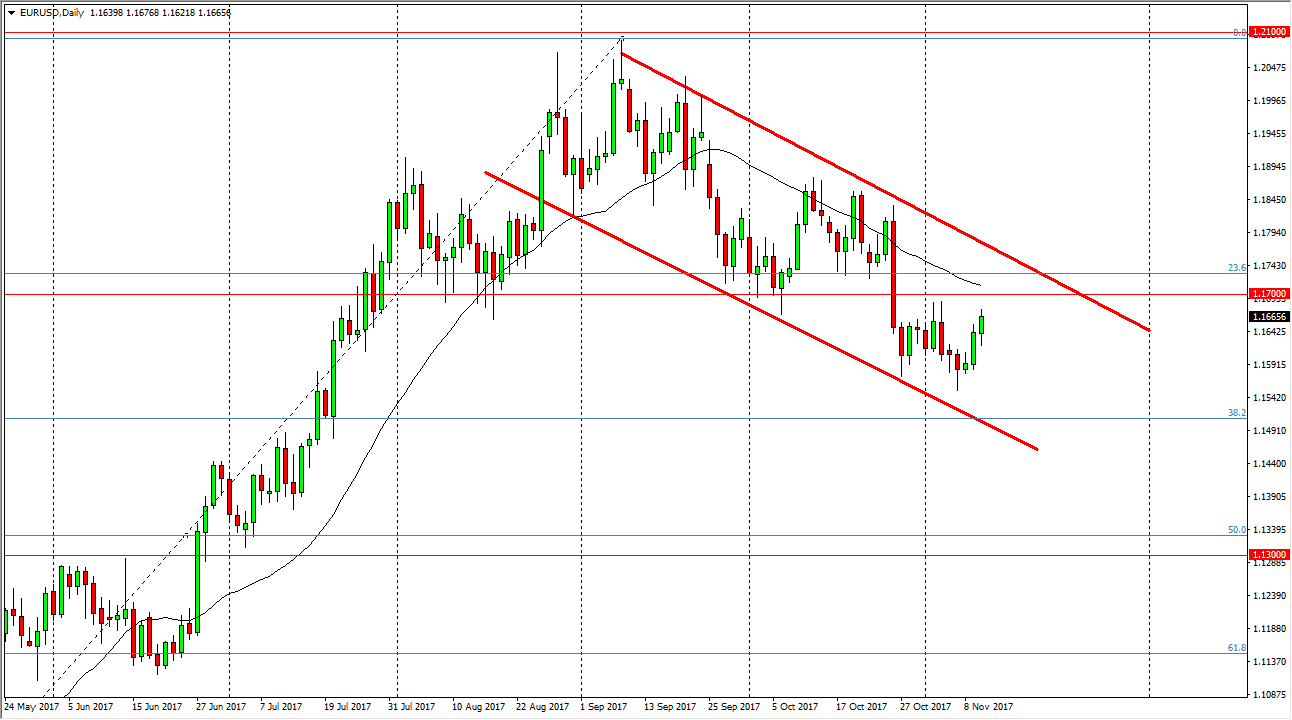

EUR/USD

The EUR/USD pair initially dipped a bit during the trading session on Friday, but found enough strength to turn around and rally a bit. The 1.17 level above was the neckline of the and shoulders pattern on the daily chart, so I think that level should be resistance. We have seen a little bit of a turnaround in this market, mainly due to the US Congress not been able to pass some type of tax bill. Ultimately, this market should continue to find that area interesting, and of course we have been in a downtrend in general. Because of this, I suspect that any time we get some type of exhaustion near the 1.17 level, I am more than likely going to start selling. However, if we were to break above the 1.1750 level, then I think the entire thing gets blown out of the water, and we will probably go looking towards the 1.20 level after that.

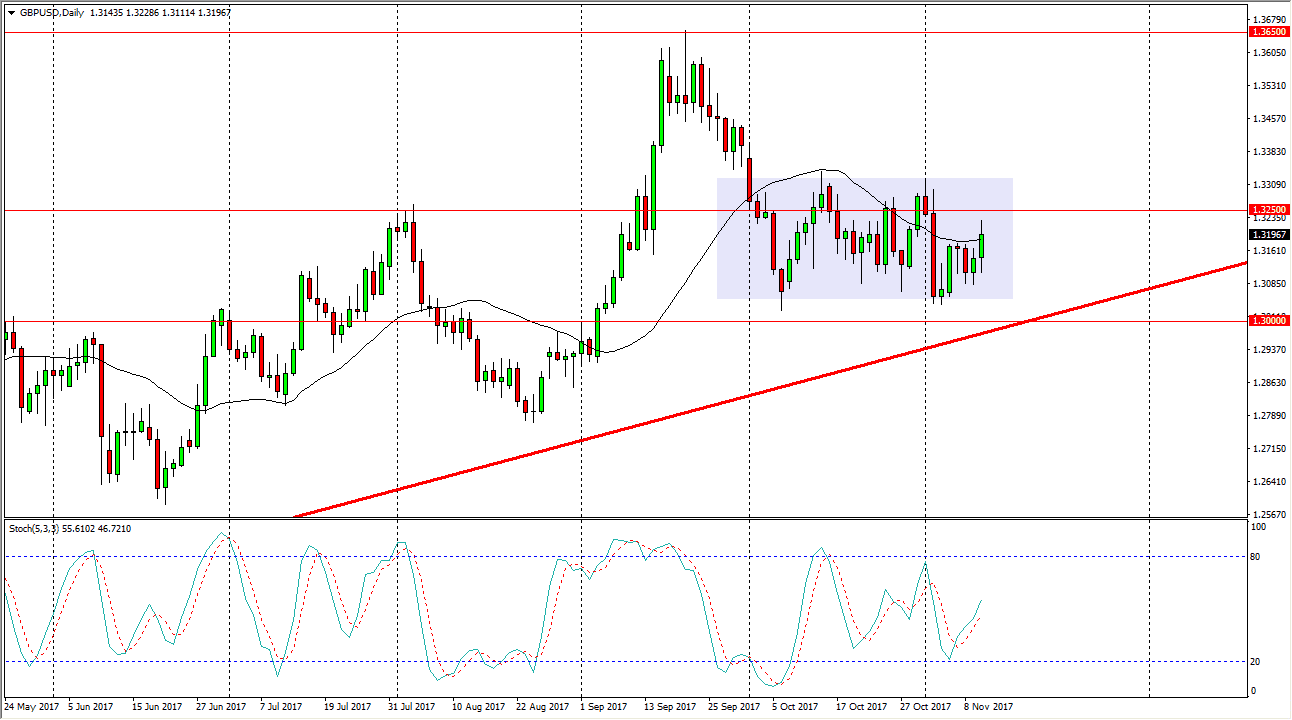

GBP/USD

The British pound initially fell during the Friday session as well, but then turned around to form a green candle. The 1.3250 level above has been resistance, and you can see that we are starting to fail a bit. Even if we break above there, the 1.3333 level should be resistance. But if we can break above there, the market should then go to the 1.35 handle, and then eventually the 1.3650 level after that. That’s the area where we gapped down after the surprise vote, so I would anticipate that there is can be a lot of selling pressure. The uptrend line just below should be a supportive factor, just as the 1.30 level will as well. Ultimately, I believe that the market continues to go back and forth, and I believe that in the short term we are very much range bound.