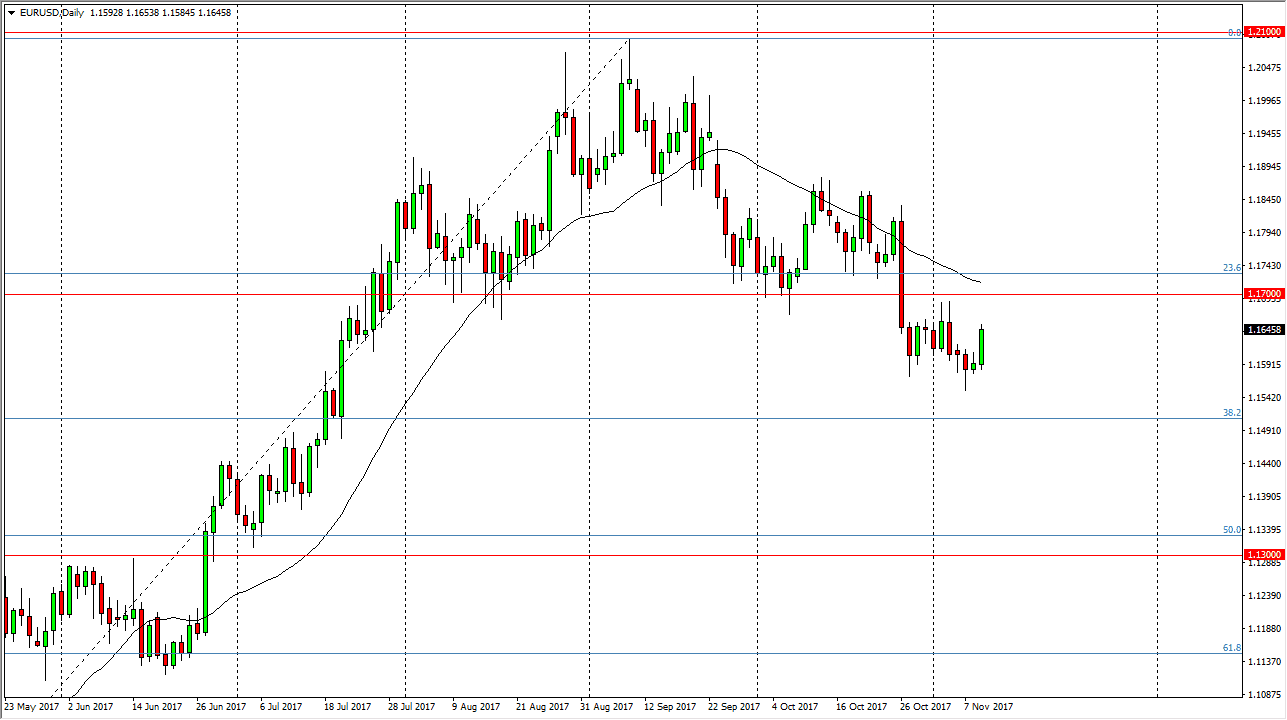

EUR/USD

The EUR/USD pair rallied a bit during the day on Thursday, as we continue to consolidate between the 1.16 level on the bottom, and the 1.17 level at the top. It’s likely that we will see significant resistance at 1.17, as was a neckline of the head and shoulders pattern that I’ve been following. Any signs of exhaustion near the 1.17 level for me is a selling opportunity, and I will do so as I still believe that the 1.13 level underneath should continue to be a target. It is not until we break above the 1.18 level that I would be interested in buying this market. Signs of exhaustion are exactly what I’m looking for, and I will do so on short-term charts. Although we have stabilized a bit, there’s nothing on this chart that tells me we are about to turn around.

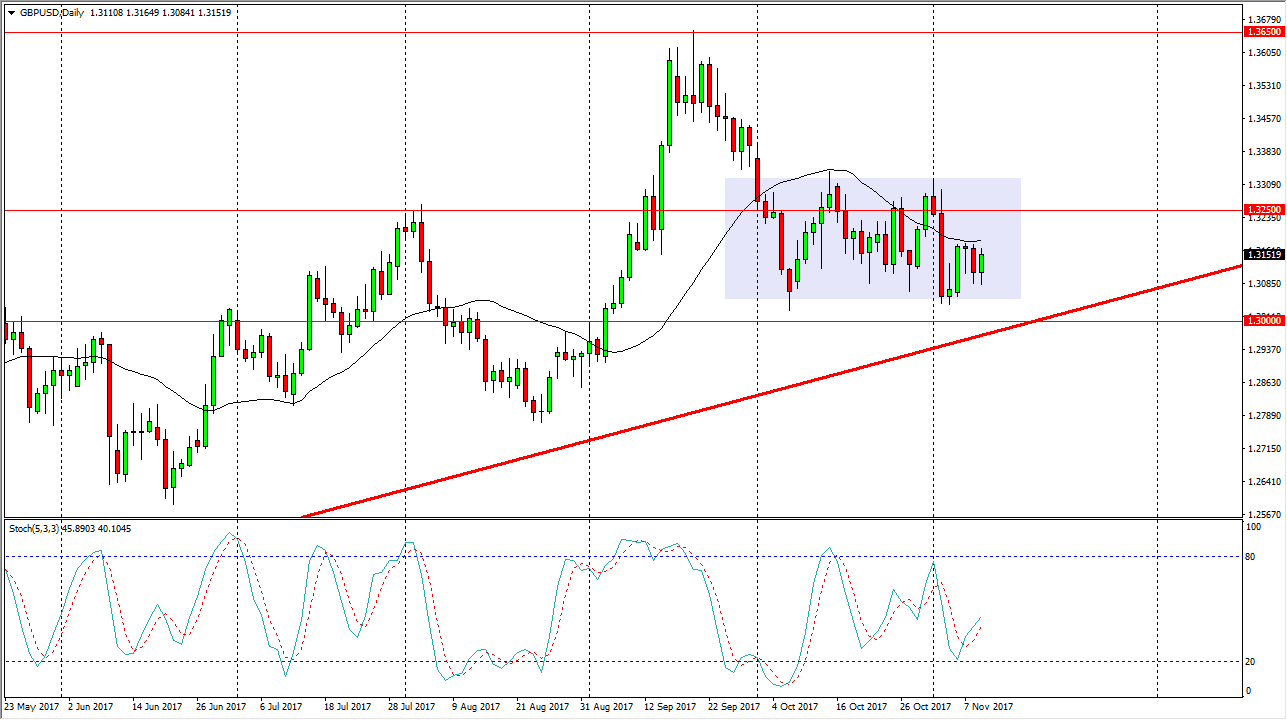

GBP/USD

The British pound rallied a bit during the day on Thursday as we continue to consolidate. The 1.3050 level has been significant support, and of course the 1.30 level just below is even more supportive, not only based upon the large, round, psychologically significant number, but also the structural support that I see on longer-term charts. Even more so, we have an uptrend line that looks very likely to hold as well, so I think that the market is ready to at least sit still. That’s exactly what I expect to see, and I believe that the 1.3333 level above is resistance, and is not until we break above there that we will get out of this consolidation. Because of this, it’s very likely that we will see a continued bouncing around in this market, and therefore I think short-term back and forth trading is probably about as good as it gets in the cable pair.