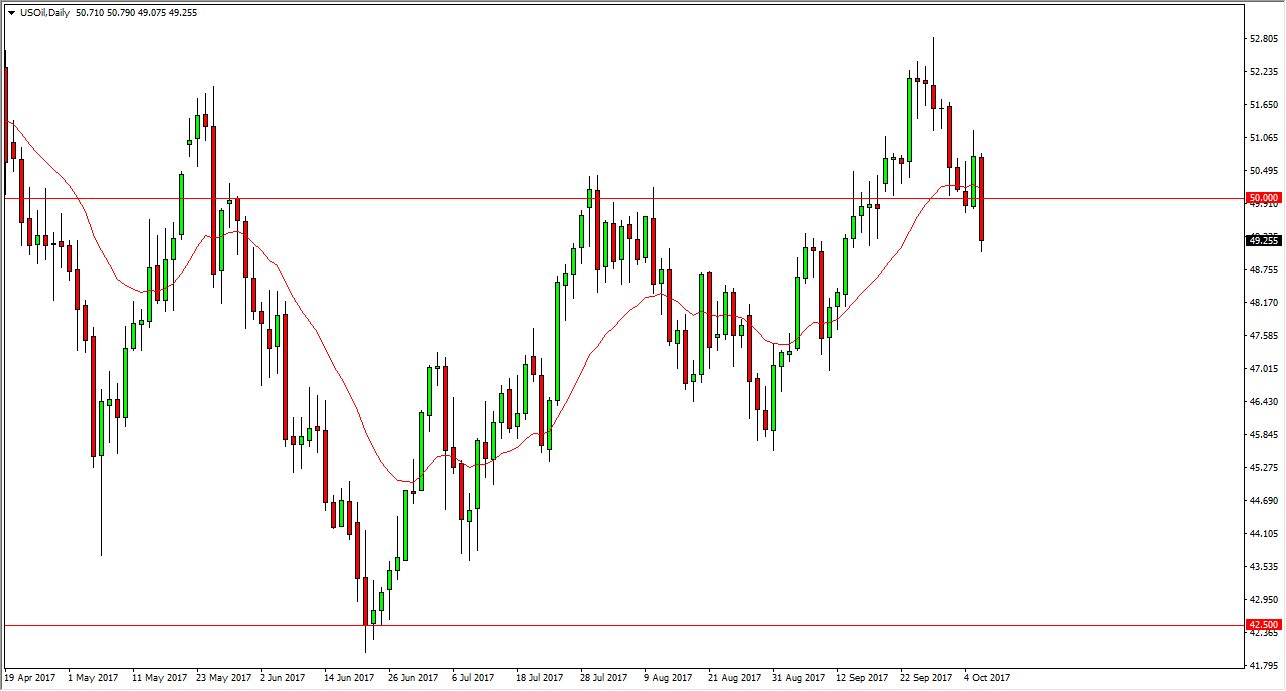

WTI Crude Oil

The WTI Crude Oil market broke down significantly on Friday, slicing through the $50 level. This is a very bearish turn of events, but I also recognize that the support level that starts at the $50 level probably extends down to the $49 handle, and therefore I think a breakdown below that level is probably needed to start shorting with any type of confidence. That being said, I certainly would be a buyer at this point. I would need to see the market break above the $51 level to feel comfortable doing so, especially because of the massive amounts of volatility that we have seen lately. If we break down below the $49 level, the market should then go looking for the $46 level under that. Alternately, if we break above the $51 level, the market should then go looking towards the $52.50 level as well.

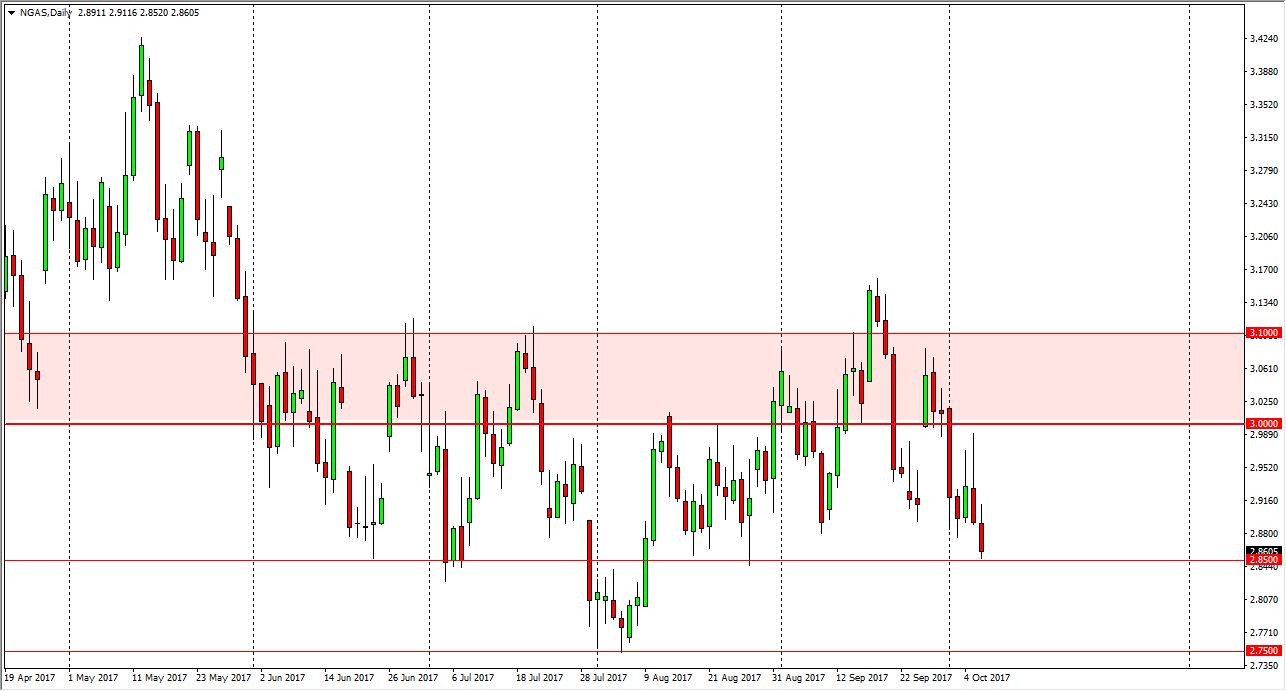

Natural Gas

Natural gas markets tried to rally on Friday but ended up rolling over and testing the $2.85 level. This level has been supportive in the past, so it’s not surprising to see that the market could break down below it. However, if we did breakdown below that level, I think the market will go looking towards the $2.75 level for support. That level is even more supportive than the $2.85 level, so I think we will continue to see buying on the occasion. However, I believe that the overall bearishness continues, and that given enough time the market will break down below every time we rally. Rallies are to be sold, as there is a significant amount of supply above the $3 handle. This is because US fracking companies become profitable above that level, ensuring that there will be mass quantities available.